Capital One 2014 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

169

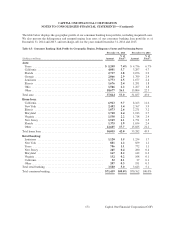

Credit Card

Our credit card loan portfolio is generally highly diversified across millions of accounts and numerous geographies

without significant individual exposure. We therefore generally manage credit risk on a portfolio basis. The risk in

our credit card portfolio correlates to broad economic trends, such as unemployment rates, gross domestic product

(“GDP”), and home values, as well as customer liquidity, which can have a material effect on credit performance.

The primary factors we assess in monitoring the credit quality and risk of our credit card portfolio are delinquency

and charge-off trends, including an analysis of the migration of loans between delinquency categories over time.

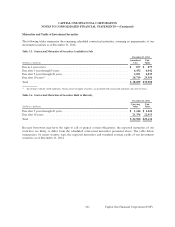

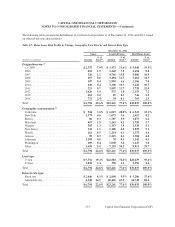

The table below displays the geographic profile of our credit card loan portfolio and delinquency statistics as of

December 31, 2014 and 2013. We also present the delinquency rates of our credit card loan portfolio, including

Acquired Loans, and comparative net charge-offs for the years ended December 31, 2014 and 2013.

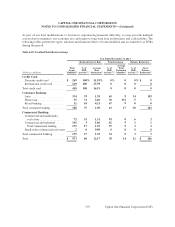

Table 4.3: Credit Card: Risk Profile by Geographic Region and Delinquency Status

December 31, 2014 December 31, 2013

% of % of

(Dollars in millions) Amount Total(1) Amount Total(1)

Domestic credit card:

California . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,574 10.0% $ 7,940 9.8%

New York . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,610 6.5 5,277 6.5

Texas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,382 6.3 4,993 6.1

Florida . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,794 5.6 4,325 5.3

Illinois . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,747 4.4 3,603 4.4

Pennsylvania . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,581 4.2 3,442 4.2

Ohio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,075 3.6 2,965 3.6

New Jersey . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,868 3.3 2,736 3.4

Michigan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,681 3.1 2,595 3.2

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37,392 43.5 35,379 43.6

Total domestic credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77,704 90.5 73,255 90.1

International credit card:

Canada . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,747 5.5 4,503 5.5

United Kingdom . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,425 4.0 3,547 4.4

Total international credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,172 9.5 8,050 9.9

Total credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $85,876 100.0% $81,305 100.0%

December 31, 2014 December 31, 2013

% of % of

(Dollars in millions) Amount Total(2) Amount Total(2)

Selected credit metrics:

30+ day delinquencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,832 3.30% $ 2,881 3.54%

90+ day delinquencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,292 1.50 1,328 1.63

(1) Percentages by geographic region within the domestic and international credit card portfolios are calculated based on the total held for

investment credit card loans as of the end of the reported period.

(2) Calculated by dividing delinquent credit card loans by the total balance of credit card loans held for investment as of the end of the reported

period.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)