SunTrust 2010 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

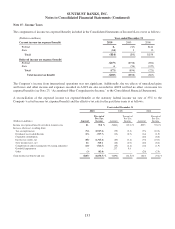

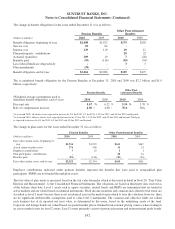

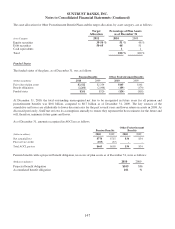

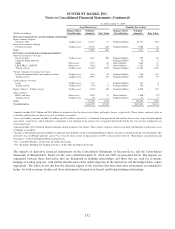

(Dollars in millions)

Assets Measured

at Fair Value as

of December 31,

2009

Fair Value

Measurements as of

December 31, 2009 1

Quoted Prices In

Active Markets

for Identical

Assets (Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Mutual funds:

Large cap fund $37 $37 $- $-

Investment grade tax-exempt bond 25 25 - -

International fund 7 7 - -

Common and collective funds

SunTrust Reserve Fund 2 - 2 -

SunTrust Equity Fund 33 - 33 -

SunTrust Georgia Tax-Free Fund 27 - 27 -

SunTrust National Tax-Free Fund 18 - 18 -

SunTrust Aggregate Fixed Income Fund 7 - 7 -

SunTrust Short-Term Bond Fund 5 - 5 -

$161 $69 $92 $-

1Schedule does not include accrued income amounting to less than 0.1% of total plan assets.

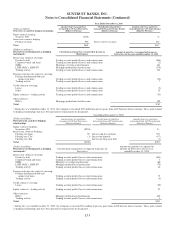

The investment strategies related to the mutual funds in the Other Postretirement Benefits plans are similar to those for the

mutual funds in the Pension Benefits plans. The investment strategies related to the common and collective funds in the

Other Postretirement Benefits plans is discussed below:

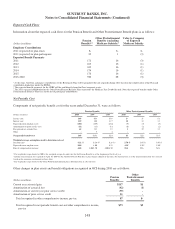

Common and collective fund strategies:

The primary objective of the SunTrust Reserve Fund is to provide a high level of current income that is consistent with

the preservation of capital and liquidity by investing exclusively in investment grade fixed income securities. The net

asset value of the Fund is determined on each business day (“valuation date”). There are currently no redemption

restrictions on these investments. Fund units are issued and redeemed based upon the net asset value per unit

determined on the valuation date.

The primary objective of the SunTrust Equity Fund is to provide capital appreciation by investing in growth companies

with leadership positions. The Fund invests primarily in a portfolio of diversified equities. The net asset value of the

Fund is determined semi-monthly on the close of the 15th and last calendar day (“valuation date”). There are currently

no redemption restrictions on these investments. Fund units are issued and redeemed based upon the net asset value per

unit determined on the valuation date.

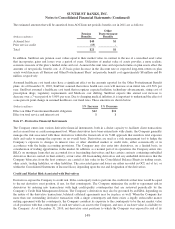

The primary objective of the SunTrust Georgia Tax-Free Fund is to produce a high level of current income, which is

exempt from U.S. income taxes and state taxes for Georgia residents. The fund primarily invests in high quality, fixed

income obligations of the state, counties, cities, and political subdivisions of Georgia. Investments include intermediate-

term and long-term maturities. The net asset value of the fund is determined semi-monthly on the close of the 15th and

last calendar day (“valuation date”). There are currently no investment redemption restrictions on these investments. Fund

units are issued and redeemed based upon the net asset value per unit determined on the valuation date.

The primary objective of the SunTrust National Tax-Free Fund is to produce a high level of income, which is exempt

from U.S. income taxes. The Fund primarily invests in high-quality bond securities from municipalities throughout the

U.S. The net asset value of the fund is determined semi-monthly on the close of the 15th and last calendar day

(“valuation date”). There are currently no investment redemption restrictions on these investments. Fund units are

issued and redeemed based upon the net asset value per unit determined on the valuation date.

The primary objective of the SunTrust Aggregate Fixed Income Fund is to provide a high level of total return through

current income and capital appreciation by investing primarily in investment grade fixed income securities. The net

asset value of the Fund is determined semi-monthly on the close of the 15th and last calendar day (“valuation date”).

145