SunTrust 2010 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

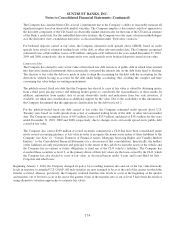

grade ratings at the time of origination or purchase. The 2006 to 2007 vintage collateral is primarily comprised of

prime jumbo fixed and floating rate loans. The 2003 vintage securities are interests retained from a securitization of

prime first-lien fixed and floating rate loans and are primarily all investment grade rated, with the exception of a

small amount of support bonds. The majority of these securities have maintained their original ratings, with a small

amount of upgrades and only one bond downgraded since inception of the deal. Securities that are classified as AFS

and are in an unrealized loss position are included as part of our quarterly OTTI evaluation process. See Note 5,

“Securities Available for Sale,” to the Consolidated Financial Statements for details regarding assumptions used to

assess impairment and impairment amounts recognized through earnings on private RMBS during 2010 and 2009.

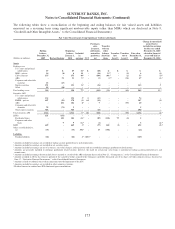

CDO securities

Level 2 securities AFS consists of a senior interest in a third party CLO for which independent pricing (based on

market trades and from new issuance of similar assets) is readily available. The Company’s investments in level 3

trading CDOs consist of the remaining positions from the SIV liquidation, senior ARS interests in Company-

sponsored securitizations of trust preferred collateral, and retained subordinate interests in both a Company-

sponsored securitization and a structured participation of commercial loans. The Company received $89 million and

$84 million in cash proceeds from sales, pay downs, liquidations, and maturities of the SIV investments during the

years ended December 31, 2010 and 2009, respectively. As a result, the Company was able to reduce its direct

exposure to SIV investments to zero at December 31, 2010 versus $149 million at December 31, 2009. As part of the

final SIV liquidation, the Company also received a pro-rata share of the SIV’s underlying collateral, which consisted

of CDOs, corporate bonds, ABS, and private-label MBS, all of which are performing assets. The Company continues

to hold $54 million of securities within trading assets that are related to the SIV liquidation, including $15 million of

CDO securities. CDO interests in Company-sponsored securitizations and structured participations, which are

classified as trading assets, totaled $40 million and $26 million as of December 31, 2010 and 2009, respectively. The

net increase in value of these interests during 2010 is due to an improvement in cash flow expectations, a steady

recovery in value in the broader CLO market, and improvement in the credit of the underlying collateral, which

triggered a markup in 2010 of certain of these interests that the Company had written down to zero in 2009. The

Company recognized net gains in the value of these interests of $34 million, including cash proceeds of $15 million

from the sales of certain of its CLO interests. These sales, along with other observable market activity for CLO

interests resulted in a transfer of the remaining $2 million interest from level 3 to level 2. For all other CDO

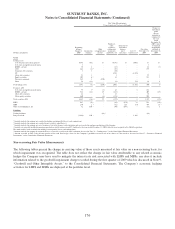

interests, there continues to be a lack of observable secondary market trading and market data is generally not

available for significant assumptions that would be used to estimate fair values; therefore, the Company has

classified these instruments as level 3 within the fair value hierarchy.

CDOs related to trust preferred ARS purchased since the auction rate market began failing in February 2008 have

been considered level 3 securities. The significant decrease in the volume and level of activity in these markets has

necessitated the use of significant unobservable inputs into the Company’s valuations. The auctions for these ARS

continue to fail; therefore, actual trades are not available to corroborate pricing estimates. There are also no

comparable or relevant indices for regional trust preferred collateral or CDOs, nor is indicative broker pricing or

third party pricing available. The Company does have visibility into the underlying collateral in the CDOs and,

therefore, can model expected cash flows using estimated discount rates based on pricing and/or spread levels seen

on trades of similarly structured securities for valuation purposes. In pricing the CLO preference shares and the

residual interest in the commercial loan participation, the Company was able to obtain market information for other

performing CLO equity level positions as a starting point for which to develop assumptions to use in modeling the

cash flows related to the securitization as well as a yield range expected in the marketplace.

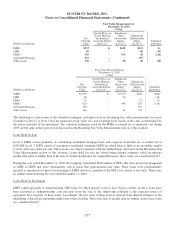

Asset-backed securities

Level 2 ABS classified as securities AFS are interests collateralized by 2009 and 2010 vintage third party

securitizations of auto loans. These ABS are either publicly traded or are 144A privately placed bonds. The

Company utilizes an independent pricing service to obtain fair values for publicly traded securities and similar

securities for estimating the fair value of the privately placed bonds. No significant unobservable assumptions are

used in pricing the auto loan ABS; therefore, the Company classifies these bonds as level 2. In addition, at

December 31, 2010, the Company transferred $32 million of trading ARS and $93 million of AFS ARS

collateralized by government guaranteed student loans from level 3 to level 2 in the fair value hierarchy. These ARS

168