Capital One 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Liquidity Risk: Liquidity risk is the risk that the Company will not be able to meet its future financial

obligations as they come due, or invest in future asset growth because of an inability to obtain funds at a

reasonable price within a reasonable time period;

•Market Risk: Market risk is the risk that an institution’s earnings or the economic value of equity could be

adversely impacted by changes in interest rates, foreign exchange rates, or other market factors;

•Operational Risk: Operational risk is the risk of loss, capital impairment, adverse customer experience, or

reputational impact resulting from failure to comply with policies and procedures, inadequate or failed internal

processes or systems, or from external events;

•Reputation Risk: Reputation risk is the risk to market value, recruitment and retention of talented associates

and maintenance of a loyal customer base due to the negative perceptions of Capital One’s internal and external

constituents regarding Capital One’s business strategies and activities; and

•Strategic Risk: Strategic risk is the risk of material impact on current or anticipated earnings, capital, franchise

or enterprise value arising from: the Company’s competitive and market position and evolving forces in the

industry that can affect that position; lack of responsiveness to these conditions; strategic decisions to change

the Company’s scale, market position or operating model; or failure to appropriately consider implementation

risks inherent in the Company’s strategy.

Below we provide an overview of how we manage our eight primary risk categories.

Compliance Risk Management

We recognize that compliance requirements for financial institutions are increasingly complex and that there are

heightened expectations from our regulators and our customers. In response, we continuously evaluate the regulatory

environment and pro-actively adjust our compliance risk program to fully address these expectations.

Our Compliance Management Program establishes expectations for determining compliance requirements, assessing

the risk of new product offerings, creating appropriate controls and training to address requirements, monitoring for

control performance, and independently testing for adherence to compliance requirements. The program also

establishes regular compliance reporting to senior business leaders, the executive committee and the Board of

Directors.

The Chief Compliance Officer is responsible for establishing and overseeing our Compliance Risk Management

Program. Business areas incorporate compliance requirements and controls into their business policies, standards,

processes and procedures. They regularly monitor and report on the efficacy of their compliance controls and

Corporate Compliance periodically independently tests to validate the effectiveness of business controls.

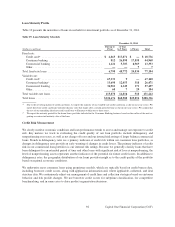

Credit Risk Management

We recognize that we are exposed to cyclical changes in credit quality. Consequently, we try to ensure our credit

portfolio is resilient to economic downturns. Our most important tool in this endeavor is sound underwriting. In

unsecured consumer loan underwriting, we generally assume that loans will be subject to an environment in which

losses are higher than those prevailing at the time of underwriting. In commercial underwriting, we generally require

strong cash flow, collateral and covenants and guarantees. In addition to sound underwriting, we continually monitor

our portfolio and take steps to collect or work out distressed loans.

The Chief Risk Officer, in conjunction with the Consumer and Commercial Chief Credit Officers, is responsible for

establishing credit risk policies and procedures, including underwriting and hold guidelines and credit approval

authority, and monitoring credit exposure and performance of our lending-related transactions. These responsibilities

are fulfilled by the Chief Consumer Credit Officer and the Chief Commercial Credit Officer who are responsible

85 Capital One Financial Corporation (COF)