Capital One 2014 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.152

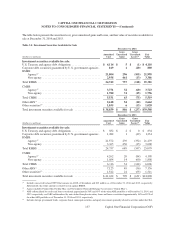

The accounting guidance for fair value requires that we maximize the use of observable inputs and minimize the

use of unobservable inputs in determining fair value. The accounting guidance also provides for the irrevocable

option to elect, on a contract-by-contract basis, to measure certain financial assets and liabilities at fair value at

inception of the contract and record any subsequent changes in fair value into earnings. We have not made any

material fair value option elections as of and for the years ended December 31, 2014, 2013 and 2012. See “Note

18—Fair Value Measurement” for additional information.

Accounting for Acquisitions

We account for business combinations under the acquisition method of accounting. Under the acquisition method,

tangible and intangible identifiable assets acquired, liabilities assumed and any noncontrolling interest in the

acquiree are recorded at fair value as of the acquisition date, with limited exceptions. Transaction costs and costs

to restructure the acquired company are expensed as incurred. Goodwill is recognized as the excess of the

acquisition price over the estimated fair value of the net assets acquired. Likewise, if the fair value of the net assets

acquired is greater than the acquisition price, a bargain purchase gain is recognized and recorded in non-interest

income.

If the acquired set of activities and assets does not meet the accounting definition of a business, the transaction is

accounted for as an asset acquisition. In an asset acquisition, the assets acquired are recorded at the purchase price

plus any transaction costs incurred and, therefore, no goodwill is recognized.

New Accounting Standards Adopted

Accounting for Investments in Qualified Affordable Housing Projects

In January 2014, the Financial Accounting Standard Board (“FASB”) issued guidance permitting an entity to

account for Investments in Qualified Affordable Housing Projects using the proportional amortization method if

certain criteria are met. The proportional amortization method amortizes the cost of the investment over the period

in which the investor expects to receive tax credits and other tax benefits, and the resulting amortization is

recognized as a component of income tax expense attributable to continuing operations. Historically, these

investments were under the equity method of accounting and the passive losses related to the investments were

recognized within non-interest expense. We adopted this guidance as of January 1, 2014 with retrospective

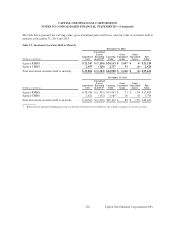

application. As a result, as of December 31, 2013, total assets, total liabilities, and retained earnings were reduced

by $115 million, $3 million and $112 million, respectively, from $297.0 billion, $255.3 billion and $20.4 billion,

respectively. As of December 31, 2012, total assets and total liabilities increased by $24 million and $98 million,

respectively, from $313.0 billion and $272.4 billion, respectively; while retained earnings were reduced by $74

million from $16.9 billion. In addition, net income was reduced by $38 million from $4.2 billion for the year ended

December 31, 2013, and by $25 million from $3.5 billion for the year ended December 31, 2012. Net income per

basic common share was reduced by 6 cents per share from $7.05 per share and by 4 cents per share from $6.21

per share for the years ended December 31, 2013 and 2012, respectively. Net income per diluted common share

was reduced by 7 cents per share from $6.96 per share and by 5 cents per share from $6.16 per share for the years

ended December 31, 2013 and 2012, respectively.

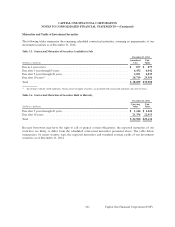

During 2014, we recognized amortization of $305 million and tax credits of $336 million associated with these

investments within income taxes. The carrying value of our investments in these qualified affordable housing projects

was $3.2 billion and $2.8 billion as of December 31, 2014 and 2013, respectively. We are periodically required to provide

additional financial or other support during the period of the investments. We recorded a liability of $1.3 billion for these

unfunded commitments as of December 31, 2014, which is expected to be paid from 2015 to 2018.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)