Capital One 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

exposures under a broad range of scenarios. Investment securities and derivatives are the main levers for the

management of interest rate and foreign exchange risk.

The Chief Risk Officer, in conjunction with the Chief Market and Liquidity Risk Officer, is responsible for the

establishment of market risk management policies and standards and for governance and monitoring of market risk at

a corporate level. The Chief Financial Officer is accountable for the management of market risk. We manage market

risk exposure, which is principally driven by balance sheet interest rate risk, centrally and establish quantitative limits to

control our exposure. Market risk is inherent in the financial instruments associated with our business operations and

activities, including loans, deposits, securities, short-term borrowings, long-term debt and derivatives.

The market risk positions of our banking entities and our total company are calculated separately and in total and

are reported in comparison to pre-established limits to the Asset Liability Committee monthly and to the Risk

Committee of the Board of Directors no less than quarterly. Management is authorized to utilize financial instruments

as outlined in our policy to actively manage market risk exposure.

Operational Risk Management

We recognize the criticality of managing operational risk on a day-to-day basis and that there are heightened

expectations from our regulators and our customers. We have implemented appropriate operational risk management

policies, standards, processes and tools to enable the delivery of high quality and consistent customer experiences.

The Chief Operational Risk Officer is responsible for establishing and overseeing our Operational Risk Management

Program. The program establishes and enforces requirements and practices for assessing the operational risk profile,

executing key control processes for select operational risks, and reporting of operational risk results. These activities

are executed in accordance with Basel II Advanced Approaches requirements.

Reputation Risk Management

We recognize that reputation risk is of particular concern for financial institutions as a result of the aftermath of the

financial crisis and economic downturn, which has resulted in increased scrutiny and widespread regulatory changes.

We manage both strategic and tactical reputation issues and build our relationships with the government, media,

consumer advocates, and other constituencies to help strengthen the reputations of both our company and industry.

Our actions include implementing pro-consumer practices in our business and taking public positions in support of

better consumer practices in our industry. The General Counsel is responsible for managing our overall reputation

risk program. Day-to-day activities are controlled by the frameworks set forth in our Reputation Risk Management

Policy and other risk management policies.

Strategic Risk Management

Capital One monitors external market and industry developments to identify potential areas of strategic opportunity

or risk. These items provide input for development of the Company’s strategy led by the Chief Executive Officer

and other senior executives. Through the ongoing development and vetting of the corporate strategy, the Chief Risk

Officer identifies and assesses risks associated with the strategy across all risk categories and monitors them

throughout the year.

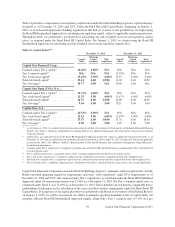

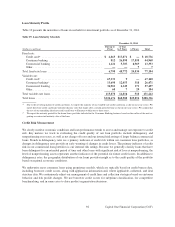

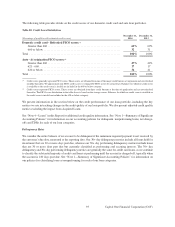

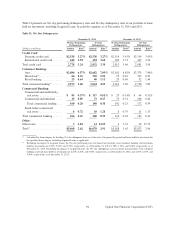

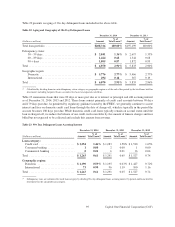

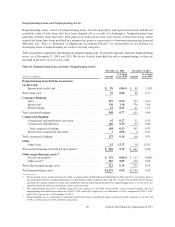

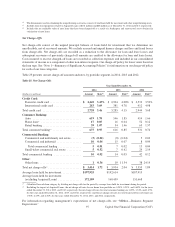

CREDIT RISK PROFILE

Our loan portfolio accounts for the substantial majority of our credit risk exposure. Our lending activities are

governed under our credit policy and are subject to independent review and approval. Below we provide information

about the composition of our loan portfolio, key concentrations and credit performance metrics.

87 Capital One Financial Corporation (COF)