Capital One 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Impairment

In addition to our loan portfolio, we review other assets for impairment on a regular basis in accordance with

applicable impairment accounting guidance. This process requires significant management judgment and involves

various estimates and assumptions. Our investment securities, goodwill and intangible assets represent a significant

portion of our total assets excluding loans. Accordingly, below we describe our process for assessing impairment of

these assets and the key estimates and assumptions involved in this process.

Investment Securities

We regularly review our investment securities for other-than-temporary impairment (“OTTI”) using both

quantitative and qualitative criteria. If we intend to sell a security in an unrealized loss position or it is more likely

than not that we will be required to sell the security prior to recovery of its amortized cost basis, the entire

difference between the amortized cost basis of the security and its fair value is recognized in earnings. If we do

not intend to sell the security and it is not more likely than not that we will be required to sell the security before

recovery of our amortized cost, we evaluate other qualitative criteria to determine whether a credit loss exists.

Our evaluation requires significant management judgment and a consideration of many factors, including, but

not limited to, the extent and duration of the impairment; the health of and specific prospects for the issuer,

including whether the issuer has failed to make scheduled interest or principal payments; recent events specific

to the issuer and/or industry to which the issuer belongs; the payment structure of the security; external credit

ratings; the value of underlying collateral and current market conditions. Quantitative criteria include assessing

whether there has been an adverse change in expected future cash flows. See “Note 3—Investment Securities”

for additional information.

Goodwill and Intangible Assets

Goodwill resulting from business combinations prior to January 1, 2009 represents the excess of the purchase price

over the fair value of the net assets of businesses acquired. Goodwill resulting from business combinations after

January 1, 2009, is generally determined as the excess of the fair value of the consideration transferred, plus the fair

value of any non-controlling interests in the acquiree, over the fair value of the net assets acquired and liabilities

assumed as of the acquisition date.

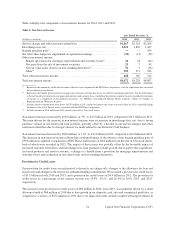

Goodwill totaled $14.0 billion as of both December 31, 2014 and 2013. Intangible assets, which we report on our

consolidated balance sheets as a component of other assets, consist primarily of purchased credit card relationships

(“PCCR”) and core deposit intangibles. The net carrying amount of intangible assets decreased to $1.3 billion as

of December 31, 2014, from $1.8 billion as of December 31, 2013. Goodwill and intangible assets together represented

5% of our total assets as of both December 31, 2014 and 2013, respectively. We did not recognize impairment on

goodwill or intangible assets in 2014, 2013 or 2012.

Goodwill

Goodwill is not amortized but is tested for impairment at the reporting unit level, on an annual basis or in interim

periods if events or circumstances indicate potential impairment. A reporting unit is an operating segment or one

level below. The goodwill impairment test, performed at October 1 of each year, is a two-step test. The first step

identifies whether there is potential impairment by comparing the fair value of each reporting unit to its carrying

amount, including goodwill. If the fair value of a reporting unit is less than its carrying amount, the second step of

the impairment test is required to measure the amount of any potential impairment loss.

Estimating the fair value of reporting units and the assets, liabilities and intangible assets of a reporting unit is a

subjective process that involves the use of estimates and judgments. The fair value of reporting units is calculated

using a discounted cash flow model, a form of the income approach. The model uses projected cash flows based on

45 Capital One Financial Corporation (COF)