Capital One 2014 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.154

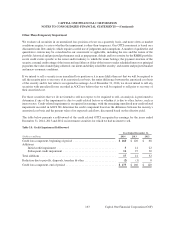

Revenue from Contracts with Customers

In May 2014, the FASB issued revised guidance for the recognition, measurement, and disclosure of revenue from

contracts with customers. The guidance is applicable to all entities and, once effective, will replace significant

portions of existing industry and transaction-specific revenue recognition rules with a more principles-based

recognition model. Most revenue associated with financial instruments, including interest and loan origination fees,

is outside the scope of the guidance. Gains and losses on investment securities, derivatives and sales of financial

instruments are similarly excluded from the scope. The guidance is effective for annual and interim periods beginning

after December 15, 2016, with early adoption prohibited. Entities can elect to adopt the guidance either on a full or

modified retrospective basis. Full retrospective adoption will require a cumulative effect adjustment to retained

earnings as of the beginning of the earliest comparative period presented. Modified retrospective adoption will require

a cumulative effect adjustment to retained earnings as of the beginning of the reporting period in which the entity

first applies the new guidance. We are currently evaluating the guidance to identify which of our revenue streams are

within its scope and determine which transition method we plan to elect. Accordingly, we cannot yet quantify the

impact our adoption of this guidance will have in the first quarter of 2017.

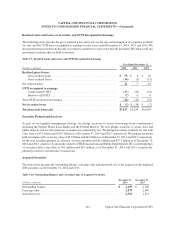

Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity

In April 2014, the FASB issued guidance changing the criteria for reporting discontinued operations. As a result of the

change, only those disposals of components of an entity that represent a strategic shift that have, or will have, a major

effect on an entity’s operations and financial results will be reported as discontinued operations. Expanded disclosures

will be required of discontinued operations and disposals of individually significant components of an entity that do not

currently qualify for discontinued operations reporting. The guidance is effective for disposals or classifications as held

for sale of components of an entity that occur within annual and interim periods beginning after December 15, 2014,

with early adoption permitted in certain circumstances. Our adoption of this guidance in the first quarter of 2015 will

not impact what we currently report as discontinued operations due to the prospective transition provisions.

Reclassification of Collateralized Mortgage Loans Upon Foreclosure

In January 2014, the FASB issued guidance clarifying when an entity should reclassify a consumer mortgage loan

collateralized by residential real estate to foreclosed property. Reclassification should occur when the creditor obtains

legal title to the residential real estate property or when the borrower conveys all interest in the residential real estate

property to the creditor to satisfy that loan through completion of a deed in lieu of foreclosure or through a similar

legal agreement. An entity should not wait until a redemption period, if any, has expired to reclassify a consumer

mortgage loan to foreclosed property. The guidance is effective for annual and interim periods beginning after

December 15, 2014, with early adoption permitted. We do not expect our adoption of this guidance in the first quarter

of 2015 to have a significant impact on our financial condition, results of operations or liquidity as the guidance is

materially consistent with our current practice.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)