SunTrust 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

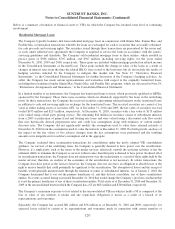

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

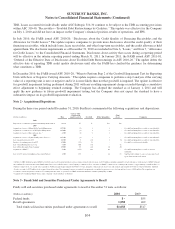

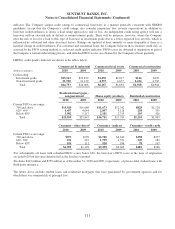

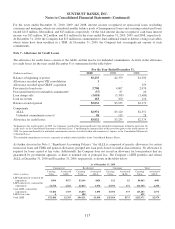

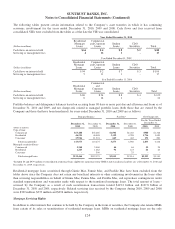

As of December 31, 2009

(Dollars in millions)

Unpaid

Principal

Balance

Amortized

Cost1

Related

Allowance

Impaired loans with no related allowance recorded:

Commercial loans:

Commercial & industrial $170 $153 $-

Commercial real estate 36 32 -

Commercial construction 92 82 -

Total commercial loans 298 267 -

Impaired loans with an allowance recorded:

Commercial loans:

Commercial & industrial 214 191 56

Commercial real estate 74 67 11

Commercial construction 860 770 127

Total commercial loans 1,148 1,028 194

Residential loans:

Residential mortgages - nonguaranteed 2,075 1,991 272

Home equity products 287 287 48

Residential construction 180 174 23

Total residential loans 2,542 2,452 343

Consumer loans:

Other direct 6 6 1

Total impaired loans $3,994 $3,753 $538

1Amortized cost reflects charge-offs that have been recognized plus other amounts that have been applied to

reduce net book balance.

The tables above exclude student loans and residential mortgages that were guaranteed by government agencies and for

which there was nominal risk of principal loss.

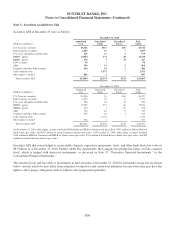

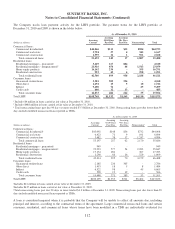

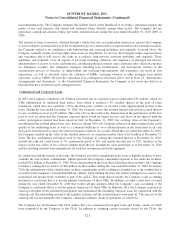

The average recorded investment in loans individually evaluated for impairment and restructured loans for the years ended

December 31, 2010, 2009, and 2008 was $4.1 billion, $3.0 billion, and $1.0 billion, respectively.

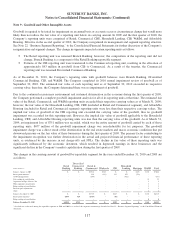

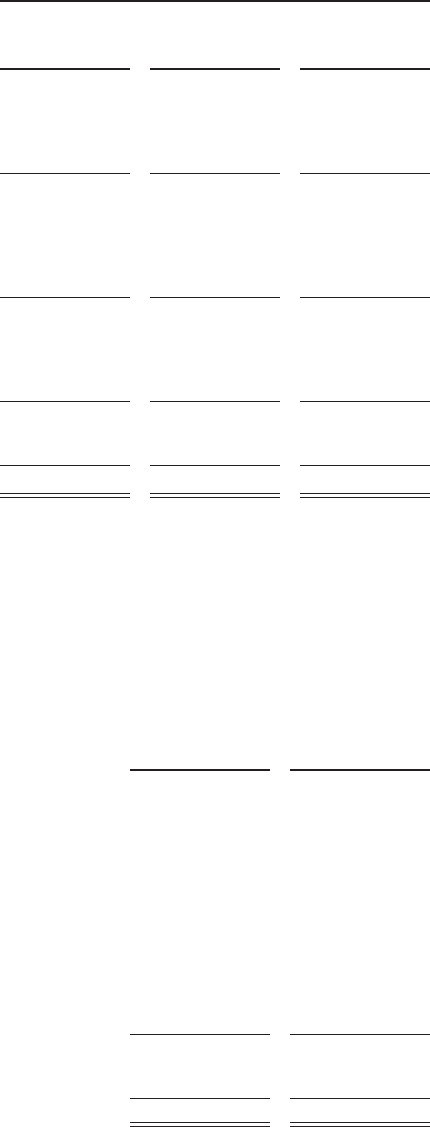

Nonperforming assets at December 31, 2010 and 2009 are shown in the following table:

(Dollars in millions)

December 31,

2010

December 31,

2009

Nonperforming Assets

Nonaccrual/NPLs:

Commercial loans:

Commercial & industrial1$584 $732

Commercial real estate 342 191

Commercial construction 961 1,247

Residential loans:

Residential mortgages - nonguaranteed21,543 2,283

Home equity products 355 367

Residential construction 290 529

Consumer loans:

Other direct 10 8

Indirect 25 45

Total nonaccrual/NPLs 4,110 5,402

OREO3596 620

Other repossessed assets 52 79

Total nonperforming assets $4,758 $6,101

1Includes $4 million and $12 million of loans carried at fair value at December 31, 2010 and 2009, respectively.

2Includes $24 million and $34 million of loans carried at fair value at December 31, 2010 and 2009, respectively.

3Does not include foreclosed real estate related to serviced loans insured by the FHA or the VA. Insurance

proceeds due from the FHA and the VA are recorded as a receivable in other assets until the funds are received

and the property is conveyed.

114