SunTrust 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

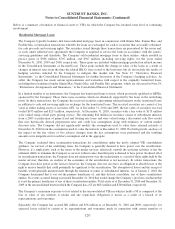

ultimate recoverability of the par value. The Company evaluated its holdings in FHLB stock at December 31, 2010 and

believes its holdings in the stock are ultimately recoverable at par. In addition, the Company does not have operational or

liquidity needs that would require a redemption of the stock in the foreseeable future and therefore determined that the stock

was not other-than-temporarily impaired.

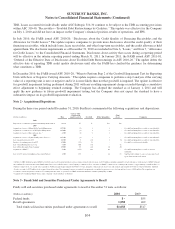

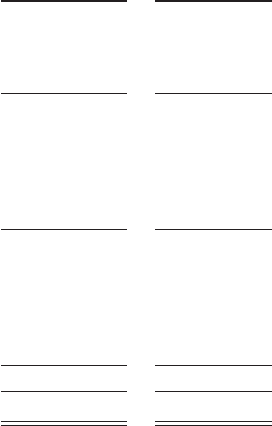

Note 6 - Loans

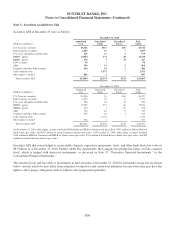

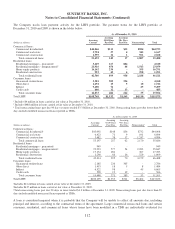

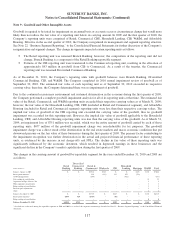

The composition of the Company’s loan portfolio at December 31, 2010 and 2009 is shown in the following table:

(Dollars in millions)

December 31,

2010

December 31,

2009

Commercial loans:

Commercial & industrial1$44,753 $44,008

Commercial real estate 6,167 6,694

Commercial construction 2,568 4,984

Total commercial loans 53,488 55,686

Residential loans:

Residential mortgages - guaranteed 4,520 949

Residential mortgages - nonguaranteed223,959 25,847

Home equity products 16,751 17,783

Residential construction 1,291 1,909

Total residential loans 46,521 46,488

Consumer loans:

Guaranteed student loans 4,260 2,786

Other direct 1,722 1,484

Indirect 9,499 6,665

Credit cards 485 566

Total consumer loans 15,966 11,501

LHFI $115,975 $113,675

LHFS $3,501 $4,670

1Includes $4 million and $12 million of loans previously acquired from GB&T and carried at fair value at

December 31, 2010 and 2009, respectively.

2Includes $488 million and $437 million of loans carried at fair value at December 31, 2010 and 2009,

respectively.

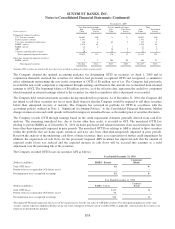

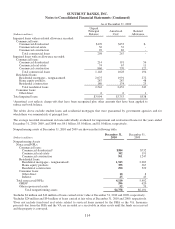

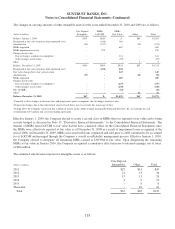

As of December 31, 2010, the Company had pledged $50.2 billion of net eligible loan collateral to support $31.2 billion in

available borrowing capacity at either the Federal Reserve discount window or the FHLB of Atlanta. Of the available

borrowing capacity, $34 million of FHLB advances were outstanding and $6.1 billion of undrawn FHLB letters of credit

were outstanding as of December 31, 2010.

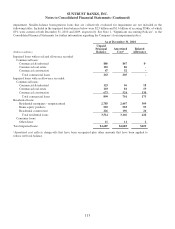

During the years ended December 31, 2010 and 2009, the Company transferred $213 million and $307 million, respectively, in

LHFS to LHFI. The loans transferred included $147 million and $272 million, respectively, in loans for which fair value had been

elected. Loans for which fair value had been elected will continue to be reported at fair value while classified as LHFI. The

remaining $66 million and $35 million, respectively, of transferred loans were valued at LOCOM. The value of these loans had

been written down by $31 million and $9 million, respectively, prior to the transfer. The loans were transferred because they were

deemed no longer marketable or the Company believed that retention of the loans provided a better risk-adjusted return.

During the years ended December 31, 2010 and 2009, the Company transferred $346 million and $125 million, respectively,

in LHFI to LHFS. Included in such transfers for the year ended December 31, 2010 were $160 million of NPLs that were

written down by $51 million upon the transfer and sold to third party investors.

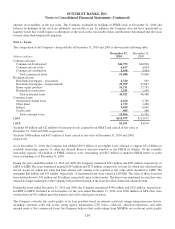

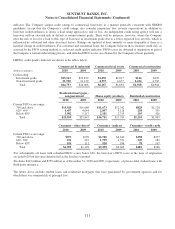

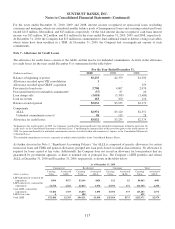

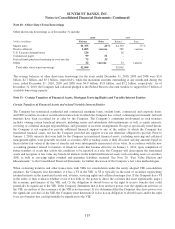

The Company evaluates the credit quality of its loan portfolio based on internal credit risk ratings using numerous factors,

including consumer credit risk scores, rating agency information, LTV ratios, collateral, collection experience, and other

internal metrics. For commercial loans, the Company believes that credit ratings from NRSROs are a relevant credit quality

110