SunTrust 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

also hold, as of December 31, 2010, a total of approximately $215 million of private equity investments that include direct

investments and limited partnerships. We hold these investments as long-term investments and make additional contributions

based on our contractual commitments but have decided to limit investments into new private equity investments.

Impairment charges could occur if deteriorating conditions in the market persist, including, but not limited to, goodwill and

other intangibles impairment charges and increased charges with respect to OREO.

OFF-BALANCE SHEET ARRANGEMENTS

See discussion of off-balance sheet arrangements in Note 11, “Certain Transfers of Financial Assets, Mortgage Servicing

Rights and Variable Interest Entities,” and Note 18, “Reinsurance Arrangements and Guarantees,” to the Consolidated

Financial Statements.

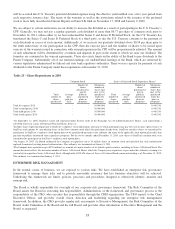

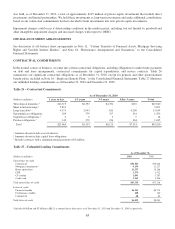

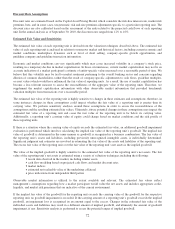

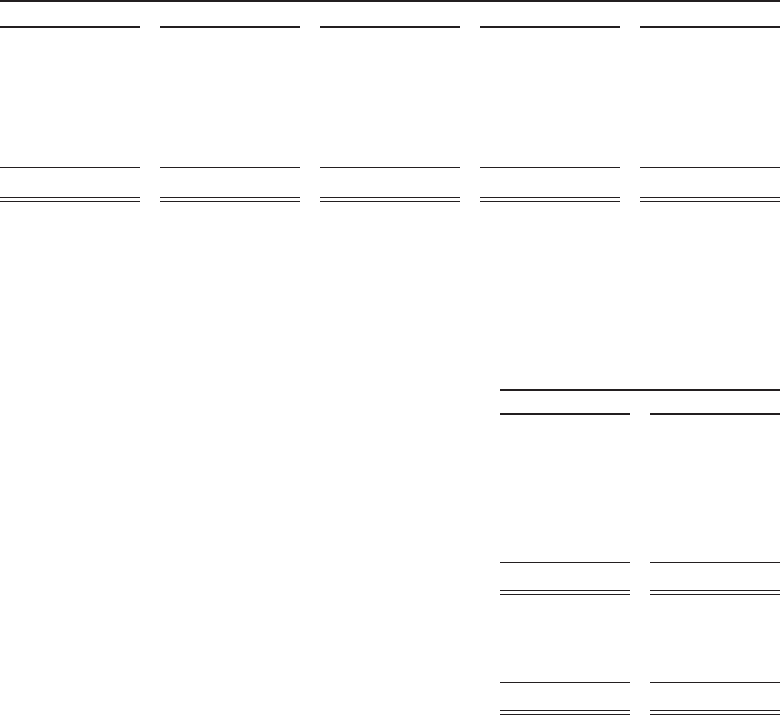

CONTRACTUAL COMMITMENTS

In the normal course of business, we enter into certain contractual obligations, including obligations to make future payments

on debt and lease arrangements, contractual commitments for capital expenditures, and service contracts. Table 26

summarizes our significant contractual obligations as of December 31, 2010, except for pension and other postretirement

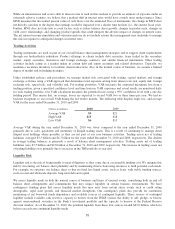

benefit plans, included in Note 16, “Employee Benefit Plans,” to the Consolidated Financial Statements. Table 27 illustrates

our unfunded lending commitments as of December 31, 2010 and December 31, 2009.

Table 26 – Contractual Commitments

As of December 31, 2010

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Time deposit maturities 1$12,319 $6,357 $4,754 $110 $23,540

Short-term borrowings 15,821 - - - 5,821

Long-term debt 1,2 4,571 2,043 811 6,209 13,634

Operating lease obligations 209 379 327 561 1,476

Capital lease obligations 1223714

Purchase obligations 3143 372 226 304 1,045

Total $23,065 $9,153 $6,121 $7,191 $45,530

1Amounts do not include accrued interest.

2Amounts do not include capital lease obligations.

3Includes contracts with a minimum annual payment of $5 million.

Table 27 – Unfunded Lending Commitments

As of December 31,

(Dollars in millions) 2010 2009

Unused lines of credit

Commercial $34,363 $35,028

Mortgage commitments 19,159 12,227

Home equity lines 13,557 15,208

CRE 1,579 1,922

CP conduit 1,091 3,787

Credit card 3,561 3,946

Total unused lines of credit $63,310 $72,118

Letters of credit

Financial standby $6,263 $8,778

Performance standby 108 140

Commercial 68 83

Total letters of credit $6,439 $9,001

1Includes $4 billion and $3 billion in IRLCs accounted for as derivatives as of December 31, 2010 and December 31, 2009, respectively.

63