Capital One 2014 Annual Report Download - page 26

Download and view the complete annual report

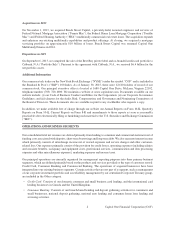

Please find page 26 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Banks are national associations chartered under the laws of the United States, the deposits of which are insured by

the Deposit Insurance Fund (the “DIF”) of the Federal Deposit Insurance Corporation (the “FDIC”) up to applicable

limits. In addition to regulatory requirements imposed as a result of COBNA’s international operations (discussed

below), the Banks are subject to comprehensive regulation and periodic examination by the OCC, the FDIC and by the

Consumer Financial Protection Bureau (the “CFPB”).

We are also registered as a financial institution holding company under Virginia law and, as such, we are subject to

periodic examination by Virginia’s Bureau of Financial Institutions. We also face regulation in the international

jurisdictions in which we conduct business (see below under “Regulation of International Business by Non-U.S.

Authorities”).

Regulation of Business Activities

The business activities of the Company and Banks also are subject to regulation and supervision under various laws

and regulations.

Regulations of Consumer Lending Activities

The activities of the Banks as consumer lenders are subject to regulation under various federal laws, including the

Truth in Lending Act, the Equal Credit Opportunity Act, the Fair Credit Reporting Act (the “FCRA”), the CRA and

the Servicemembers Civil Relief Act (“SCRA”), as well as under various state laws. Depending on the underlying

issue and applicable law, regulators are often authorized to impose penalties for violations of these statutes and, in

certain cases, to order banks to compensate injured borrowers. Borrowers may also have a private right of action for

certain violations. Federal bankruptcy and state debtor relief and collection laws also affect the ability of a bank

to collect outstanding balances owed by borrowers. These laws may affect the ability of banks to collect outstanding

balances.

The Credit Card Accountability Responsibility and Disclosure (“CARD”) Act (amending the Truth In Lending Act)

enacted in May 2009, and related changes to Regulation Z, impose a number of restrictions on credit card practices

impacting rates and fees, require that a consumer’s ability to pay be taken into account before issuing credit or

increasing credit limits, and update the disclosures required for open-end credit.

Mortgage Lending

The CFPB has issued several final rules pursuant to the Dodd-Frank Act that provide additional disclosure

requirements and substantive limitations on our mortgage lending activities. These rules, which include the

Ability-to-Repay and Qualified Mortgage Standards Under the Truth in Lending Act (Regulation Z) and

Integrated Mortgage Disclosures under the Real Estate Settlement Procedures Act (Regulation X) and the Truth In

Lending Act (Regulation Z), could impact the type and amount of mortgage loans we offer. The Dodd-Frank Act

also generally requires securitizers to retain a five percent economic interest in the credit risk of assets sold through

the issuance of asset-backed securitizations, with an exemption for traditionally underwritten residential mortgage

loans that meet the definition of a qualified residential mortgage loan. The final implementing rules on risk retention

define a qualified residential mortgage loan to be identical to the CFPB’s definition of a qualified mortgage loan.

Debit Interchange Fees

The Dodd-Frank Act requires that the amount of any interchange fee received by a debit card issuer with respect to

debit card transactions be reasonable and proportional to the cost incurred by the issuer with respect to the transaction.

In 2011 and 2012, the Federal Reserve adopted final rules that implement the portion of the Dodd-Frank Act that limits

interchange fees received by a debit card issuer. The final rules limited interchange fees per debit card transaction to

$0.21 plus five basis points of the transaction amount and provided for an additional $0.01 fraud prevention

4Capital One Financial Corporation (COF)