Capital One 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

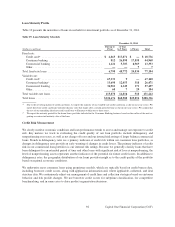

Loan Modifications and Restructurings

As part of our loss mitigation efforts, we may provide short-term (three to twelve months) or long-term (greater

than twelve months) modifications to a borrower experiencing financial difficulty to improve long-term collectability

of the loan and to avoid the need for foreclosure or repossession of collateral.

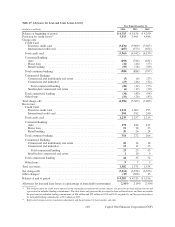

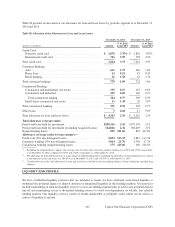

Table 26 presents our loans modified in TDRs as of December 31, 2014 and 2013. It excludes loan modifications

that do not meet the definition of a TDR and Acquired Loans accounted for based on expected cash flows, which

we track and report separately.

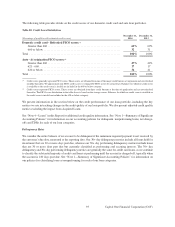

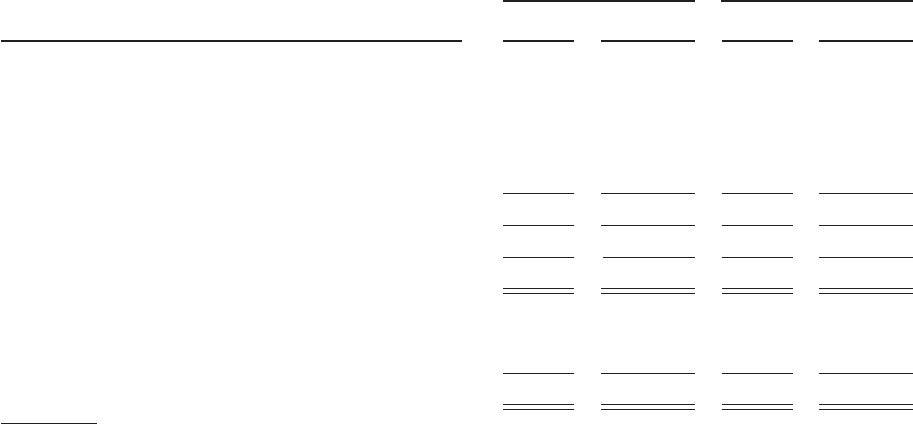

Table 26: Loan Modifications and Restructurings

December 31, 2014 December 31, 2013

% of Total % of Total

(Dollars in millions) Amount Modifications Amount Modifications

Modified and restructured loans:

Credit card(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 692 41.9% $ 780 46.4%

Consumer banking:

Auto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 435 26.3 355 21.1

Home loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 218 13.2 244 14.5

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 2.1 64 3.8

Total consumer banking . . . . . . . . . . . . . . . . . . . . . . . . . 688 41.6 663 39.4

Commercial banking . . . . . . . . . . . . . . . . . . . . . . . . . . . 272 16.5 238 14.2

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,652 100.0% $ 1,681 100.0%

Status of modified and restructured loans:

Performing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,203 72.8% $ 1,250 74.4%

Nonperforming . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 449 27.2 431 25.6

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,652 100.0% $ 1,681 100.0%

(1) Amount reflects the total outstanding customer balance, which consists of unpaid principal balance, accrued interest and fees.

The majority of our credit card TDRs involve reducing the interest rate on the account and placing the customer on

a fixed payment plan not exceeding 60 months. We determine the effective interest rate for purposes of measuring

impairment on modified loans that involve a reduction and are considered to be a TDR based on the interest rate in

effect immediately prior to the loan entering the modification program. In some cases, the interest rate on a credit

card account is automatically increased due to non-payment, late payment or similar events. In all cases, we cancel

the customer’s available line of credit on the credit card. If the customer does not comply with the modified payment

terms, then the credit card loan agreement may revert to its original payment terms, with the amount of any loan

outstanding reflected in the appropriate delinquency category. The loan amount may then be charged off in

accordance with our standard charge-off policy.

Within the Consumer Banking business, the majority of our modified loans receive an extension, while a portion

receive an interest rate reduction or principal reduction. Their impairment is determined using the present value of

expected cash flows, or a collateral evaluation for auto and home loans that were charged down to fair value. In the

Commercial Banking business, the majority of modified loans receive an extension, with a portion of these loans

receiving an interest rate reduction. The impairment on modified commercial loans is generally determined based

on the underlying collateral value. We provide additional information on modified loans accounted for as TDRs,

including the performance of those loans subsequent to modification, in “Note 4—Loans.”

98 Capital One Financial Corporation (COF)