Capital One 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

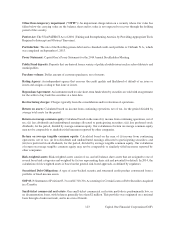

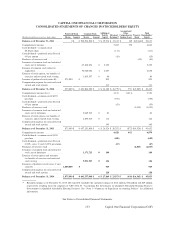

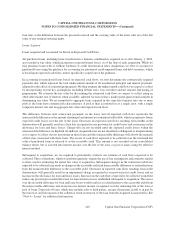

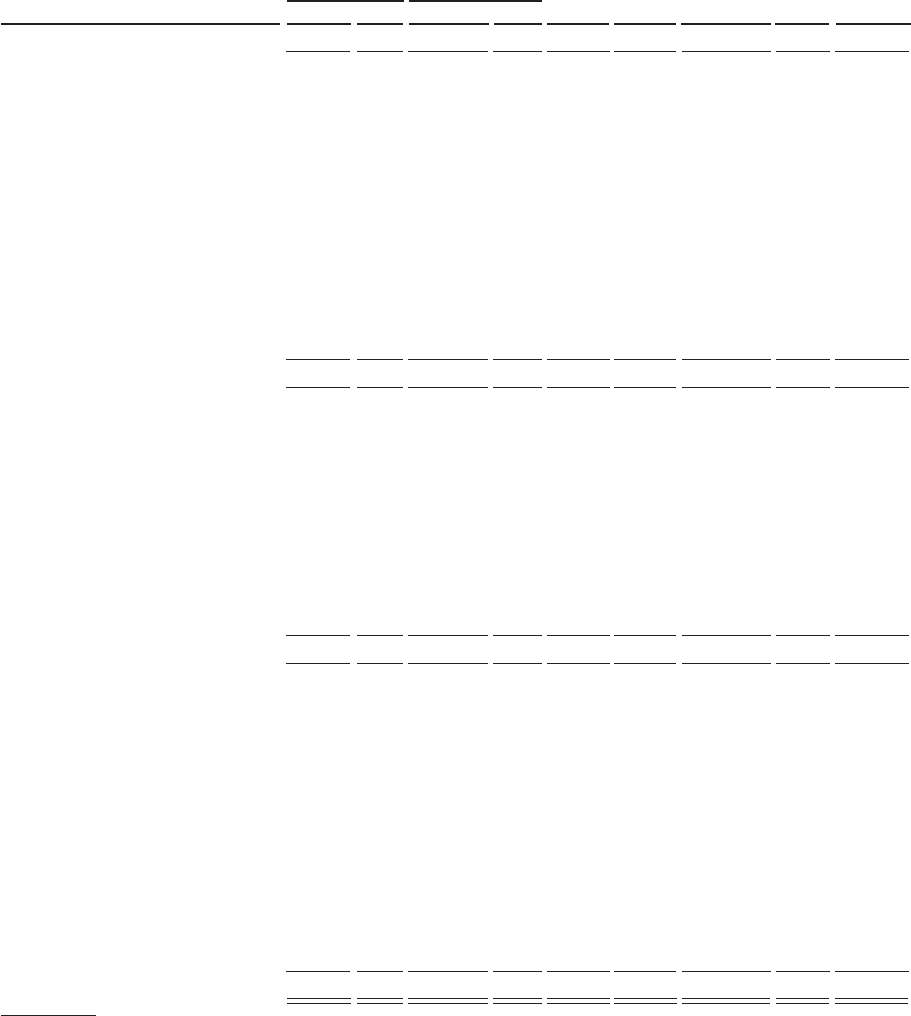

CAPITAL ONE FINANCIAL CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Accumulated

Preferred Stock Common Stock Additional Other Total

Paid-In Retained Comprehensive Treasury Stockholders’

(Dollars in millions, except per share data) Shares Amount Shares Amount Capital Earnings(1) Income (Loss) Stock Equity

Balance as of December 31, 2011 . . . . . . . 0 $ 0 508,594,308 $ 5 $ 19,274 $ 13,413 $ 169 $(3,244)$ 29,617

Comprehensive income . . . . . . . . . . . . . . . . 3,492 570 4,062

Cash dividends—common stock

$0.20 per share . . . . . . . . . . . . . . . . . . . . (111) (111)

Cash dividends—preferred series B stock

6% per annum . . . . . . . . . . . . . . . . . . . . . (15) (15)

Purchases of treasury stock . . . . . . . . . . . . . (43) (43)

Issuances of common stock and restricted

stock, net of forfeitures . . . . . . . . . . . . . . 67,368,854 0 3,233 3,233

Issuance of common stock related to

acquisition . . . . . . . . . . . . . . . . . . . . . . . . 54,028,086 1 2,637 2,638

Exercise of stock options, tax benefits of

exercises and restricted stock vesting . . . 1,815,337 0 80 80

Issuance of preferred stock (series B) . . . . . 875,000 0 853 853

Compensation expense for restricted stock

awards and stock options . . . . . . . . . . . . 111 111

Balance as of December 31, 2012 . . . . . . . 875,000 $ 0 631,806,585 $ 6 $ 26,188 $ 16,779 $ 739 $(3,287) $ 40,425

Comprehensive income (loss) . . . . . . . . . . . 4,121 (1,611) 2,510

Cash dividends—common stock $0.95

per share . . . . . . . . . . . . . . . . . . . . . . . . . (555) (555)

Cash dividends—preferred series B stock

6% per annum . . . . . . . . . . . . . . . . . . . . . (53) (53)

Purchases of treasury stock . . . . . . . . . . . . . (1,033) (1,033)

Issuances of common stock and restricted

stock, net of forfeitures . . . . . . . . . . . . . . 3,049,705 0 81 81

Exercise of stock options, tax benefits of

exercises and restricted stock vesting . . . 2,295,510 0 114 114

Compensation expense for restricted stock

awards and stock options . . . . . . . . . . . . 143 143

Balance as of December 31, 2013 . . . . . . . 875,000 $ 0 637,151,800 $ 6 $ 26,526 $ 20,292 $ (872) $(4,320) $ 41,632

Comprehensive income . . . . . . . . . . . . . . . . 4,428 442 4,870

Cash dividends—common stock $1.20

per share . . . . . . . . . . . . . . . . . . . . . . . . . (680) (680)

Cash dividends—preferred series B stock

6.00%, series C stock 6.25% per annum (67) (67)

Purchases of treasury stock . . . . . . . . . . . . . (2,045) (2,045)

Issuances of common stock and restricted

stock, net of forfeitures . . . . . . . . . . . . . . 1,373,725 0 100 100

Exercise of stock options and warrants,

tax benefits of exercises and restricted

stock vesting . . . . . . . . . . . . . . . . . . . . . . 5,031,523 0 146 146

Issuances of preferred stock (series C and

series D) . . . . . . . . . . . . . . . . . . . . . . . . . 1,000,000 0 969 969

Compensation expense for restricted stock

awards and stock options . . . . . . . . . . . . 128 128

Balance as of December 31, 2014 . . . . . . . 1,875,000 $ 0 643,557,048 $ 6 $ 27,869 $ 23,973 $ (430) $(6,365) $ 45,053

(1) Retained earnings as of December 31, 2013, 2012 and 2011 includes the cumulative impact of $112 million, $74 million and $49 million,

respectively resulting from the adoption of ASU 2014-01 “Accounting For Investments in Qualified Affordable Housing Projects”

(Investments in Qualified Affordable Housing Projects). See “Note 1—Summary of Significant Accounting Policies” for additional

information.

133

See Notes to Consolidated Financial Statements.

Capital One Financial Corporation (COF)