Capital One 2014 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

175

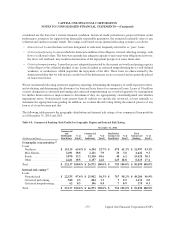

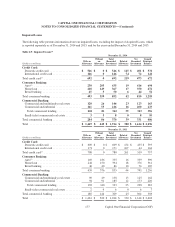

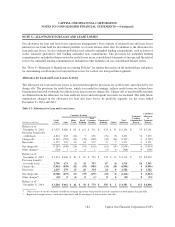

considered are the borrower’s current financial condition, historical credit performance, projected future credit

performance, prospects for support from financially responsible guarantors, the estimated realizable value of any

collateral and current economic trends. The ratings scale based on our internal risk-rating system is as follows:

•Noncriticized: Loans that have not been designated as criticized, frequently referred to as “pass” loans.

•Criticized performing: Loans in which the financial condition of the obligor is stressed, affecting earnings, cash

flows or collateral values. The borrower currently has adequate capacity to meet near-term obligations; however,

the stress, left unabated, may result in deterioration of the repayment prospects at some future date.

•Criticized nonperforming: Loans that are not adequately protected by the current net worth and paying capacity

of the obligor or the collateral pledged, if any. Loans classified as criticized nonperforming have a well-defined

weakness, or weaknesses, which jeopardize the repayment of the debt. These loans are characterized by the

distinct possibility that we will sustain a credit loss if the deficiencies are not corrected and are generally placed

on nonaccrual status.

We use our internal risk-rating system for regulatory reporting, determining the frequency of credit exposure reviews,

and evaluating and determining the allowance for loan and lease losses for commercial loans. Loans of $1 million

or more designated as criticized performing and criticized nonperforming are reviewed quarterly by management

for further deterioration or improvement to determine if they are appropriately classified/graded and whether

impairment exists. Noncriticized loans greater than $1 million are specifically reviewed, at least annually, to

determine the appropriate loan grading. In addition, we evaluate the risk rating during the renewal process of any

loan or if a loan becomes past due.

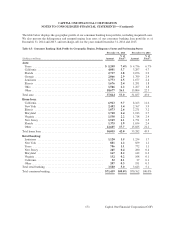

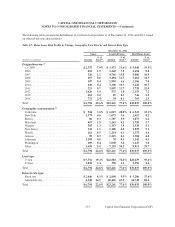

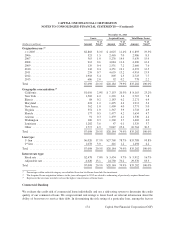

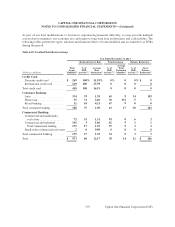

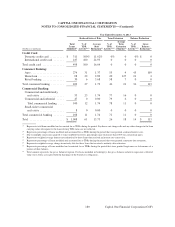

The following table presents the geographic distribution and internal risk ratings of our commercial loan portfolio

as of December 31, 2014 and 2013.

Table 4.8: Commercial Banking: Risk Profile by Geographic Region and Internal Risk Rating

December 31, 2014

Commercial

and Commercial Small-ticket Total

Multifamily % of and % of Commercial % of Commercial % of

(Dollars in millions) Real Estate Total(1) Industrial Total(1) Real Estate Total(1) Banking Total(1)

Geographic concentration:(2)

Loans:

Northeast . . . . . . . . . . . . . . . $ 15,135 65.4% $ 6,384 23.7% $ 478 61.2% $ 21,997 43.2%

Mid-Atlantic . . . . . . . . . . . . . 2,491 10.8 2,121 7.9 30 3.8 4,642 9.1

South . . . . . . . . . . . . . . . . . . 3,070 13.3 12,310 45.6 48 6.2 15,428 30.3

Other . . . . . . . . . . . . . . . . . . . 2,441 10.5 6,157 22.8 225 28.8 8,823 17.4

Total . . . . . . . . . . . . . . . . . . . . . $ 23,137 100.0% $ 26,972 100.0% $ 781 100.0% $ 50,890 100.0%

Internal risk rating:(3)

Loans:

Noncriticized . . . . . . . . . . . . $ 22,535 97.4% $ 25,982 96.3% $ 767 98.2% $ 49,284 96.9%

Criticized performing . . . . . . 540 2.3 884 3.3 7 0.9 1,431 2.8

Criticized nonperforming . . . 62 0.3 106 0.4 7 0.9 175 0.3

Total . . . . . . . . . . . . . . . . . . . . . $ 23,137 100.0% $ 26,972 100.0% $ 781 100.0% $ 50,890 100.0%

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)