SunTrust 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

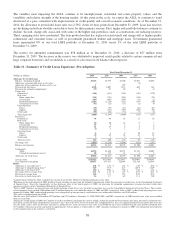

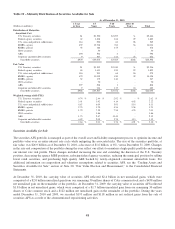

from financial assets and financial liabilities being carried at different bases of accounting and/or (iii) to more accurately

portray the active and dynamic management of a company’s balance sheet. Based on our balance sheet management

strategies and objectives, we have elected to carry certain financial assets and financial liabilities at fair value; these

instruments include all, or a portion, of the following: long-term debt, LHFS, brokered deposits, MSRs, trading assets, and a

small portion of LHFI.

The following is a discussion of the more significant financial assets and financial liabilities that are currently carried at fair

value on the Consolidated Balance Sheets at December 31, 2010 and December 31, 2009. For a complete discussion of our

fair value elections and the methodologies used to estimate the fair values of our financial instruments, refer to Note 20, “Fair

Value Election and Measurement,” to the Consolidated Financial Statements.

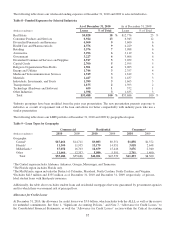

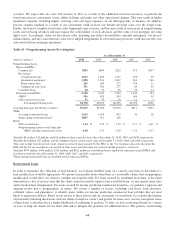

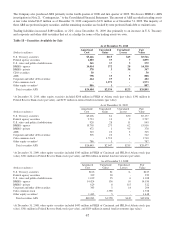

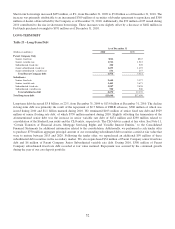

Table 17 - Trading Assets and Liabilities

As of December 31

(Dollars in millions) 2010 2009 2008

Trading Assets

U.S. Treasury securities $187 $499 $143

Federal agency securities 361 474 803

U.S. states and political subdivisions 123 59 2,166

RMBS - agency 301 94 59

MBS - private 15 616

CDO securities 55 175 278

ABS 59 51 172

Corporate and other debt securities 743 466 590

CP 14 1 400

Equity securities 221 256 193

Derivative contracts 2,743 2,610 4,699

Trading loans 1,353 289 877

Total trading assets $6,175 $4,980 $10,396

Trading Liabilities

U.S. Treasury securities $439 $190 $395

Federal agency securities -346

Corporate and other debt securities 398 144 147

Equity securities -813

Derivative contracts 1,841 1,844 2,640

Total trading liabilities $2,678 $2,189 $3,241

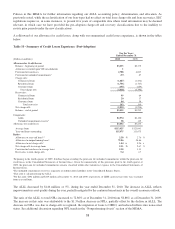

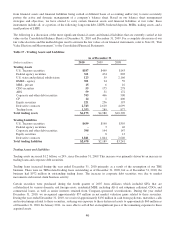

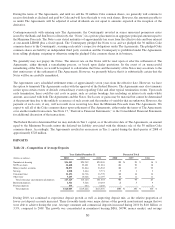

Trading Assets and Liabilities

Trading assets increased $1.2 billion, or 24%, since December 31, 2009. This increase was primarily driven by an increase in

trading loans and corporate debt securities.

Trading loans increased during the year ended December 31, 2010 primarily as a result of the resumption of our TRS

business. There were no TRS-related trading loans outstanding as of December 31, 2009, but as of December 31, 2010, the

business had $972 million in outstanding trading loans. The increase in corporate debt securities was due to market

movements and normal client business activity.

Certain securities were purchased during the fourth quarter of 2007 from affiliates which included SIVs that are

collateralized by various domestic and foreign assets, residential MBS, including Alt-A and subprime collateral, CDOs, and

commercial loans, as well as senior interests retained from Company-sponsored securitizations. During the year ended

December 31, 2010, we recognized approximately $37 million in net market valuation gains related to these securities.

During the year ended December 31, 2010, we received approximately $136 million in cash from paydowns, maturities, calls

and restructurings related to these securities, reducing our exposure to these distressed assets to approximately $60 million as

of December 31, 2010. In January 2011, we were able to sell all but an insignificant piece of the remaining exposure to these

acquired assets.

46