SunTrust 2010 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

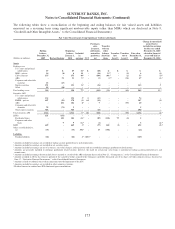

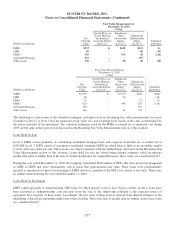

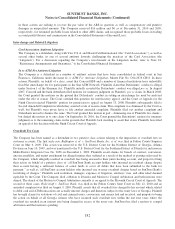

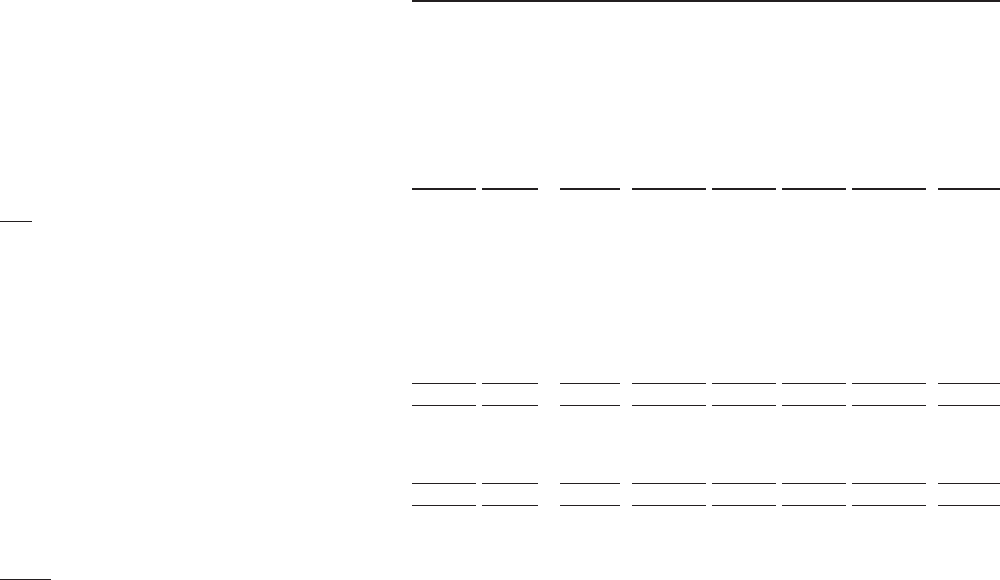

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

Fair Value Measurements

Using Significant Unobservable Inputs

(Dollars in millions)

Beginning

balance

January 1,

2009

Included in

earnings

Other

comprehensive

income

Purchases,

sales,

issuances,

settlements,

maturities

paydowns, net

Transfers to/

from other

balance

sheet

line items

Level 3

transfers, net

Fair value

December 31,

2009

Change in

unrealized

gains/

(losses)

included in

earnings for

the year

ended

December 31,

2009 related

to financial

instruments

still held at

December 31,

2009

Assets

Trading assets

U.S. Treasury and federal agencies $645 ($3) $- ($181) $- ($461) $- $-

U.S. states and political subdivisions 7 - - - - - 7 -

RMBS – private 38 1 - (25) - - 14 (7)

CDO 262 (4) 5- (83) - - 175 -

Corporate debt securities 7 3 - (10) - - - -

CP - - - 1,295 - (1,295) - -

Other debt securities 23 1 - 1 - - 25 1

Equity securities 102 6 5- 43 - - 151 2

Derivative contracts 249 1 (250) - - - - -

Other 58 (11) - (4) - (25) 18 9

Total trading assets 1,391 (6) 1, 5 (250) 61,036 - (1,781) 390 5 1

Securities AFS

U.S. states and political subdivisions 79 5 5(3) 48 - 3 132 -

RMBS – private 522 (21) 29 (123) - - 407 (19)

Other debt securities 28 - 3 47 - - 78 -

Other equity securities 860 - (4) (151) - - 705 -

Total securities AFS 1,489 (16) 2, 5 25 (179) - 3 1,322 (19) 2

LHFS 487 (9) 3- (82) (279) 34 151 (19) 3

LHFI 270 2 4- (72) 263 (14) 449 15 4

Other assets/(liabilities), net 72 630 3- (40) (697) - (35) 6

Liabilities

Trading liabilities - - (46) 6- - - (46) -

Long-term debt (3,496) 130 1- - - 3,366 - -

1Amounts included in earnings are recorded in trading account profits/(losses) and commissions.

2Amounts included in earnings are recorded in net securities gains/(losses).

3Amounts included in earnings are net of issuances, fair value changes, and expirations and are recorded in mortgage production related income.

4Amounts are generally included in mortgage production related income except $2.4 million for the year ended December 31, 2009 related to loans acquired in the GB&T acquisition.

The mark on these loans is included in trading account profits/(losses) and commissions.

5Amounts included in earnings do not include losses accrued as a result of the ARS settlement discussed in Note 21, “Contingencies,” to the Consolidated Financial Statements.

6Amount recorded in OCI is the effective portion of the cash flow hedges related to the Company’s probable forecasted sale of its shares of Coke stock as discussed in Note 17, “Derivative Financial

Instruments,” to the Consolidated Financial Statements.

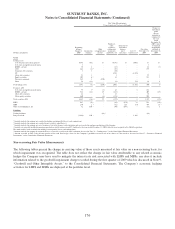

Non-recurring Fair Value Measurements

The following tables present the change in carrying value of those assets measured at fair value on a non-recurring basis, for

which impairment was recognized. The table does not reflect the change in fair value attributable to any related economic

hedges the Company may have used to mitigate the interest rate risk associated with LHFS and MSRs, nor does it include

information related to the goodwill impairment charge recorded during the first quarter of 2009 which is discussed in Note 9,

“Goodwill and Other Intangible Assets,” to the Consolidated Financial Statements. The Company’s economic hedging

activities for LHFS and MSRs are deployed at the portfolio level.

176