Capital One 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

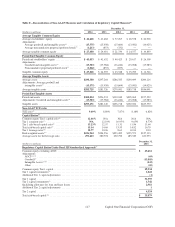

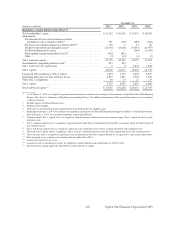

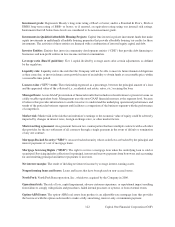

December 31,

(Dollars in millions) 2013 2012 2011 2010

Regulatory Capital Ratios Under Basel I(5)

Total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 41,632 $ 40,425 $ 29,617 $ 26,509

Adjustments:

Net unrealized losses on investment securities

available for sale recorded in AOCI(12) . . . . . . . . . . . . . . . . . . . . . . . . . . . 791 (712) (289) (368)

Net losses on cash flow hedges recorded in AOCI(12) . . . . . . . . . . . . . . . . . 136 2 71 86

Disallowed goodwill and intangible assets(2) . . . . . . . . . . . . . . . . . . . . . . . . (14,326) (14,428) (13,855) (13,953)

Disallowed deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (563) (1,169)

Noncumulative perpetual preferred stock(3) . . . . . . . . . . . . . . . . . . . . . . . . . (853) (853) — —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5) (12) (2) (2)

Tier 1 common capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,375 24,422 14,979 11,103

Noncumulative perpetual preferred stock(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . 853 853 — —

Tier 1 restricted core capital items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 2 3,635 3,636

Tier 1 capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,230 25,277 18,614 14,739

Long-term debt qualifying as Tier 2 capital . . . . . . . . . . . . . . . . . . . . . . . . . . 1,914 2,119 2,438 2,827

Qualifying allowance for loan and lease losses . . . . . . . . . . . . . . . . . . . . . . . . 2,833 2,831 1,978 3,750

Other Tier 2 components . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 13 23 29

Tier 2 capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,757 4,963 4,439 6,606

Total risk-based capital(14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 32,987 $ 30,240 $ 23,053 $ 21,345

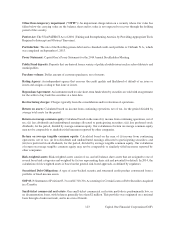

(1) As of January 1, 2014, we adopted the proportional amortization method of accounting for Investments in Qualified Affordable Housing

Projects. See “Note 1—Summary of Significant Accounting Policies” for additional information. Prior periods have been recast to conform

to this presentation.

(2) Includes impact of related deferred taxes.

(3) Includes related surplus.

(4) TCE ratio is a non-GAAP measure calculated based on TCE divided by tangible assets.

(5) Beginning on January 1, 2014, we calculate our regulatory capital under the Basel III Standardized Approach subject to transition provisions.

Prior to January 1, 2014, we calculated regulatory capital under Basel I.

(6) Common equity Tier 1 capital ratio is a regulatory capital measure calculated based on common equity Tier 1 capital divided by risk-

weighted assets.

(7) Tier 1 common capital ratio is a regulatory capital measure under Basel I calculated based on Tier 1 common capital divided by Basel I

risk-weighted assets.

(8) Tier 1 risk-based capital ratio is a regulatory capital measure calculated based on Tier 1 capital divided by risk-weighted assets.

(9) Total risk-based capital ratio is a regulatory capital measure calculated based on total risk-based capital divided by risk-weighted assets.

(10) Tier 1 leverage ratio is a regulatory capital measure calculated based on Tier 1 capital divided by average assets, after certain adjustments.

(11) Risk-weighted assets continue to be calculated based on Basel I in 2014.

(12) Amounts presented are net of tax.

(13) Amounts based on transition provisions for regulatory capital deductions and adjustments of 20% for 2014.

(14) Total risk-based capital equals the sum of Tier 1 capital and Tier 2 capital.

118 Capital One Financial Corporation (COF)