SunTrust 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

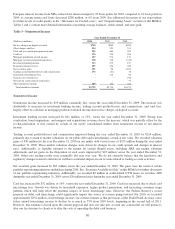

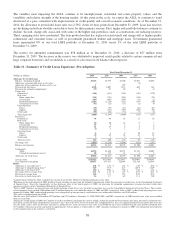

Under the post-adoption classification, we have included commercial and construction loans secured by owner-occupied

properties as part of commercial and industrial loans, as the primary source of loan repayment for owner-occupied properties

is business income and not real estate operations.

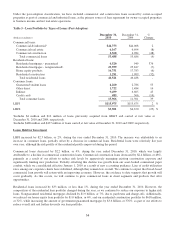

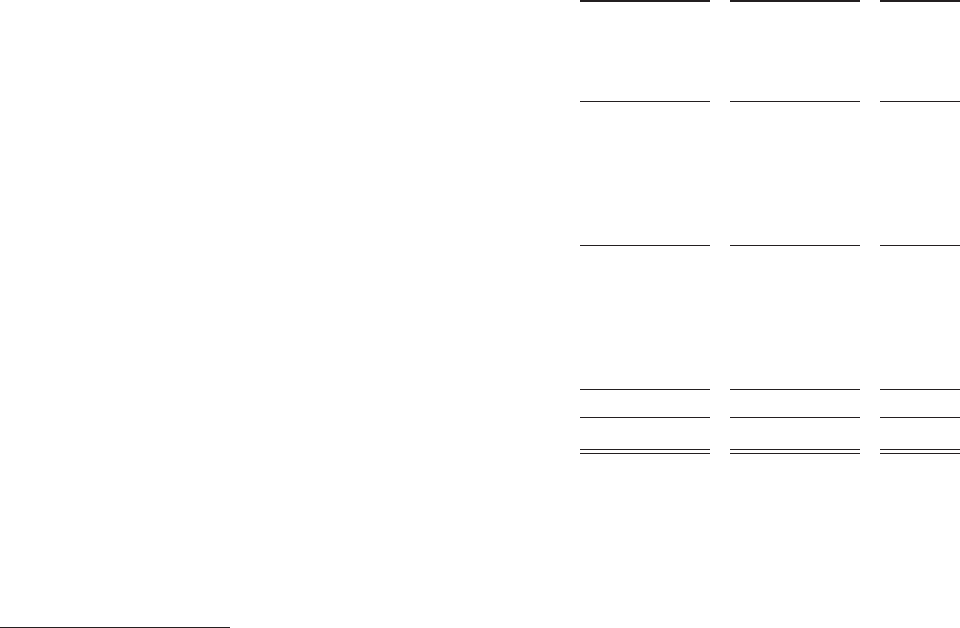

Table 5 - Loan Portfolio by Types of Loans (Post-Adoption)

(Dollars in millions)

December 31,

2010

December 31,

2009

%

Change

Commercial loans:

Commercial & industrial1$44,753 $44,008 2

Commercial real estate 6,167 6,694 (8)

Commercial construction 2,568 4,984 (48)

Total commercial loans 53,488 55,686 (4)

Residential loans:

Residential mortgages - guaranteed 4,520 949 376

Residential mortgages - nonguaranteed223,959 25,847 (7)

Home equity products 16,751 17,783 (6)

Residential construction 1,291 1,909 (32)

Total residential loans 46,521 46,488 -

Consumer loans:

Guaranteed student loans 4,260 2,786 53

Other direct 1,722 1,484 16

Indirect 9,499 6,665 43

Credit cards 485 566 (14)

Total consumer loans 15,966 11,501 39

LHFI $115,975 $113,675 2 %

LHFS $3,501 $4,670 (25) %

1Includes $4 million and $12 million of loans previously acquired from GB&T and carried at fair value at

December 31, 2010 and 2009, respectively.

2Includes $488 million and $437 million of loans carried at fair value at December 31, 2010 and 2009, respectively.

Loans Held for Investment

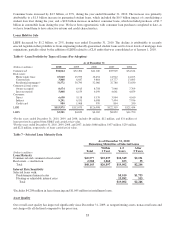

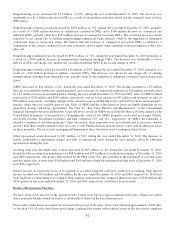

LHFI increased by $2.3 billion, or 2%, during the year ended December 31, 2010. The increase was attributable to an

increase in consumer loans, partially offset by a decrease in commercial loans. Residential loans were relatively flat year

over year, although the risk profile of the residential profile improved during the period.

Commercial loans decreased by $2.2 billion, or 4%, during the year ended December 31, 2010, which was largely

attributable to a decline in commercial construction loans. Commercial construction loans decreased by $2.4 billion, or 48%,

primarily as a result of our efforts to reduce risk levels by aggressively managing existing construction exposure and

significantly limiting new production. Partially offsetting this decline was growth from our asset-backed commercial paper

conduit, which we consolidated effective January 1, 2010 as a result of new accounting guidance. Line of credit utilization

rates among our corporate clients have stabilized, although they remain low overall. We continue to expect that broad-based

commercial loan growth will return with an improving economy. However, the evidence to date suggests that growth will

occur gradually. As this occurs, we will continue to grow commercial loans in client segments and products that offer

opportunities.

Residential loans increased by $33 million, or less than 1%, during the year ended December 31, 2010. However, the

composition of the residential loan portfolio changed during the year, as we continued to reduce our exposure to higher risk

loans. Nonguaranteed residential mortgages declined by $1.9 billion, or 7%, due to paydowns and charge-offs. Additionally,

we reduced our home equity loan portfolio by $1.0 billion, or 6%, and our residential construction portfolio by $618 million,

or 32%, while increasing the amount of government guaranteed mortgages by $3.6 billion, or 376%, as part of our efforts to

reduce overall risk and further diversify our loan portfolio.

34