SunTrust 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

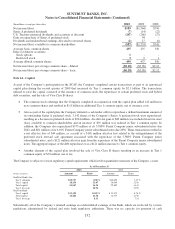

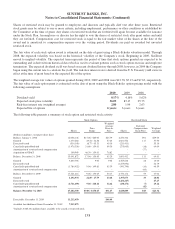

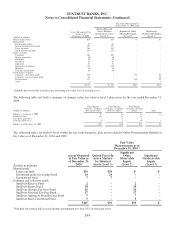

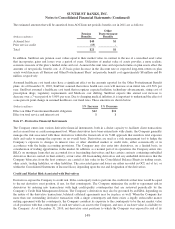

The change in benefit obligations for the years ended December 31 was as follows:

Pension Benefits

Other Postretirement

Benefits

(Dollars in millions) 2010 2009 2010 2009

Benefit obligation, beginning of year $2,008 $1,922 $179 $205

Service cost 69 64 --

Interest cost 129 119 10 11

Plan participants’ contributions --20 22

Actuarial (gain)/loss 209 19 7(28)

Benefits paid (95) (116) (30) (34)

Less federal Medicare drug subsidy --33

Plan amendments (59) ---

Benefit obligation, end of year $2,261 $2,008 $189 $179

The accumulated benefit obligation for the Pension Benefits at December 31, 2010 and 2009 was $2.2 billion and $1.9

billion, respectively.

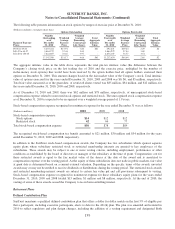

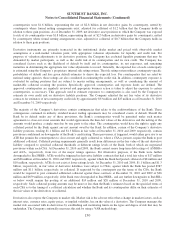

Pension Benefits

Other Post-

retirement Benefits

(Weighted average assumptions used to

determine benefit obligations, end of year) 2010 2009 2010 2009

Discount rate 5.67 % 6.32 % 5.10 % 5.70 %

Rate of compensation increase 4.00 24.00 1N/A N/A

1At year-end 2009, all salaries were expected to increase by 2% for 2010, 3% for 2011, 3.5% for 2012, and 4% for 2013 and beyond.

2At year-end 2010, all base salaries were expected to increase by 3% for 2011, 3.5% for 2012, and 4% for 2013 and beyond. Total pay

is expected to increase by 6% for 2011, 6% for 2012 and 4% for 2013 and beyond.

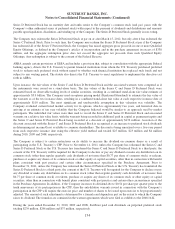

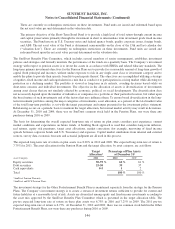

The change in plan assets for the years ended December 31 was as follows:

Pension Benefits Other Postretirement Benefits

(Dollars in millions) 2010 2009 2010 2009

Fair value of plan assets, beginning of

year $2,334 $1,919 $161 $147

Actual return on plan assets 276 506 13 25

Employer contributions 725 11

Plan participants’ contributions --20 22

Benefits paid (95) (116) (30) (34)

Fair value of plan assets, end of year $2,522 $2,334 $165 $161

Employer contributions indicated under pension benefits represent the benefits that were paid to nonqualified plan

participants. SERPs are not funded through plan assets.

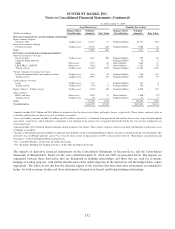

The fair value of plan assets is measured based on the fair value hierarchy which is discussed in detail in Note 20, “Fair Value

Election and Measurement”, to the Consolidated Financial Statements. The valuations are based on third party data received as

of the balance sheet date. Level 1 assets such as equity securities, mutual funds, and REITs are instruments that are traded in

active markets and are valued based on identical instruments. Fixed income securities and common and collective trust funds are

classified as level 2 assets because there is not an identical asset in the market upon which to base the valuation; however, there

are no significant unobservable assumptions used to value level 2 instruments. The common and collective funds are valued

each business day at its reported net asset value, as determined by the issuer, based on the underlying assets of the fund.

Corporate and foreign bonds are valued based on quoted market prices obtained from external pricing sources where trading in

an active market exists for level 2 assets. Level 3 assets primarily consist of private placement and noninvestment grade bonds.

142