Capital One 2014 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146

Determining the appropriateness of the allowance is complex and requires judgment by management about the effect

of matters that are inherently uncertain. Subsequent evaluations of the loan portfolio, in light of the factors then

prevailing, may result in significant changes in the allowance and the reserve for unfunded lending commitments in

future periods.

Securitization of Loans

Our loan securitization activities primarily involve the securitization of credit card loans, which have provided a

source of funding for us. See “Note 6—Variable Interest Entities and Securitizations” for additional details. Loan

securitization involves the transfer of a pool of loan receivables from our portfolio to a trust. The trust then sells an

undivided interest in the pool of loan receivables to third-party investors through the issuance of debt securities and

transfers the proceeds from the debt issuance to us as consideration for the loan receivables transferred. The debt

securities are collateralized by the transferred receivables from our portfolio. We remove loans from our consolidated

balance sheets when securitizations qualify as sales to non-consolidated VIEs, recognize assets retained and liabilities

assumed at fair value and record a gain or loss on the transferred loans. Alternatively, when the transfer does not

qualify as a sale but instead is considered a secured borrowing or when the sale is to a consolidated VIE, the asset will

remain on our consolidated balance sheets with an offsetting liability recognized for the amount of proceeds received.

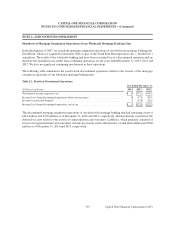

Premises and Equipment

Land is carried at cost. Premises and equipment, including leasehold improvements, are carried at cost less

accumulated depreciation and amortization. We capitalize direct costs incurred during the application development

stage of internally developed software projects. Depreciation and amortization expenses are computed generally by

the straight-line method over the estimated useful lives of the assets. Useful lives for premises and equipment are

estimated as follows:

Premises & Equipment Useful Lives

Buildings and improvement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-39 years

Furniture and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-10 years

Computer software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3-7 years

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lesser of useful life or the remaining

fixed non-cancelable lease term

Expenditures for maintenance and repairs are expensed to earnings as incurred. Gains or losses upon disposition

are reflected in earnings as realized.

Goodwill and Intangible Assets

Goodwill is not amortized but is tested for impairment, at the reporting unit level, annually or more frequently when

adverse circumstances indicate that it is more likely than not that the carrying amount of a reporting unit exceeds

its fair value. A reporting unit is defined as an operating segment or one level below an operating segment and

goodwill is assigned to one or more reporting units at the date of acquisition. Our reporting units are Domestic Card,

International Card, Auto, Other Consumer Banking and Commercial Banking. The annual goodwill impairment

test, performed as of October 1 of each year, is a two-step test. The first step identifies whether there is potential

impairment by comparing the fair value of a reporting unit to its carrying amount, including goodwill. If fair value

is less than the carrying amount, the second step of the impairment test is required to measure the amount of any

potential impairment loss. Intangible assets with definite useful lives are amortized either on a straight-line or on an

accelerated basis over their estimated useful lives and are evaluated for impairment whenever events or changes in

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)