Capital One 2014 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.190

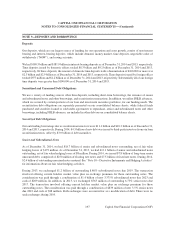

remaining trusts, for which we no longer service the underlying mortgage loans, we do not consolidate these entities

since we do not have the power to direct the activities that most significantly impact the economic performance of

the trusts.

In connection with the securitization of certain option-ARM loans, a third party is obligated to advance a portion of

any “negative amortization” resulting from monthly payments that are less than the interest accrued for that payment

period. We have an agreement in place with the third party that mirrors this advance requirement. The amount

advanced is tracked through mortgage-backed securities retained as part of the securitization transaction. As advances

occur, we record an asset in the form of negative amortization bonds, which are held at fair value in other assets on

our consolidated balance sheets. Our maximum exposure is affected by rate caps and monthly payment change caps,

but the funding obligation cannot exceed the difference between the original loan balance multiplied by a preset

negative amortization cap and the current unpaid principal balance.

We have also entered into certain derivative contracts related to the securitization activities. These are classified

as free-standing derivatives, with fair value adjustments recorded in non-interest income in our consolidated

statements of income. See “Note 10—Derivative Instruments and Hedging Activities” for further details on these

derivatives.

GreenPoint Mortgage Home Equity Lines of Credit (“HELOCs”)

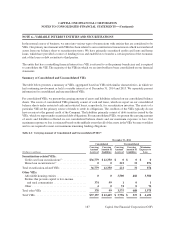

Our discontinued wholesale mortgage banking unit, GreenPoint, previously sold HELOCs in whole loan sales and

subsequently acquired residual interests in certain trusts which securitized some of those loans. As the residual interest

holder, GreenPoint is required to fund advances on the HELOCs when certain performance triggers are met due to

deterioration in asset performance. On behalf of GreenPoint, we have funded cumulative advances of $30 million

and $29 million as of December 31, 2014 and 2013, respectively. These advances are generally expensed as funded

due to the low likelihood of recovery. We also have unfunded commitments of $6 million and $7 million related to

those interests for our non-consolidated VIEs as of December 31, 2014 and 2013, respectively.

During 2013, we deconsolidated one of these trusts as a result of no longer being deemed the primary beneficiary

due to our sale of loan servicing rights. The deconsolidation of the trust resulted in the removal of $33 million of

assets and $30 million in liabilities from our consolidated balance sheets and a $3 million charge to in our

consolidated statements of income. As such, we no longer consolidate the trust because we neither lack the power

to direct the activities that most significantly impact the economic performance of the trust nor have the right to

receive benefits of the obligation to absorb losses that could potentially be significant to the trusts.

GreenPoint Credit Manufactured Housing

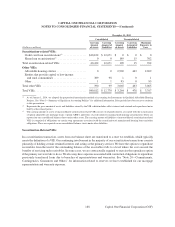

We retain the primary obligation for certain provisions of corporate guarantees, recourse sales and clean-up calls

related to the discontinued manufactured housing operations of GreenPoint Credit, LLC, which was a subsidiary

of GreenPoint and was sold to a third party in 2004. Although we are the primary obligor, recourse obligations

related to aforementioned whole loan sales, commitments to exercise mandatory clean-up calls on certain

securitization transactions and servicing were transferred to a third party in the sale transaction. We do not

consolidate the trusts used for the securitization of manufactured housing loans because we do not have the power

to direct the activities that most significantly impact the economic performance of the trusts since we no longer

service the loans.

We were required to fund letters of credit in 2004 to cover losses and are obligated to fund future amounts under

swap agreements for certain transactions. We have the right to receive any funds remaining in the letters of credit

after the securities are released.

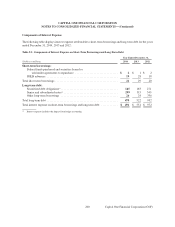

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)