Capital One 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFF-BALANCE SHEET ARRANGEMENTS AND VARIABLE INTEREST ENTITIES

In the ordinary course of business, we are involved in various types of arrangements with limited liability

companies, partnerships or trusts that often involve special purpose entities and variable interest entities (“VIE”).

Some of these arrangements are not recorded on our consolidated balance sheets or may be recorded in amounts

different from the full contract or notional amount of the arrangements, depending on the nature or structure of,

and accounting required to be applied to, the arrangement. These arrangements may expose us to potential losses

in excess of the amounts recorded on our consolidated balance sheets. Our involvement in these arrangements can

take many forms, including securitization and servicing activities, the purchase or sale of mortgage-backed or other

asset-backed securities in connection with our home loan portfolio and loans to VIEs that hold debt, equity, real

estate or other assets.

Our continuing involvement in unconsolidated VIEs primarily consists of certain mortgage loan trusts and

community reinvestment and development entities. We provide a discussion of our activities related to these VIEs

in “Note 6—Variable Interest Entities and Securitizations.”

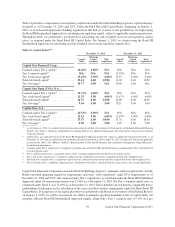

CAPITAL MANAGEMENT

The level and composition of our capital are determined by multiple factors, including our consolidated regulatory

capital requirements and internal risk-based capital assessments such as internal stress testing and economic capital.

The level and composition of our capital may also be influenced by rating agency guidelines, subsidiary capital

requirements, the business environment, conditions in the financial markets and assessments of potential future

losses due to adverse changes in our business and market environments.

Capital Standards and Prompt Corrective Action

Bank holding companies and national banks are subject to capital adequacy standards adopted by the Federal Reserve

and the OCC, respectively. The capital adequacy standards set forth minimum risk-based and leverage capital

requirements that are based on quantitative and qualitative measures of assets and off-balance sheet items. National

banks, as insured depository institutions, are also subject to Prompt Corrective Action (“PCA”) capital regulations,

which require the U.S. federal banking agencies to take “prompt corrective action” for banks that do not meet

established minimum capital requirements.

In July 2013, the Federal Banking Agencies finalized a new capital rule that implements the Basel III capital accord

(the “Final Basel III Capital Rules”) developed by the Basel Committee on Banking Supervision (“Basel

Committee”) and certain Dodd-Frank Act capital provisions and updates the PCA capital requirements. Prior to

being revised in the Final Basel III Capital Rules, the minimum risk-based capital requirements adopted by the U.S.

federal banking agencies followed the Basel I framework, originally promulgated pursuant to the Basel Committee’s

Basel I accord, and the advanced approaches capital rules (“Advanced Approaches”), based upon the framework

originally promulgated as a result of the Basel II accord. The Final Basel III Capital Rules amended both the Basel

I and Advanced Approaches frameworks, establishing a new common equity Tier 1 capital requirement and setting

higher minimum capital ratio requirements. The Company refers to the amended Basel I framework as the “Basel

III Standardized Approach,” and the amended Advanced Approaches framework as the “Basel III Advanced

Approaches.”

At the end of 2012, the Company met one of the two independent eligibility criteria set by banking regulators for

becoming subject to the Advanced Approaches capital rules. As a result, the Company has undertaken a multi-year

process of implementing the Advanced Approaches regime for calculating risk-weighted assets and regulatory capital

levels. Certain provisions of the Final Basel III Capital Rules began to take effect on January 1, 2014 for Advanced

Approaches banking organizations, including the Company. The Company entered parallel run under Advanced

77 Capital One Financial Corporation (COF)