Capital One 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

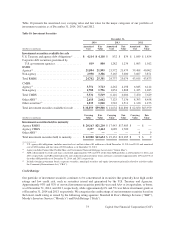

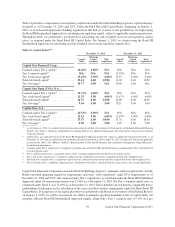

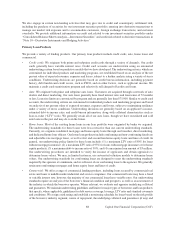

Table 14 provides a comparison of our regulatory capital ratios under the Federal Banking Agencies’ capital adequacy

standards as of December 31, 2014 and 2013. Under the Final Basel III Capital Rules, beginning on January 1,

2014, as an Advanced Approaches banking organization that had yet to enter or exit parallel run, we began using

the Basel III Standardized Approach for calculating our regulatory capital, subject to applicable transition provisions.

Throughout 2014, we continued to use Basel I for calculating our risk-weighted assets in our regulatory capital

ratios, as required under the Final Basel III Capital Rules. On January 1, 2015, we began using the Basel III

Standardized Approach for calculating our risk-weighted assets in our regulatory capital ratios.

Table 14: Capital Ratios(1)(2)

December 31, 2014 December 31, 2013

Minimum Minimum

Capital Capital Well- Capital Capital Well-

Ratio Adequacy Capitalized Ratio Adequacy Capitalized

Capital One Financial Corp:

Common equity Tier 1 capital

(3)

. . . . . . . . . . . .

12.46% 4.00% N/A

N/A N/A N/A

Tier 1 common capital

(4)

. . . . . . . . . . . . . . . . . .

N/A N/A N/A

12.19% N/A N/A

Tier 1 risk-based capital

(5)

. . . . . . . . . . . . . . . . .

13.23% 5.50% 6.00%

12.57 4.00% 6.00%

Total risk-based capital

(6)

. . . . . . . . . . . . . . . . .

15.14 8.00 10.00

14.69 8.00 10.00

Tier 1 leverage

(7)

. . . . . . . . . . . . . . . . . . . . . . . .

10.77 4.00 N/A

10.06 4.00 N/A

Capital One Bank (USA), N.A.:

Common equity Tier 1 capital

(3)

. . . . . . . . . . . .

11.33% 4.00% N/A

N/A N/A N/A

Tier 1 risk-based capital

(5)

. . . . . . . . . . . . . . . . .

11.33 5.50 6.00%

11.47% 4.00% 6.00%

Total risk-based capital

(6)

. . . . . . . . . . . . . . . . .

14.57 8.00 10.00

14.90 8.00 10.00

Tier 1 leverage

(7)

. . . . . . . . . . . . . . . . . . . . . . . .

9.64 4.00 5.00

10.21 4.00 5.00

Capital One, N.A.:

Common equity Tier 1 capital

(3)

. . . . . . . . . . . .

12.53% 4.00% N/A

N/A N/A N/A

Tier 1 risk-based capital

(5)

. . . . . . . . . . . . . . . . .

12.53 5.50 6.00%

12.67% 4.00% 6.00%

Total risk-based capital

(6)

. . . . . . . . . . . . . . . . .

13.57 8.00 10.00

13.76 8.00 10.00

Tier 1 leverage

(7)

. . . . . . . . . . . . . . . . . . . . . . . .

8.90 4.00 5.00

8.96 4.00 5.00

(1) As of January 1, 2014, we adopted the proportional amortization method of accounting for Investments in Qualified Affordable Housing

Projects. See “Note 1—Summary of Significant Accounting Policies” for additional information. Prior periods have been recast to conform

to this presentation.

(2) Capital ratios are calculated based on the Basel III Standardized Approach framework, subject to applicable transition provisions, as of

December 31, 2014 and are calculated based on the Basel I capital framework as of December 31, 2013. Capital ratios that are not applicable

are denoted by “N/A.” See “MD&A—Table F—Reconciliation of Non-GAAP Measures and Calculation of Regulatory Capital Measures”

for additional information.

(3) Common equity Tier 1 capital ratio is a regulatory capital measure under Basel III calculated based on common equity Tier 1 capital divided

by risk-weighted assets.

(4) Tier 1 common capital ratio is calculated based on Tier 1 common capital divided by Basel I risk-weighted assets.

(5) Tier 1 risk-based capital ratio is a regulatory capital measure calculated based on Tier 1 capital divided by risk-weighted assets.

(6) Total risk-based capital ratio is a regulatory capital measure calculated based on total risk-based capital divided by risk-weighted assets.

(7) Tier 1 leverage ratio is a regulatory capital measure calculated based on Tier 1 capital divided by average assets, after certain adjustments.

Capital One Financial Corporation exceeded Federal Banking Agencies’ minimum capital requirements and the

Banks exceeded minimum regulatory requirements and were “well-capitalized” under PCA requirements as of

December 31, 2014 and 2013. Our common equity Tier 1 capital ratio, as calculated under the Basel III Standardized

Approach, subject to transition provisions, was 12.46% as of December 31, 2014. Our Tier 1 common capital ratio, as

calculated under Basel I, was 12.19% as of December 31, 2013. These numbers are not directly comparable due to

methodological differences in the calculation of the ratios and the transition requirements under the Final Basel III

Capital Rules. For purposes of our capital plan that was submitted to the Board of Governors of the Federal Reserve

on January 5, 2015, we will be assessed on our ability to maintain specified minimum levels of capital under our

currently effective Basel III Standardized Approach regime, along with a Tier 1 common ratio of 5.0% on a pro

79 Capital One Financial Corporation (COF)