SunTrust 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

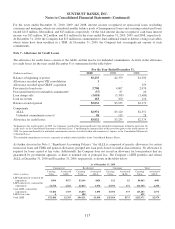

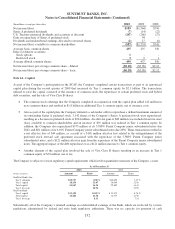

Company also acts as collateral manager for these CLOs. The securities retained by the Company and the fees received

as collateral manager represent a VI in the CLOs, which are considered to be VIEs.

Beginning January 1, 2010, upon adoption of the new VIE consolidation guidance, the Company determined that it was the

primary beneficiary of, and thus, would consolidate one of these CLOs as it has both the power to direct the activities that

most significantly impact the entity’s economic performance and the obligation to absorb losses and the right to receive

benefits from the entity that could potentially be significant to the CLO. In addition to fees received as collateral manager,

including eligibility for performance incentive fees, and owning certain preference shares, the Company’s multi-seller

conduit, Three Pillars, owns a senior interest in the CLO, resulting in economics that could potentially be significant to the

VIE. Accordingly, on January 1, 2010, the Company consolidated $307 million in total assets and $279 million in net

liabilities, after the elimination of this senior interest. The Company elected to consolidate the CLO at fair value and to

carry the financial assets and financial liabilities of the CLO at fair value subsequent to adoption. The initial consolidation

of the CLO had a negligible impact on the Company’s Consolidated Statements of Shareholders’ Equity. Substantially all

of the assets and liabilities of the CLO are loans and issued debt, respectively. The loans are classified within LHFS at fair

value and the debt is included with long-term debt at fair value on the Company’s Consolidated Balance Sheets (see Note

20, “Fair Value Election and Measurement,” to the Consolidated Financial Statements for a discussion of the Company’s

methodologies for estimating the fair values of these financial instruments). At December 31, 2010, the Company’s

Consolidated Balance Sheets reflected $316 million of loans held by the CLO and $290 million of debt issued by the CLO.

The Company is not obligated, contractually or otherwise, to provide financial support to this VIE nor has it previously

provided support to this VIE. Further, creditors of the VIE have no recourse to the general credit of the Company, as the

liabilities of the CLO are paid only to the extent of available cash flows from the CLO’s assets.

For the remaining CLOs, which are also considered to be VIEs, the Company has determined that it is not the primary

beneficiary as it does not have an obligation to absorb losses or the right to receive benefits from the entities that could

potentially be significant to the VIE. At December 31, 2009, the carrying value of the Company’s investment in the

preference shares was zero due to the significant deterioration in the performance of the collateral in those vehicles;

however, during 2010, the Company observed an improvement in cash flow expectations as well as an overall steady

recovery in liquidity and value in the broader CLO market. As a result, the Company was able to liquidate a number of

its positions in these CLO preference shares during 2010 and received $15 million in proceeds upon sale of these

positions; its remaining preference share exposure was valued at $2 million as of December 31, 2010. The Company

recorded gains of $17 million for the year ended December 31, 2010, and losses of $6 million and $12 million for the

years ended December 31, 2009 and 2008, respectively, from its CLO preference share exposure. Upon liquidation of

the preference shares, the Company’s only remaining involvement with these VIEs was through its collateral

management role. The Company receives fees for managing the assets of these vehicles; these fees are considered

adequate compensation and are commensurate with the level of effort required to provide such services. The fees

received by the Company from these entities are recorded as trust and investment management income in the

Consolidated Statements of Income/(Loss). Senior fees earned by the Company are generally not considered at risk;

however, subordinate fees earned by the Company are subject to the availability of cash flows and to the priority of

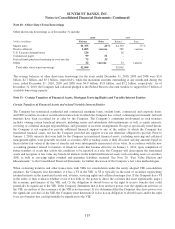

payments. The estimated assets and liabilities of these entities that were not included on the Company’s Consolidated

Balance Sheets were $2.1 billion and $2.0 billion, respectively, at December 31, 2010 and $2.3 billion and $2.2 billion,

respectively, at December 31, 2009. The Company is not obligated to provide any support to these entities, nor has it

previously provided support to these entities. No events occurred during the year ended December 31, 2010 that would

change the Company’s previous conclusion that it is not the primary beneficiary of any of these securitization entities.

Student Loans

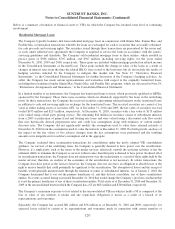

In 2006, the Company completed a securitization of government-guaranteed student loans through a transfer of loans to

a securitization SPE, which previously qualified as a QSPE, and retained the related residual interest in the SPE. The

Company, as master servicer of the loans in the SPE, has agreed to service each loan consistent with the guidelines

determined by the applicable government agencies in order to maintain the government guarantee. The Company and the

SPE have entered into an agreement to have the loans subserviced by an unrelated third party.

During the year ended December 31, 2010, the Company determined that this securitization of government-guaranteed

student loans (the “Student Loan entity”) should be consolidated as prescribed by the newly issued VIE consolidation

122