Capital One 2014 Annual Report Download - page 249

Download and view the complete annual report

Please find page 249 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

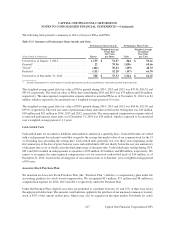

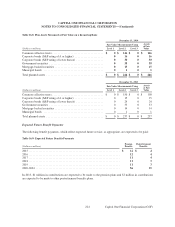

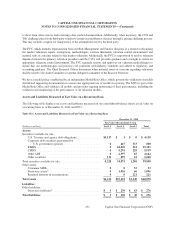

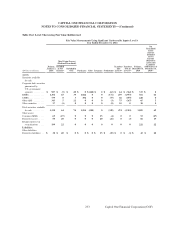

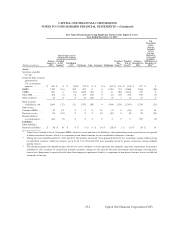

The following table presents significant components of the Company’s deferred tax assets and liabilities at

December 31, 2014 and 2013:

Table 17.4: Significant Components of Deferred Tax Assets and Liabilities

December 31, December 31,

(Dollars in millions) 2014 2013

Deferred tax assets:

Allowance for loan and lease losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,574 $ 1,583

Rewards programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 993 855

Security and loan valuations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 928 1,296

Compensation and employee benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 305 304

Representation and warranty reserve . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 271 444

Net operating loss and tax credit carryforwards . . . . . . . . . . . . . . . . . . . . . 163 248

Goodwill and intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140 0

Unearned income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100 87

Net unrealized losses on derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41 167

Other foreign deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 314 259

Subtotal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,838 5,250

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (148) (139)

Total deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,690 5,111

Deferred tax liabilities:

Original issue discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 875 893

Fixed assets and leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 208 173

Goodwill and intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 010

Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 275 303

Total deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,358 1,379

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,332 $ 3,732

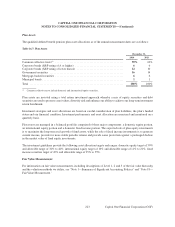

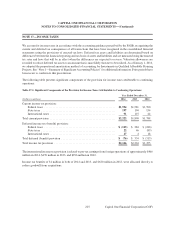

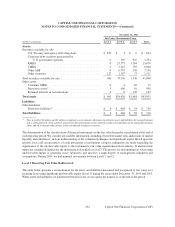

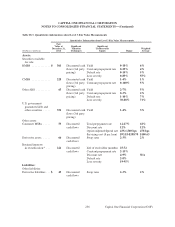

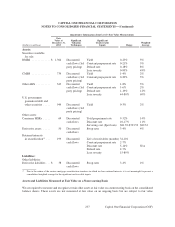

As of the end of December 31, 2014, we had federal net operating loss carry-forwards and losses of $18 million

attributable to ING Direct that expire from 2018 to 2032. Under IRS rules, the Company’s ability to utilize these

losses against future income is limited to $2 million per year. We have state operating loss carryforwards with a net

tax value of $157 million that expire from 2015 to 2033.

The valuation allowance increased by $9 million to adjust the tax benefit of certain state deferred tax assets and net

operating loss carryforwards to the amount we have determined is more likely than not to be realized.

The accounting guidance for income taxes clarifies the accounting for uncertainty in income taxes, and prescribes

a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax

position taken or expected to be taken in a tax return. The guidance also provides rules on derecognition,

classification, interest and penalties, accounting in interim periods, and disclosure. We recognize accrued interest

and penalties related to income taxes as a component of income tax expense. We recognized a $3 million benefit,

$13 million benefit and $3 million expense for net interest and penalties for 2014, 2013 and 2012, respectively.

227

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)