Capital One 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

forma basis as calculated under Basel I, under baseline and stressful c

onditions. We estimate that our Tier 1 common

ratio, as calculated under Basel I, was approximately 12.46% as of December 31

, 2014. See “MD&A—Table F—

Reconciliation of Non-GAAP Measures and Calculation of Regulatory Capital Measures” for additional information

about our Tier 1 common ratio as calculated under Basel I.

As described above, we currently are using the Basel III Standardized Approach for calculating our regulatory

capital, subject to transition provisions. The calculation of our Basel III Standardized Approach common equity

Tier 1 capital under the Final Basel III Capital Rules includes additional adjustments and deductions not included

in the Tier 1 common capital calculation under Basel I, such as the inclusion of the unrealized gains and losses on

available for sale investment securities included in AOCI and adjustments related to intangibles. The inclusion of

AOCI and the adjustments related to intangibles are phased-in at 20% for 2014, 40% for 2015, 60% for 2016, 80%

for 2017 and 100% for 2018.

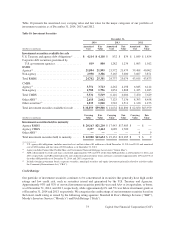

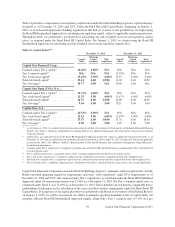

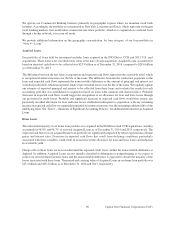

The following table compares our common equity Tier 1 capital and risk-weighted assets as of December 31, 2014,

calculated based on the Final Basel III Capital Rules, subject to applicable transition provisions, to our estimated

common equity Tier 1 capital and risk-weighted assets as of December 31, 2014, calculated under the Basel III

Standardized Approach, as it applies when fully phased-in. Our estimated common equity Tier 1 capital ratio under

fully phased-in Basel III Standardized Approach is based on our interpretations, expectations and assumptions of

relevant regulations, interpretations provided by our regulators, and is subject to change based on changes to future

regulations and interpretations.

In November 2014, our regulators informed us that they had updated their interpretation guidance regarding the

prospective capital treatment for certain securitization exposures. This guidance resulted in a reduction of

approximately 20 basis points to our estimated fully phased-in Basel III Standardized Approach common equity

Tier 1 capital ratio. As we continue to engage with our regulators during our parallel run, we anticipate that there

could be further changes to the calculation.

See the table and notes below for further discussion on our interpretations, expectations and assumptions used in

calculating this ratio.

Table 15: Estimated Common Equity Tier 1 Capital Ratio under Fully Phased-In Basel III Standardized Approach(1)

(Dollars in millions) December 31, 2014

Common equity Tier 1 capital under Basel III Standardized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 29,534

Adjustments related to AOCI(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (362)

Adjustments related to intangibles(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (973)

Other adjustments(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1)

Estimated common equity Tier 1 capital under fully phased-in Basel III Standardized . . . . . . . . . . . . . . $ 28,198

Risk-weighted assets under Basel I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 236,944

Adjustments for Basel III Standardized(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,075

Estimated risk-weighted assets under Basel III Standardized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 246,019

Estimated common equity Tier 1 capital ratio under fully phased-in Basel III Standardized(4) . . . . . . . . 11.5%

(1) Estimated common equity Tier 1 capital ratio under fully phased-in Basel III Standardized Approach is a non-GAAP financial measure.

(2) Assumes adjustments are fully phased-in.

(3) Adjustments to the Basel I approach to calculating risk-weighted assets include higher risk weights for exposures 90 days or more past due

or in nonaccrual, high volatility commercial real estate, securitization exposures and corresponding adjustments to PCCR intangibles,

deferred tax assets and certain other assets in the calculation of common equity Tier 1 capital under the Basel III Standardized Approach.

(4) Calculated by dividing estimated common equity Tier 1 capital under the fully phased-in Basel III Standardized Approach by estimated

risk-weighted assets under the Basel III Standardized Approach.

80 Capital One Financial Corporation (COF)