SunTrust 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

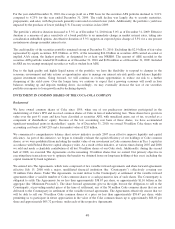

During the terms of The Agreements, and until we sell the 30 million Coke common shares, we generally will continue to

receive dividends as declared and paid by Coke and will have the right to vote such shares. However, the amounts payable to

us under The Agreements will be adjusted if actual dividends are not equal to amounts expected at the inception of the

derivative.

Contemporaneously with entering into The Agreements, the Counterparty invested in senior unsecured promissory notes

issued by the Bank and SunTrust (collectively, the “Notes”) in a private placement in an aggregate principal amount equal to

the Minimum Proceeds. The Notes carry stated maturities of approximately ten years from the effective date and bear interest

at one-month LIBOR plus a fixed spread. The Counterparty pledged the Notes to us and we pledged the 30 million Coke

common shares to the Counterparty, securing each entity’s respective obligations under The Agreements. The pledged Coke

common shares are held by an independent third party custodian and the Counterparty is prohibited under The Agreements

from selling, pledging, assigning or otherwise using the pledged Coke common shares in its business.

We generally may not prepay the Notes. The interest rate on the Notes will be reset upon or after the settlement of The

Agreements, either through a remarketing process, or based upon dealer quotations. In the event of an unsuccessful

remarketing of the Notes, we would be required to collateralize the Notes and the maturity of the Notes may accelerate to the

first anniversary of the settlement of The Agreements. However, we presently believe that it is substantially certain that the

Notes will be successfully remarketed.

The Agreements carry scheduled settlement terms of approximately seven years from the effective date. However, we have

the option to terminate The Agreements earlier with the approval of the Federal Reserve. The Agreements may also terminate

earlier upon certain events of default, extraordinary events regarding Coke and other typical termination events. Upon such

early termination, there could be exit costs or gains, such as certain breakage fees including an interest rate make-whole

amount, associated with both The Agreements and the Notes. Such costs or gains may be material but cannot be determined

at the present time due to the unlikely occurrence of such events and the number of variables that are unknown. However, the

payment of such costs, if any, will not result in us receiving less than the Minimum Proceeds from The Agreements. We

expect to sell all of the Coke common shares upon settlement of The Agreements, either under the terms of The Agreements

or in another market transaction. See Note 17, “Derivative Financial Instruments,” to the Consolidated Financial Statements

for additional discussion of the transactions.

The Federal Reserve determined that we may include in Tier 1 capital, as of the effective date of The Agreements, an amount

equal to the Minimum Proceeds minus the deferred tax liability associated with the ultimate sale of the 30 million Coke

common shares. Accordingly, The Agreements resulted in an increase in Tier 1 capital during the third quarter of 2008 of

approximately $728 million.

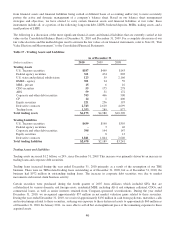

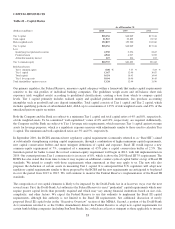

DEPOSITS

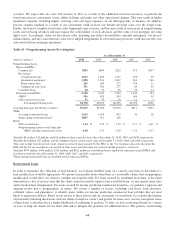

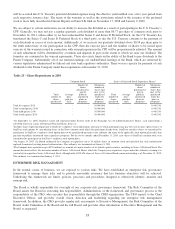

Table 20 – Composition of Average Deposits

Year Ended December 31 Percent of Total

(Dollars in millions) 2010 2009 2008 2010 2009 2008

Noninterest-bearing $26,103 $24,249 $20,949 22 % 20 % 18 %

NOW accounts 24,668 23,601 21,081 21 20 18

Money market accounts 38,893 31,864 26,565 32 27 23

Savings 4,028 3,664 3,771 333

Consumer time 14,232 16,718 16,770 12 14 14

Other time 9,205 13,068 12,197 811 11

Total consumer and commercial deposits 117,129 113,164 101,333 98 95 87

Brokered deposits 2,561 5,648 10,493 259

Foreign deposits 355 434 4,250 --4

Total deposits $120,045 $119,246 $116,076 100 % 100 % 100 %

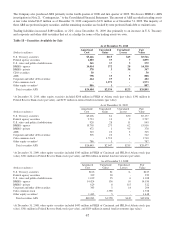

During 2010, we continued to experience deposit growth as well as improving deposit mix, as the relative proportion of

lower cost deposit accounts increased. These favorable trends were major drivers of the growth in net interest margin that we

were able to achieve during the year. Average consumer and commercial deposits increased during 2010 by $4.0 billion, or

3.5%, compared to 2009. The growth was concentrated in noninterest bearing DDA, NOW, money market, and savings

50