SunTrust 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Annual Report

suntrust banks, inc.

Table of contents

-

Page 1

2010 Annual Report suntrust banks, inc. -

Page 2

... 1,668 retail branches and 2,918 ATMs are located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. In addition, SunTrust provides customers with a full selection of technology-based banking channels including online, state-of... -

Page 3

... is working. Our low-cost deposits grew 10 percent year over year, demonstrating our success in increasing client loyalty and market share. A significant expansion of our net interest margin and solid performance from several of our key businesses resulted in improved revenue. Our capital ratios... -

Page 4

... have stated on many occasions our willingness, our ability, and our desire to repay the government's investment in our Company at the appropriate time. We are pleased that SunTrust enters the capital plan review process with a reduced risk proï¬le, improving credit and earnings trends, and a Tier... -

Page 5

... for clients to manage their money and focus on what matters to them. Those efforts are paying off. Competitive studies indicate that the service we provide through our branches and call center agents is among the best in the industry. Our work to help educate clients about the new choices they have... -

Page 6

... risk-adjusted returns - such as credit card and asset-based lending. Our success in growing market share will be driven by investments in client loyalty, evolving our highly successful "Live Solid. Bank Solid." brand positioning, and focusing on areas offering the greatest opportunity to drive... -

Page 7

SunTrust 2010 Annual Report 5 board of directors James M. Wells III 1 Chairman and Chief Executive Ofï¬cer David H. Hughes 3, 5 Former Chairman of the Board Hughes Supply, Inc. Orlando, Florida Larry L. Prince 2, 4 Chairman of the Executive Committee Genuine Parts Company Atlanta, Georgia 1 ... -

Page 8

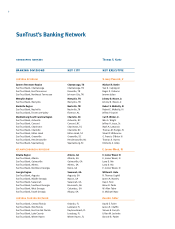

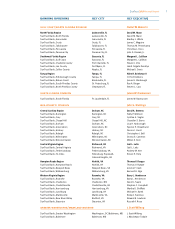

...Bank, Athens SunTrust Bank, Northwest Georgia Georgia Region SunTrust Bank, Augusta SunTrust Bank, Middle Georgia SunTrust Bank, Savannah SunTrust Bank, Southeast Georgia SunTrust Bank, West Georgia SunTrust Bank, South Georgia Atlanta, GA Atlanta, GA Gainesville, GA Athens, GA Rome, GA Savannah, GA... -

Page 9

SunTrust 2010 Annual Report 7 banking divisions gulf coast/north florida division North Florida Region SunTrust Bank, North Florida SunTrust Bank, Gainesville SunTrust Bank, Ocala SunTrust Bank, Tallahassee SunTrust Bank, Pensacola SunTrust Bank, Panama City Southwest Florida Region SunTrust Bank,... -

Page 10

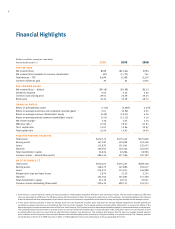

... 20 2009 ($1,564) (1,733) 8,299 83 2008 $796 741 9,210 1,004 for the year Net income/(loss) Net income/(loss) available to common shareholders Total revenue - FTE 1 Common dividends paid per common share Net income/(loss) - diluted Dividends declared Common stock closing price Book value ($0.18... -

Page 11

... is a shell company (as defined in Rule 12b-2 of the Act). Yes ' No È The aggregate market value of the voting Common Stock held by non-affiliates at June 30, 2010 was approximately $11.6 billion, based on the New York Stock Exchange closing price for such shares on that date. For purposes of... -

Page 12

...14: Directors, Executive Officers and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions, and Director Independence. Principal Accounting Fees and Services. 193... -

Page 13

... debt obligation. CD - Certificate of deposit. CDS - Credit default swaps. CFPB - Bureau of Consumer Financial Protection. CIB - Corporate and Investment Banking. Class B shares - Visa Inc. Class B common stock. CLO - Collateralized loan obligation. CMBS - Commercial mortgage-backed securities... -

Page 14

... - Deposit Insurance Fund. Dodd-Frank Act - The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. EAPMC - Earning Asset/Portfolio Management Committee. EESA - The Emergency Economic Stabilization Act of 2008. EPS - Earnings per share. ERISA - Employee Retirement Income Security Act... -

Page 15

...- Long-term incentive. LTV - Loan to value. MBS - Mortgage-backed securities. MD&A - Management's Discussion and Analysis of Financial Condition and Results of Operations. MIP - Management Incentive Plan. MMMF - Money market mutual funds. Moody's - Moody's Investors Service. MSR - Mortgage servicing... -

Page 16

... Community Capital - SunTrust Community Capital, LLC. TAGP - Transaction Account Guarantee Program. TARP - Troubled Asset Relief Program. TDR - Troubled debt restructuring. The Agreements - Equity forward agreements. Three Pillars - Three Pillars Funding, LLC. TransPlatinum - TransPlatinum Service... -

Page 17

... trust and investment services. Additional subsidiaries provide mortgage banking, asset management, securities brokerage, capital market services, and credit-related insurance. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the... -

Page 18

... of regulation, commercial banks are affected significantly by the actions of the Federal Reserve as it attempts to control the money supply and credit availability in order to influence the economy. On July 21, 2010, the Dodd-Frank Act was signed into law. The Dodd-Frank Act imposes new regulatory... -

Page 19

...must have a Tier 1 risk-based capital ratio of at least six percent, a total risk-based capital ratio of at least ten percent and a leverage ratio of at least five percent and not be subject to a capital directive order. Regulators also must take into consideration: (a) concentrations of credit risk... -

Page 20

...any buffer: • • • 3.5% Tier 1 Common Equity to risk-weighted assets; 4.5% Tier 1 capital to risk-weighted assets; and 8.0% Total capital to risk-weighted assets. The Basel III final framework provides for a number of new deductions from and adjustments to Tier 1 Common Equity. These include... -

Page 21

... one-year time horizon. In order to comply with these requirements, banks will take a number of actions which may include increasing their asset holdings of U.S. Treasury securities and other sovereign debt, increasing the use of long-term debt as a funding source and adopting new business practices... -

Page 22

... on the amount of deposits any bank may hold within that state. The Company is subject to the rules and regulations promulgated under the EESA by virtue of the Company's sale of preferred stock to the U.S. Treasury under the U.S. Treasury's CPP. Additional information relating to the restrictions on... -

Page 23

... branching legislation and certain state legislation. Employees As of December 31, 2010, there were 29,056 full-time equivalent employees within SunTrust. None of the domestic employees within the Company are subject to a collective bargaining agreement. Management considers its employee relations... -

Page 24

.... Dramatic declines in the housing market over the past several years, with falling home prices and increasing foreclosures, unemployment and under-employment, have negatively impacted the credit performance of real estate related loans and resulted in significant write-downs of asset values by... -

Page 25

...regulations that have been proposed, the following may adversely affect our business: • Limitations on debit card interchange fees may affect our profits; • Changing the assessment base for deposit insurance premiums from deposits to average consolidated total assets less average tangible equity... -

Page 26

... fail to perform according to the terms of their contracts. A number of our products expose us to credit risk, including loans, leases and lending commitments, derivatives, trading account assets, insurance arrangements with respect to such products, and assets held for sale. As one of the nation... -

Page 27

...mortgages, home equity lines of credit, and mortgage loans sourced from brokers that are outside our branch bank network. These conditions have resulted in losses, write downs and impairment charges in our mortgage and other lines of business. Continued declines in real estate values, low home sales... -

Page 28

...our Mortgage line of business. In addition, process changes required as a result of our assessment could increase our default servicing costs over the longer term. Finally, the time to complete foreclosure sales temporarily may increase, and this may result in an increase in nonperforming assets and... -

Page 29

...balance sheet financial instruments or the value of equity investments that we hold could decline; • The value of assets for which we provide processing services could decline; or • To the extent we access capital markets to raise funds to support our business, such changes could affect the cost... -

Page 30

... in any number of activities, including lending practices, the failure of any product or service sold by us to meet our clients' expectations or applicable regulatory requirements, corporate governance and acquisitions, or from actions taken by government regulators and community organizations in... -

Page 31

... to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients, or be subject to cost increases. Company Risks We may not... -

Page 32

... of our funding from the capital markets. Although our issuer ratings are still rated investment grade by the major rating agencies, those ratings were downgraded during 2009 and 2010 by the major rating agencies. These rating agencies regularly evaluate us and their ratings are based on a number of... -

Page 33

... to execute the business strategy and provide high quality service may suffer if we are unable to recruit or retain a sufficient number of qualified employees or if the costs of employee compensation or benefits increase substantially. Further, in June, 2010, the Federal Reserve, the Office of... -

Page 34

... or submit under the Exchange Act is accurately accumulated and communicated to management, and recorded, processed, summarized, and reported within the time periods specified in the SEC's rules and forms. We believe that any disclosure controls and procedures or internal controls and procedures, no... -

Page 35

... UNRESOLVED STAFF COMMENTS The Company's headquarters is located in Atlanta, Georgia. As of December 31, 2010, the Bank owned 613 of its 1,668 fullservice banking offices and leased the remaining banking offices. (See Note 8, "Premises and Equipment," to the Consolidated Financial Statements for... -

Page 36

...'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES The principal market in which the common stock of the Company is traded is the NYSE. See Item 6 and Table 29 in the MD&A for information on the high and the low sales prices of SunTrust common stock on the... -

Page 37

... Total assets Earning assets Loans Allowance for loan and lease losses Consumer and commercial deposits Brokered and foreign deposits Long-term debt Total shareholders' equity Financial Ratios and Other Data Return on average total assets Return on average total assets less net unrealized securities... -

Page 38

...future levels of net interest margin, future repurchase related losses and reserves, our expense base, home prices, default frequency, loss severity, commercial loan growth; expectations regarding the effect on us over time of changes in the FDIC's method of assessing deposit insurance premiums; and... -

Page 39

... and our headquarters are located in Atlanta, Georgia. Our principal banking subsidiary, SunTrust Bank, offers a full line of financial services for consumers and businesses through its branches located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and... -

Page 40

... rates for at least two years. The Federal Reserve has forecast a gradual economic recovery through 2011, and, as a result, the Federal Reserve has reaffirmed that it will maintain key interest rates at record lows for an extended period of time as long as the economic data supports these low rates... -

Page 41

... 2011. Asset quality improvement was broad-based in 2010, with improvements in the provision for credit losses, net charge-offs, NPLs, nonperforming assets, and early stage delinquencies. The ALLL remains elevated by historical standards at 2.58% of total loans, but declined 18 basis points compared... -

Page 42

... in long-term debt. As a result, our net interest margin increased to 3.38% for the year ended December 31, 2010 from 3.04% in 2009. Noninterest income remained stable during 2010, most notably due to increases in trading income offset by lower mortgage production income and lower service charges... -

Page 43

... trading assets Unrealized gains on securities available for sale, net Total assets Liabilities and Shareholders' Equity Interest-bearing deposits: NOW accounts Money market accounts Savings Consumer time Other time Total interest-bearing consumer and commercial deposits Brokered deposits Foreign... -

Page 44

... NOW accounts Money market accounts Savings Consumer time Other time Brokered deposits Foreign deposits Funds purchased Securities sold under agreements to repurchase Interest-bearing trading liabilities Other short-term borrowings Long-term debt Total interest expense Net change in net interest... -

Page 45

...rate indices. In addition, loan-related interest income has been augmented by improved risk-based pricing discipline. Average consumer and commercial deposits increased $4.0 billion, or 4%, in 2010 compared to 2009. This growth consisted of increases of $7.0 billion, or 22%, in money market accounts... -

Page 46

...banking income, trading account profits/(losses) and commissions, and card fees, largely offset by a decline in mortgage production related income and service charges on deposit accounts. Investment banking income increased by $41 million, or 15%, versus the year ended December 31, 2009. Strong loan... -

Page 47

..." to this Annual Report on Form 10-K and Note 18, "Reinsurance Arrangements and Guarantees - Loan Sales," to the Consolidated Financial Statements for additional information. Service charges on deposit accounts decreased by $88 million, or 10%, versus the year ended December 31, 2009. The decreases... -

Page 48

...) Employee compensation Employee benefits Personnel expense Other real estate expense Credit and collection services Operating losses Mortgage reinsurance Credit-related costs Outside processing and software Net occupancy expense Regulatory assessments Marketing and customer development Equipment... -

Page 49

... in the underlying plan assets in 2010. Full-time equivalent employees increased by 1,055 compared to December 31, 2009, with the majority of the increase resulting from hiring within our technology, mortgage, retail branches, and client support areas. These increases are a direct result of our... -

Page 50

... our asset-backed commercial paper conduit, which we consolidated effective January 1, 2010 as a result of new accounting guidance. Line of credit utilization rates among our corporate clients have stabilized, although they remain low overall. We continue to expect that broad-based commercial loan... -

Page 51

... estate: Home equity lines Construction Residential mortgages2 Commercial real estate: Owner occupied Investor owned Consumer: Direct Indirect Credit card LHFI LHFS 1For the years ended December 31, 2010, 2009, and 2008, includes $4 million, $12 million, and $31 million of loans previously acquired... -

Page 52

... guarantor's, if any, abilities to service the debt, the loan terms, and the value of the property. These factors are taken into consideration when formulating our ALLL through our credit risk rating and/or specific reserving processes. We believe the current commercial real estate cycle is not over... -

Page 53

... 100 % (Dollars in millions) Real Estate Consumer Products and Services Diversified Financials and Insurance Health Care and Pharmaceuticals Retailing Automotive Government Diversified Commercial Services and Supplies Capital Goods Religious Organizations/Non-Profits Energy and Utilities Media and... -

Page 54

...charge-offs3 Net charge-offs to average loans Provision for loan losses to average loans Recoveries to total charge-offs 1Beginning in the fourth quarter of 2009, SunTrust began recording the provision for unfunded commitments within the provision for credit losses in the Consolidated Statements of... -

Page 55

... estate: Home equity lines Construction Residential mortgages Commercial real estate Consumer loans: Direct Indirect Credit cards Total recoveries Net charge-offs Balance-end of period Components: ALLL Unfunded commitments reserve Allowance for credit losses Average loans Year-end loans outstanding... -

Page 56

... of Total Loans Commercial loans Real estate loans Consumer loans Total 1Beginning 2010 29 % 56 15 100 % 2009 2007 29 % 61 10 100 % 2006 29 % 61 10 100 % 29 % 60 11 100 % in 2008, the unallocated reserve is reflected in our homogeneous pool estimates. Charge-offs Net charge-offs for the years... -

Page 57

... at fair value at December 31, 2010 and 2009, respectively. 3Does not include foreclosed real estate related to serviced loans insured by the FHA or the VA. Insurance proceeds due from the FHA and the VA are recorded as a receivable in other assets until the funds are received and the property is... -

Page 58

... the Consolidated Statements of Income/(Loss). Geographically, most of our OREO properties are located in Georgia, Florida, and North Carolina. Residential properties and land comprised 52% and 36%, respectively, of OREO; the remainder is related to commercial and other properties. Upon foreclosure... -

Page 59

... Federal Reserve, have conducted a review of our mortgage servicing practices, as well as all other large servicers in the U.S. We expect these regulators to ask us and other servicers to consent to an order possibly related to (i) the filing of affidavits without personal knowledge, (ii) the filing... -

Page 60

... fair value at December 31, 2010, 2009, and 2008 respectively. 3Does not include foreclosed real estate related to serviced loans insured by the FHA or the VA. Insurance proceeds due from the FHA and the VA are recorded as a receivable in other assets until the funds are received and the property is... -

Page 61

...are predominately first and second lien residential mortgages and home equity lines of credit, $437 million in commercial loans, which are predominately incomeproducing properties, and $11 million in direct consumer loans. At December 31, 2010, 70% of our total TDR portfolio was current with respect... -

Page 62

...a company's balance sheet. Based on our balance sheet management strategies and objectives, we have elected to carry certain financial assets and financial liabilities at fair value; these instruments include all, or a portion, of the following: long-term debt, LHFS, brokered deposits, MSRs, trading... -

Page 63

... preferred bank debt or student loans. Trading liabilities increased $489 million, or 22%, since December 31, 2009 due primarily to an increase in U.S. Treasury and corporate and other debt securities that act as a hedge for some of the trading assets we own. Table 18 - Securities Available for Sale... -

Page 64

... automobile loans. For additional information on composition and valuation assumptions related to securities AFS, see the "Trading Assets and Securities Available for Sale" section of Note 20, "Fair Value Election and Measurement," to the Consolidated Financial Statements. At December 31, 2010, the... -

Page 65

... 30 million shares that we owned. Our primary objective in executing these transactions was to optimize the benefits we obtained from our long-term holding of this asset, including the capital treatment by bank regulators. We entered into The Agreements, which were comprised of two variable forward... -

Page 66

... 14 11 95 5 100 % 2008 18 % 18 23 3 14 11 87 9 4 100 % Noninterest-bearing NOW accounts Money market accounts Savings Consumer time Other time Total consumer and commercial deposits Brokered deposits Foreign deposits Total deposits During 2010, we continued to experience deposit growth as well as... -

Page 67

... the new banking landscape. We continue to manage judiciously through the implications of impending or executed regulatory change and evaluate the impacts to our deposit products and clients. Average brokered and foreign deposits decreased by $3.2 billion, or 52%, during 2010 compared to 2009. This... -

Page 68

... of the Student Loan entity and the CLO entity, respectively. The CLO debt is carried at fair value. See Note 11, "Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities," to the Consolidated Financial Statements for additional information related to the... -

Page 69

... capital Total capital Risk-weighted assets Tier 1 capital Less: Qualifying trust preferred securities Preferred stock Allowable minority interest Tier 1 common equity Risk-based ratios: Tier 1 common equity Tier 1 capital Total capital Tier 1 leverage ratio Total shareholders' equity to assets 2010... -

Page 70

...and Tier 1 common equity and the decline in risk weighted assets. Our Total capital ratio was stable as a result of lower risk weighted assets, offset by the tender for subordinated debt that we completed in the third quarter. See additional discussion related to the repurchase of debt securities in... -

Page 71

... option plan rather than pursuant to publicly announced share repurchase programs. For the twelve months ended December 31, 2010, zero shares of SunTrust common stock were surrendered by participants in SunTrust's employee stock option plans. 3On August 14, 2007, the Board authorized the Company to... -

Page 72

... and/or corporate goals and strategies. Similarly, risk management systems, processes and applications are routinely enhanced to support our risk and business objectives. Risk information is available at both an enterprise and a detailed level. Senior management and Board reports provide a holistic... -

Page 73

...includes a risk manager and support staff embedded within each line of business and corporate function. These risk managers also report indirectly to the CORO and are responsible for execution of the Operational Risk Management program within their areas. Market Risk Management Market risk refers to... -

Page 74

... include the net interest payments. The swaps are accounted for as trading assets and therefore, the benefit to income due to a decline in short term interest rates will be recognized as a gain in the fair value of the swaps and will be recorded as an increase in trading account profits/(losses) and... -

Page 75

...of our overall balance sheet management strategies and to support client requirements through our broker/dealer subsidiary. Product offerings to clients include debt securities, loans traded in the secondary market, equity securities, derivatives and foreign exchange contracts, and similar financial... -

Page 76

.... Net short-term unsecured borrowings, which includes wholesale domestic and foreign deposits and Fed funds purchased, totaled $7.1 billion as of December 31, 2010, down from $8.9 billion as of December 31, 2009. We also have access to wholesale liquidity via the capital markets. The Parent Company... -

Page 77

...need for working capital. Certain provisions of long-term debt agreements and the lines of credit prevent us from creating liens on, disposing of, or issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations, certain leases, sales or... -

Page 78

... purchase capital stock in the FHLB. In exchange, members take advantage of competitively priced advances as a wholesale funding source and access grants and low-cost loans for affordable housing and community-development projects, amongst other benefits. As of December 31, 2010, we held a total of... -

Page 79

... Lending Commitments (Dollars in millions) Unused lines of credit Commercial Mortgage commitments 1 Home equity lines CRE CP conduit Credit card Total unused lines of credit Letters of credit Financial standby Performance standby Commercial Total letters of credit As of December 31, 2010 2009... -

Page 80

... on appraisals, broker price opinions, recent sales of foreclosed properties, automated valuation models, other property-specific information, and relevant market information, supplemented by our internal property valuation professionals. The value estimate is based on an orderly disposition and... -

Page 81

... Assets" sections in this MD&A as well as Note 6, "Loans," and Note 7, "Allowance for Credit Losses," to the Consolidated Financial Statements. Mortgage Repurchase Reserve We sell residential mortgage loans to investors through securitizations or whole loan sales in the normal course of our business... -

Page 82

... by delays in the foreclosure process which is a heightened risk in some of the states where our loans sold were originated. Approximately 15% of the population of loans sold between January 1, 2005 and December 31, 2010 were sold to non-agency investors, some in the form of securitizations. Due to... -

Page 83

...instrument's fair value after evaluating all available information pertaining to fair value. This process has involved the gathering of multiple sources of information, including broker quotes, values provided by pricing services, trading activity in other similar securities, market indices, pricing... -

Page 84

...discount rates. Pricing services and broker quotes were obtained, when available, to assist in estimating the fair value of level 3 instruments. We evaluate third party pricing to determine the reasonableness of the information relative to changes in market data such as any recent trades we executed... -

Page 85

...has caused us to evaluate the performance of the underlying collateral and use a discount rate commensurate with the rate a market participant would use to value the instrument in an orderly transaction, but that also acknowledges illiquidity premiums and required investor rates of return that would... -

Page 86

... other market information. Our OREO properties are concentrated in Georgia, Florida, and North Carolina, therefore further deterioration in property values in those states or changes to our disposition strategies could cause our estimates of OREO values to decline which would result in further write... -

Page 87

... loan and deposit growth, forward interest rates, historical performance, and industry and economic trends, among other considerations. The long-term growth rate used in determining the terminal value of each reporting unit was estimated at 4% in 2009 and 2010 based on management's assessment... -

Page 88

...reporting unit's net assets. The fair value of the reporting unit's net assets is estimated using a variety of valuation techniques including the following: • recent data observed in the market, including similar assets • cash flow modeling based on projected cash flows and market discount rates... -

Page 89

.... Size and Characteristics of the Employee Population Pension cost is directly related to the number of employees covered by the plans, and other factors including salary, age, years of employment, and benefit terms. Effective January 1, 2008, retirement plan participants who were employed as of... -

Page 90

...is used to determine the present value of future benefit obligations. The discount rate for each plan is determined by matching the expected cash flows of each plan to a yield curve based on long-term, high quality fixed income debt instruments available as of the measurement date, December 31, 2010... -

Page 91

... common share Book value per common share Tangible book value per common share2 Market capitalization Market Price: High Low Close Selected Average Balances Total assets Earning assets Loans Consumer and commercial deposits Brokered and foreign deposits Total shareholders' equity Average common... -

Page 92

...sold loans, and the net impact gains on the sale of, and improved market valuations on, assets carried at fair value. Consumer and commercial fee-based income in the fourth quarter of 2010 were essentially flat compared to the fourth quarter of 2009, as strong investment banking income and card fees... -

Page 93

...(Dollars in millions) Retail Banking Diversified Commercial Banking CRE CIB Mortgage W&IM Corporate Other and Treasury 2010 $33,220 22,371 9,757 11,225 29,043 8,106 251 BUSINESS SEGMENT RESULTS Twelve Months Ended December 31, 2010 vs. 2009 Retail Banking Retail Banking's net income for the twelve... -

Page 94

... offset by a decrease in lease financing net charge-offs. Total noninterest income was $226 million, a decrease of $16 million, or 7%. Service charges on deposits decreased $5 million, or 4%, driven by lower commercial deposit analysis fees while letters of credit fees decreased $5 million, or 14... -

Page 95

...offset by the consolidation of Three Pillars and the resulting shift of $33 million from noninterest income to net interest income. In addition, derivative revenue, treasury management fees, fixed income sales and trading revenue, and equity offering fees also declined. Total noninterest expense was... -

Page 96

... by increases in personal credit lines and home equity lines. Loan-related net interest income increased $15 million, or 11%, as higher loan spreads more than offset the decrease in average loan balances. Average customer deposits increased $0.6 billion, or 6%, as money market accounts increased... -

Page 97

... of higher average deposit balances. Average loan balances declined $0.6 billion, or 2%, with decreases in residential mortgages, indirect auto, consumer direct installment, and commercial loans, partially offset by increases in student loans and home equity lines. Loan-related net interest income... -

Page 98

... residential mortgages, and commercial loans. Total noninterest income was $94 million, a $6 million, or 7%, increase driven by a $13 million increase in trading income related to affordable housing properties partially offset by declines in partnership income and syndication fees. Total noninterest... -

Page 99

... revenue based incentive compensation and pension expense. Offsetting these higher expenses were lower salaries and other related staff expenses, as well as lower outside processing and miscellaneous expenses. Mortgage Mortgage reported a net loss of $995 million for the year ended December 31, 2009... -

Page 100

...-directed retirement accounts. SunTrust's total assets under advisement were approximately $205.4 billion, which includes $119.5 billion in assets under management, $46.0 billion in non-managed trust assets, $31.8 billion in retail brokerage assets, and $8.1 billion in non-managed corporate agency... -

Page 101

... SunTrust charitable foundation in the third quarter of 2008. The decrease was partially offset by a $79 million increase in FDIC insurance expense primarily due to the special assessment recorded in the second quarter of 2009. While the special assessment was recorded in the Other line of business... -

Page 102

... equity. We believe this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity as well as preferred stock (the level of which may vary from company to company), it allows investors to more easily compare our book value... -

Page 103

... equity. We believe this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity as well as preferred stock (the level of which may vary from company to company), it allows investors to more easily compare our book value... -

Page 104

... DATA Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders of SunTrust Banks, Inc. We have audited the accompanying consolidated balance sheets of SunTrust Banks, Inc. (the Company) as of December 31, 2010 and 2009, and the related consolidated statements... -

Page 105

... 31, 2010, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of SunTrust Banks, Inc. as of December 31, 2010 and 2009 and the related consolidated statements of income... -

Page 106

... management income Card fees Mortgage production related income Mortgage servicing related income/(loss) Investment banking income Retail investment services Net securities gains2 Trading account profits/(losses) and commissions Gain from ownership in Visa Net gain on sale of businesses Net... -

Page 107

...Total consumer and commercial deposits Brokered deposits (CDs at fair value: $1,213 as of December 31, 2010; $1,261 as of December 31, 2009) Foreign deposits Total deposits Funds purchased Securities sold under agreements to repurchase Other short-term borrowings Long-term debt 3 (debt at fair value... -

Page 108

... Accretion of discount associated with U.S. Treasury preferred stock Stock compensation expense Restricted stock activity Amortization of restricted stock compensation Issuance of stock for employee benefit plans and other Fair value election of MSRs Adoption of VIE consolidation guidance Balance... -

Page 109

... and foreclosed property Deferred income tax benefit Amortization of restricted stock compensation Stock option compensation Excess tax benefits from stock-based compensation Net loss on extinguishment of debt Net securities gains Net gain on sale/leaseback of premises Net gain on sale of assets Net... -

Page 110

... company with its headquarters in Atlanta, Georgia. SunTrust's principal banking subsidiary, SunTrust Bank, offers a full line of financial services for consumers and businesses through its branches located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia... -

Page 111

... as noninterest income in the Consolidated Statements of Income/(Loss). The Company may transfer certain residential mortgage loans, commercial loans, and student loans to a held for sale classification at LOCOM. At the time of transfer, any credit losses are recorded as a reduction in the ALLL... -

Page 112

... as a TDR over the Company's year end, the loan will be removed from TDR status as long as the modified terms were market-based at the time of modification. Generally, once a residential loan becomes a TDR, it is probable that the loan will likely continue to be reported as a TDR until it... -

Page 113

... evaluation of a property's value. Estimated collateral valuations are based on appraisals, broker price opinions, recent sales of foreclosed properties, automated valuation models, other property-specific information, and relevant market information, supplemented by the Company's internal property... -

Page 114

... information on the Company's activities related to goodwill and other intangibles, refer to Note 9, "Goodwill and Other Intangible Assets," to the Consolidated Financial Statements. MSRs The Company recognizes as assets the rights to service mortgage loans based on the estimated fair value... -

Page 115

... and changes in fair value are also reported in mortgage servicing related income in the Consolidated Statements of Income/(Loss). For additional information on the Company's servicing fees, refer to Note 11, "Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest... -

Page 116

... of income tax expense/(benefit). For additional information on the Company's activities related to income taxes, refer to Note 15, "Income Taxes," to the Consolidated Financial Statements. Earnings Per Share Basic EPS is computed by dividing net income/(loss) available to common shareholders by... -

Page 117

... disclosures related to the Company's stock-based employee compensation plan are included in Note 16, "Employee Benefit Plans," to the Consolidated Financial Statements. Employee Benefits Employee benefits expense includes the net periodic benefit costs associated with the pension, supplemental... -

Page 118

... issuances of long-term debt, brokered deposits, and MSR assets. Fair value is used on a non-recurring basis as a measurement basis either when assets are evaluated for impairment, the basis of accounting is LOCOM or for disclosure purposes. Examples of these non-recurring uses of fair value include... -

Page 119

... sheet impacts from consolidating Three Pillars, the CLO, and the student loan securitization vehicle, were increases in loans and leases, the related ALLL, LHFS, long-term debt, and other short-term borrowings. The consolidations of these entities had no impact on the Company's earnings or cash... -

Page 120

...) 2010 Disposition of certain money market fund management business 2009 Acquisition of assets of Martin Kelly Capital Management Acquisition of certain assets of CSI Capital Management Acquisition of assets of Epic Advisors, Inc. 2 2008 Acquisition of assets of Cymric Family Office Services 2 Sale... -

Page 121

... strategies. The size, volume and nature of the trading instruments can vary based on economic and Company specific asset or liability conditions. Product offerings to clients include debt securities, loans traded in the secondary market, equity securities, derivative and foreign exchange contracts... -

Page 122

...31, 2009, other equity securities included $343 million in FHLB of Cincinnati and FHLB of Atlanta stock (par value), $361 million in Federal Reserve Bank stock (par value), and $82 million in mutual fund investments (par value). Securities AFS that were pledged to secure public deposits, repurchase... -

Page 123

...other debt securities Total debt securities Fair Value U.S. Treasury securities Federal agency securities U.S. states and political subdivisions RMBS - agency 1 RMBS - private CDO securities ABS Corporate and other debt securities Total debt securities 1 1 Year or Less 1-5 Years 5-10 Years After... -

Page 124

..."Significant Accounting Policies," to the Consolidated Financial Statements. Market changes in interest rates and credit spreads will result in temporary unrealized losses as the market price of securities fluctuates. The Company records OTTI through earnings based on the credit impairment estimates... -

Page 125

...used to evaluate the private RMBS for credit impairment. In addition, the Company has not purchased new private RMBS in securities AFS during the year ended December 31, 2010, and continues to reduce existing exposure primarily through paydowns. The Company held stock in the FHLB of Atlanta totaling... -

Page 126

... investors. The Company evaluates the credit quality of its loan portfolio based on internal credit risk ratings using numerous factors, including consumer credit risk scores, rating agency information, LTV ratios, collateral, collection experience, and other internal metrics. For commercial loans... -

Page 127

... (Dollars in millions) Credit rating: Investment grade Non-investment grade Total Residential mortgages nonguaranteed 2010 2009 Current FICO score range: 700 and above 620 - 699 Below 6201 Total $15,920 4,457 3,582 $23,959 $16,086 4,644 5,117 $25,847 Home equity products 2010 2009 $11,673 2,897... -

Page 128

... Total commercial loans Residential loans: Residential mortgages - guaranteed Residential mortgages - nonguaranteed2 Home equity products Residential construction Total residential loans Consumer loans: Guaranteed student loans Other direct Indirect Credit cards Total consumer loans Total... -

Page 129

... recorded: Commercial loans: Commercial & industrial Commercial real estate Commercial construction Total commercial loans Residential loans: Residential mortgages - nonguaranteed Home equity products Residential construction Total residential loans Consumer loans: Other direct Total impaired loans... -

Page 130

...2010 December 31, 2009 Nonperforming Assets Nonaccrual/NPLs: Commercial loans: Commercial & industrial1 Commercial real estate Commercial construction Residential loans: Residential mortgages - nonguaranteed2 Home equity products Residential construction Consumer loans: Other direct Indirect Total... -

Page 131

...not record an allowance for loan products that are guaranteed by government agencies, as there is nominal risk of principal loss. The Company's LHFI portfolio and related ALLL at December 31, 2010 and December 31, 2009, respectively, is shown in the tables below: Commercial Carrying Associated Value... -

Page 132

... 5 $14 2011 2012 2013 2014 2015 Thereafter Total minimum lease payments Amounts representing interest Present value of net minimum lease payments Net premises and equipment included $7 million and $8 million as of December 31, 2010 and 2009, respectively, related to capital leases. Aggregate rent... -

Page 133

...significant decline in the Company's market capitalization during the first quarter of 2009. The changes in the carrying amount of goodwill by reportable segment for the years ended December 31, 2010 and 2009 are as follows: Diversified Retail Commercial Retail & Banking Banking Commercial Wholesale... -

Page 134

..., due to changes in interest rates. Represents changes due to the collection of expected cash flows, net of accretion, due to passage of time. During 2010, the Company transferred $14.1 billion in money market funds to funds managed by Federated Investors, Inc. in exchange for cash consideration of... -

Page 135

... 1, 2010, interests that were held by the Company in transferred financial assets, excluding servicing and collateral management rights, were generally recorded as securities AFS or trading assets at their allocated carrying amounts based on their relative fair values at the time of transfer and... -

Page 136

..., and $307 million, including servicing rights, for the years ended December 31, 2010, 2009 and 2008, respectively. These gains are included within mortgage production related income in the Consolidated Statements of Income/(Loss). These gains include the change in value of the loans as a result of... -

Page 137

... a significant amount of these previously transferred loans during the years ended December 31, 2010, 2009, or 2008. The transfer of loans to investors, whether through a whole loan sale or securitization transaction, exposes the Company to losses related to potential defects in the securitization... -

Page 138

... Company's Consolidated Statements of Shareholders' Equity. Substantially all of the assets and liabilities of the CLO are loans and issued debt, respectively. The loans are classified within LHFS at fair value and the debt is included with long-term debt at fair value on the Company's Consolidated... -

Page 139

..., the related ALLL, and long-term debt. In addition, the Company's ownership of the residual interest in the SPE, previously classified in trading assets, was eliminated upon consolidation. The impact on certain of the Company's regulatory capital ratios as a result of consolidating the Student Loan... -

Page 140

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) The following tables present certain information related to the Company's asset transfers in which it has continuing economic involvement for the years ended December 31, 2010, 2009 and 2008. Cash flows and fees received ... -

Page 141

... mortgage servicing fees and late fees, net of curtailment costs. Such income earned for the years ended December 31, 2010, 2009 and 2008 was $399 million, $354 million, and $354 million, respectively. These amounts are reported in mortgage servicing-related income in the Consolidated Statements... -

Page 142

... guidance" on the Company's Consolidated Statements of Shareholders' Equity. Funding commitments extended by Three Pillars to its customers totaled $4.1 billion at December 31, 2010, the majority of which renew annually. At December 31, 2009, Three Pillars had $1.8 billion of assets not included on... -

Page 143

... that no such transactions were outstanding at December 31, 2009. However, during 2010, the Company began to execute new TRS transactions. Under the matched book TRS business model, the VIEs purchase assets (typically loans) from the market, which are identified by third party clients, that serve... -

Page 144

... Consolidated Balance Sheets. As the general partner, the Company typically guarantees the tax credits due to the limited partner and is responsible for funding construction and operating deficits. As of December 31, 2010 and December 31, 2009, total assets, which consist primarily of fixed assets... -

Page 145

... to any of the Funds. The Company did elect to provide support to three funds during 2008. For additional information, see the Company's 2009 Annual Report on Form 10-K. The Company did not provide any significant support, contractual or otherwise, to the Funds during the years ended December 31... -

Page 146

... 2009, respectively, qualified as Tier 1 capital, and long-term debt of $1.8 billion and $2.8 billion as of December 31, 2010 and 2009, respectively, qualified as Tier 2 capital. As of December 31, 2010, the Company had collateral pledged to the FHLB of Atlanta to support $7.7 billion of available... -

Page 147

... long-term debt related to these consolidated VIEs, the CLO's $290 million is carried at fair value as of December 31, 2010. See Note 11, "Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities" to the Consolidated Financial Statements for discussion related... -

Page 148

...certain preferred stock and hybrid debt securities, and the sale of Visa Class B shares. • • The common stock offerings that the Company completed in conjunction with the capital plan added 142 million in new common shares and resulted in $1.8 billion in additional Tier 1 common equity, net of... -

Page 149

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) dividends to the Parent Company under these regulations at December 31, 2010 and 2009. The Company also has cash reserves required by the Federal Reserve. As of December 31, 2010 and 2009, these reserve requirements totaled ... -

Page 150

... in determining net income/(loss) available to common shareholders. The discount is being amortized over a five-year period from each respective issuance date using the effective yield method and totaled $25 million, $23 million and $4 million during 2010, 2009 and 2008, respectively. The Company is... -

Page 151

...included in the Consolidated Statements of Income/(Loss) were as follows: (Dollars in millions) Current income tax expense/(benefit) Federal State Total Deferred income tax expense/(benefit) Federal State Total Total income tax benefit 2010 $(14) Year ended December 31 2009 ($7) 3 2008 $141 13 ($14... -

Page 152

... owned Loans State net operating losses and other carryforwards (net of federal benefit) Federal net operating loss and other carryforwards Securities Other Gross deferred tax asset Deferred Tax Liabilities Net unrealized gains in AOCI Leasing Employee benefits MSRs Mark to market Intangible assets... -

Page 153

... Corporate Governance. This compensation development became known as salary shares. Specifically, the Interim Rule prohibits the payment of short-term incentives (annual bonus) and stock options to the SEO and to the next 20 most highly compensated employees. Effective January 1, 2010, the Company... -

Page 154

...of the Company's stock. Beginning in 2009, SunTrust moved to implied volatility. The expected term represents the period of time that stock options granted are expected to be outstanding and is derived from historical data which is used to evaluate patterns such as stock option exercise and employee... -

Page 155

... for the years ended December 31, 2010, 2009 and 2008, respectively. In addition to the SunTrust stock-based compensation awards, the Company has two subsidiaries which sponsor separate equity plans where subsidiary restricted stock or restricted membership interests are granted to key employees of... -

Page 156

... the new Personal Pension Account. Effective January 1, 2008, the vesting schedule was changed from a 5-year cliff to a 3-year cliff for participants employed by the Company on and after that date. SunTrust monitors the funded status of the plan closely and due to the current funded status, SunTrust... -

Page 157

... Participants"). Obligations and related plan assets were transferred from the SunTrust Banks, Inc. Retirement Plan to the new plan. Establishing a separate plan and trust fund for the assets used to pay benefits for retirees and inactive employees allows SunTrust to manage the assets for this plan... -

Page 158

...collective funds are valued each business day at its reported net asset value, as determined by the issuer, based on the underlying assets of the fund. Corporate and foreign bonds are valued based on quoted market prices obtained from external pricing sources where trading in an active market exists... -

Page 159

... 2010, these were transferred to level 2 assets due to improved market conditions. The following tables sets forth by level, within the fair value hierarchy, plan assets related to Pension Benefits at fair value as of December 31, 2010 and 2009: Fair Value Measurements as of December 31, 2010 using... -

Page 160

... Schedule (Dollars in millions) Money market funds Mutual funds: Fixed income funds International diversified funds Large cap funds Small and mid cap funds Equity securities: Consumer Energy and utilities Financials Healthcare Industrials Information technology Materials Exchange traded funds Fixed... -

Page 161

...on the valuation date. The primary objective of the SunTrust Equity Fund is to provide capital appreciation by investing in growth companies with leadership positions. The Fund invests primarily in a portfolio of diversified equities. The net asset value of the Fund is determined semi-monthly on the... -

Page 162

... corporate bonds and U.S. Treasuries) and expenses. Capital market simulations from internal and external sources, survey data, economic forecasts and actuarial judgment are all used in this process. The expected long-term rate of return on plan assets was 8.00% in 2010 and 2009. The expected long... -

Page 163

... of Plan Assets Allocation as of December 31 2011 2010 2009 35-50 % 51 % 48 % 50-65 48 51 1 1 100 % 100 % Asset Category Equity securities Debt securities Cash equivalents Total Funded Status The funded status of the plans, as of December 31, was as follows: Pension Benefits 2010 2009 $2,522... -

Page 164

... average discount rates for the Pension Benefits as of the beginning of the fiscal year. Interim remeasurement was required on April 30, 2009 for the SunTrust Pension Plan due to plan changes adopted at that time. The discount rate as of the remeasurement date was selected based on the economic... -

Page 165

...of years. Utilization of market value of assets provides a more realistic economic measure of the plan's funded status and cost. Assumed discount rates and expected returns on plan assets affect the amounts of net periodic benefit cost. A 25 basis point decrease in the discount rate or expected long... -

Page 166

...posted by the Bank against any net amount owed by the Bank. In addition, certain of the Company's derivative liability positions, totaling $1.1 billion and $1.3 billion in fair value at December 31, 2010 and 2009, respectively, contain provisions conditioned on downgrades of the Bank's credit rating... -

Page 167

... rate loans Trading assets Total Derivatives not designated as hedging instruments 6 Interest rate contracts covering: Fixed rate debt Corporate bonds and loans MSRs LHFS, IRLCs, LHFI-FV Trading activity Foreign exchange rate contracts covering: Foreign-denominated debt and commercial loans Trading... -

Page 168

... rate debt Trading assets Corporate bonds and loans MSRs Other assets LHFS, IRLCs, LHFI-FV Other assets Trading activity Trading assets Foreign exchange rate contracts covering: Foreign-denominated debt and commercial loans Trading activity Credit contracts covering: Loans Trading activity Equity... -

Page 169

...fees on loans (1) Interest on deposits - Interest on long-term debt ($198) Classification of gain/(loss) recognized in Income on Derivatives Trading account profits/(losses) and commissions Trading account profits/(losses) and commissions Mortgage servicing related income Mortgage production related... -

Page 170

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Credit Derivatives As part of its trading businesses, the Company enters into contracts that are, in form or substance, written guarantees: specifically, CDS, swap participations, and TRS. The Company accounts for these ... -

Page 171

... to be reclassified to net interest income over the next twelve months in connection with the recognition of interest income on these hedged items. During the third quarter of 2008, the Company executed The Agreements on 30 million common shares of Coke. A consolidated subsidiary of SunTrust owns 22... -

Page 172

...on the debt are both recorded within trading account profits/(losses) and commissions. The Company enters into CDS to hedge credit risk associated with certain loans held within its CIB line of business. Trading activity, in the tables in this footnote, primarily includes interest rate swaps, equity... -

Page 173

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) At December 31, 2010, the total loss exposure ceded to the Company was approximately $547 million; however, the maximum amount of loss exposure based on funds held in each separate trust account, including net premiums due ... -

Page 174

...Financial Statements. Loan Sales STM, a consolidated subsidiary of SunTrust, originates and purchases residential mortgage loans, a portion of which are sold to outside investors in the normal course of business, through a combination of whole loan sales to GSEs, Ginnie Mae, and non-agency investors... -

Page 175

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Loan repurchase requests relate primarily to loans sold during the six year period from January 1, 2005 to December 31, 2010, which totaled $226.9 billion at the time of sale, including $173.4 billion and $30.3 billion of ... -

Page 176

... to MSR sales, which totaled $6 million and $3 million as of December 31, 2010 and December 31, 2009, respectively. Contingent Consideration The Company has contingent payment obligations related to certain business combination transactions. Payments are calculated using certain post-acquisition... -

Page 177

... in affordable housing developments. SunTrust Community Capital or its subsidiaries are limited and/or general partners in various partnerships established for the properties. If the partnerships generate tax credits, those credits may be sold to outside investors. As of December 31, 2010, SunTrust... -

Page 178

... brokered deposits, and certain issuances of fixed rate debt. In certain circumstances, fair value enables a company to more accurately align its financial performance with the economic value of actively traded or hedged assets or liabilities. Fair value also enables a company to mitigate the non... -

Page 179

... Total securities AFS LHFS Residential loans Corporate and other loans Total LHFS LHFI Other intangible assets 2 Other assets 1 Liabilities Trading liabilities U.S. Treasury securities Corporate and other debt securities Derivative contracts Total trading liabilities Brokered deposits Long-term debt... -

Page 180

... securities Total securities AFS LHFS LHFI Other intangible assets 2 Other assets 1 Liabilities Trading liabilities U.S. Treasury securities Federal agency securities Corporate and other debt securities Equity securities Derivative contracts Total trading liabilities Brokered deposits Long-term debt... -

Page 181

... Fair Values Profits/(Losses) Mortgage Mortgage Included in and Production Servicing Current Period Commissions Related Income 2 Related Income Earnings1 ($3) 26 $568 7 15 $(513) ($3) 594 7 (498) (Dollars in millions) Assets Trading assets LHFS LHFI MSRs Liabilities Brokered deposits Long-term debt... -

Page 182

... (65) Mortgage Production Related Income2 $625 (1) 17 Total Changes in Fair Values Included in Current Period Earnings1 $3 627 2 83 11 (65) (Dollars in millions) Assets Trading assets LHFS LHFI Other intangible assets Liabilities Brokered deposits Long-term debt 1Changes Mortgage Servicing Related... -

Page 183

... for its securities from an independent pricing service or third party brokers who have experience in valuing certain investments. This pricing may be used as either direct support for the Company's valuations or used to validate outputs from its own proprietary models. The Company evaluates third... -

Page 184

... flows using estimated discount rates based on pricing and/or spread levels seen on trades of similarly structured securities for valuation purposes. In pricing the CLO preference shares and the residual interest in the commercial loan participation, the Company was able to obtain market information... -

Page 185

... significant observable market data for these instruments is available. Commercial paper From time to time, the Company trades third party CP that is generally short-term in nature (less than 30 days) and highly rated (A-1/P-1). The Company estimates the fair value of the CP that it trades based on... -

Page 186

... rates, equity, or credit. As such, the Company uses market-based assumptions for all significant inputs, such as interest rate yield curves, quoted exchange rates and spot prices, market implied volatilities and credit curves. The Agreements the Company entered into related to its Coke stock... -

Page 187

...trading activity upon which to base its estimates of fair value. The loans from the Company's sales and trading business are commercial and corporate leveraged loans that are either traded in the market or for which similar loans trade. The Company elected to carry these loans at fair value in order... -

Page 188

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Level 2 LHFS are primarily agency loans which trade in active secondary markets and are priced using current market pricing for similar securities adjusted for servicing and risk. Level 3 loans are primarily non-agency ... -

Page 189

... herein under "Trading Assets and Securities Available for Sale." Brokered deposits The Company has elected to measure certain CDs at fair value. These debt instruments include embedded derivatives that are generally based on underlying equity securities or equity indices, but may be based on other... -

Page 190

... of $7 million for the years ended December 31, 2010, 2009 and 2008, respectively, due to changes in its own credit spreads on its brokered deposits carried at fair value. Long-term debt The Company has elected to carry at fair value certain fixed rate debt issuances of public debt in which it has... -

Page 191

... states and political subdivisions RMBS - private ABS Corporate and other debt securities Other equity securities Total securities AFS LHFS Residential loans Corporate and other loans LHFI Other assets/(liabilities), net Liabilities Trading liabilities 1 2 Transfers to/from other balance sheet line... -

Page 192

... recorded in mortgage production related income. 4 Amounts are generally included in mortgage production related income except $2.4 million for the year ended December 31, 2009 related to loans acquired in the GB&T acquisition. The mark on these loans is included in trading account profits/(losses... -

Page 193

...of this footnote. Leases held for sale are valued using internal estimates which incorporate market data when available. Due to the lack of current market data for comparable leases, these assets are considered level 3. During the year ended December 31, 2010, the Company transferred $160 million of... -

Page 194

..., broker pricing opinions, or other market information is available. Level 3 OREO consists of lots and land for which current property-specific values are not available. The Company values these properties using a pooled approach. Affordable Housing The Company evaluates its consolidated affordable... -

Page 195

... The Company estimated fair value based on estimated future cash flows discounted, initially, at current origination rates for loans with similar terms and credit quality, which derived an estimated value of 99% on the loan portfolio's net carrying value at both December 31, 2010 and 2009. The value... -

Page 196

... into account in estimating fair values. (f) Fair values for foreign deposits, certain brokered deposits, short-term borrowings, and certain long-term debt are based on quoted market prices for similar instruments or estimated using discounted cash flow analysis and the Company's current incremental... -

Page 197

... ARS. The fair value of ARS purchased pursuant to the pending settlement, net of redemptions and calls, was approximately $147 million and $176 million in trading securities and $128 million and $156 million in securities AFS, at December 31, 2010 and 2009, respectively. The Company had reserved $18... -

Page 198

... as a result of the method of posting order used by the Company, which allegedly resulted in overdraft fees being assessed to their joint checking account, and purport to bring their action on behalf of a putative class of "all SunTrust Bank account holders who incurred an overdraft charge despite... -

Page 199

... the Northern District of Georgia by participants in the SunTrust Banks, Inc. 401(k) Plan ("Plan") concerning the performance of certain investment options available under the Plan. In particular, the consolidated complaint alleges that the Company's publicly traded stock was an imprudent investment... -

Page 200

... in-store branches, ATMs, the internet (www.suntrust.com), and the telephone (1-800-SUNTRUST). Financial products and services offered to consumers include consumer deposits, home equity lines, consumer lines, indirect auto, student lending, bank card, and other consumer loan and fee-based products... -

Page 201

...Market, Diversified Commercial Banking and W&IM clients. In addition, CIB offers traditional lending, leasing, treasury management services and institutional investment management to its clients. The Mortgage line of business offers residential mortgage products nationally through its retail, broker... -

Page 202

..., short-term liquidity and funding activities, balance sheet risk management, and most real estate assets. Other components include Enterprise Information Services, which is the primary data processing and operations group; the Corporate Real Estate group, Marketing, SunTrust Online, Human... -

Page 203

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) The application and development of management reporting methodologies is a dynamic process and is subject to periodic enhancements. The implementation of these enhancements to the internal management reporting methodology ... -

Page 204

SUNTRUST BANKS, INC. Notes to Consolidated Financial Statements (Continued) Twelve Months Ended December 31, 2008 Retail Banking $40,205 68,786 $2,251 2,251 851 1,400 1,192 2,244 348 121 227 $227 Diversified Commercial Banking $27,289 17,392 $438 96 534 55 479 253 416 316 116 200 $200 Corporate ... -

Page 205

...) 2010 2009 2008 Income From subsidiaries: Dividends Interest on loans Trading account gains/(losses) and commissions Other income Total income Expense Interest on short-term borrowings Interest on long-term debt Employee compensation and benefits Service fees to subsidiaries Other expense Total... -

Page 206

...) 2010 2009 Assets Cash in subsidiary banks Interest-bearing deposits in other banks Cash and cash equivalents Trading assets Securities available for sale Loans to subsidiaries Investment in capital stock of subsidiaries stated on the basis of the Company's equity in subsidiaries' capital accounts... -

Page 207

... loans to subsidiaries Capital contributions to subsidiaries Sale of other assets Other, net Net cash provided by/(used in) investing activities Cash Flows from Financing Activities: Net increase/(decrease) in other short-term borrowings Proceeds from the issuance of long-term debt Repayment of long... -

Page 208

... the Securities Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the rules and forms of the SEC, and that such information is accumulated and communicated to the Company's management, including its Chief Executive Officer and Chief Financial Officer... -

Page 209

... and Analysis," "Compensation Committee Report," "Executive Compensation Tables," "2010 Summary Compensation Table," "2010 Grants and Plan-Based Awards," "Option Exercises and Stock Vested in 2010," "Outstanding Equity Awards at December 31, 2010," "2010 Pension Benefits," "2010 Nonqualified... -

Page 210

...used in connection with the issuance of Subordinated Debt Securities, incorporated by reference to Exhibit 4.4 to Registration Statement No. 333-25381. Second Supplemental Indenture by and among National Commerce Financial Corporation, SunTrust Banks, Inc. and The Bank of New York, as Trustee, dated... -

Page 211

...Employee Director Restricted Stock Unit Agreement, (ix) Form of CPP Long Term Restricted Stock Award Agreement, and (x) Form of (2010) Salary Share Stock Unit Award Agreement, and (xi) Form of 2011 SunTrust Banks, Inc. Salary Share Award Agreement, each under the SunTrust Banks, Inc. 2009 Stock Plan... -

Page 212

...'s Annual Report on Form 10-K filed February 23, 2010. SunTrust Banks, Inc. ERISA Excess Retirement Plan, amended and restated as of January 1, 2010, incorporated by reference to Exhibit 10.2 to Registrant's Current Report on Form 8-K filed January 6, 2011. SunTrust Banks, Inc. Deferred Compensation... -

Page 213

..., 2010). SunTrust Banks, Inc. 401(k) Plan Trust Agreement, amended and restated as of January 1, 2011. Ratio of Earnings to Fixed Charges and Preferred Stock Dividends. Registrant's Subsidiaries. Consent of Independent Registered Public Accounting Firm. Certification of Chairman and Chief Executive... -

Page 214

... of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SUNTRUST BANKS, INC. By: /s/ James M. Wells III James M. Wells III Chairman and Chief Executive Officer Dated: February 25, 2011 POWER OF... -

Page 215

... /s/ Dr. Phail Wynn, Jr. Dr. Phail Wynn, Jr. 2/25/2011 Date 2/25/2011 Date 2/25/2011 Date 2/25/2011 Date 2/6/2011 Date 2/8/2011 Date 2/25/2011 Date 2/25/2011 Date 2/25/2011 Date 2/25/2011 Date 2/25/2011 Date Director Director Director Director Director Director Director Director Director Director... -

Page 216

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 217

-

Page 218

-

Page 219

...Relations SunTrust Banks, Inc. P.O. Box 4418 Mail Code: GA-ATL-634 Atlanta, GA 30302-4418 800.324.8093 credit ratings Ratings as of December 31, 2010. Moody's Standard Investors & Poor's corporate ratings Long Term Ratings Senior Debt Subordinated Debt Series A Preferred Stock Short Term Commercial... -

Page 220

SunTrust Banks, Inc. 303 Peachtree Street | Atlanta, Georgia 30308 suntrust.com