Capital One 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

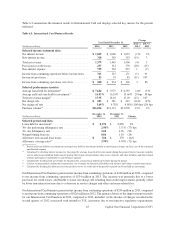

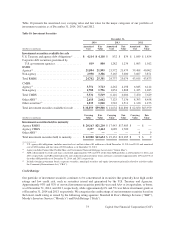

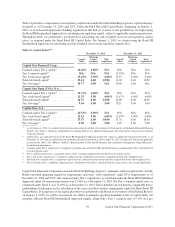

Table 10 presents the amortized cost, carrying value and fair value for the major categories of our portfolio of

investment securities as of December 31, 2014, 2013 and 2012.

Table 10: Investment Securities

December 31,

2014 2013 2012

Amortized Fair Amortized Fair Amortized Fair

(Dollars in millions) Cost Value Cost Value Cost Value

Investment securities available for sale

U.S. Treasury and agency debt obligations(1) . . . . . $ 4,114 $ 4,118 $ 832 $ 834 $ 1,849 $ 1,854

Corporate debt securities guaranteed by

U.S. government agencies . . . . . . . . . . . . . . . . . . 819 800 1,282 1,234 1,003 1,012

RMBS:

Agency(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,804 21,995 21,572 21,479 39,408 40,002

Non-agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,938 3,386 3,165 3,600 3,607 3,871

Total RMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,742 25,381 24,737 25,079 43,015 43,873

CMBS:

Agency(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,751 3,723 4,262 4,198 6,045 6,144

Non-agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,780 1,796 1,854 1,808 1,425 1,485

Total CMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,531 5,519 6,116 6,006 7,470 7,629

Other ABS(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,618 2,662 7,123 7,136 8,393 8,458

Other securities(4) . . . . . . . . . . . . . . . . . . . . . . . . . . 1,035 1,028 1,542 1,511 1,120 1,153

Total investment securities available for sale . . . . . $ 38,859 $39,508 $ 41,632 $41,800 $ 62,850 $63,979

Carrying Fair Carrying Fair Carrying Fair

(Dollars in millions) Value Value Value Value Value Value

Investment securities held to maturity

Agency RMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 20,163 $21,210 $ 17,443 $17,485 $ — $ —

Agency CMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,337 2,424 1,689 1,700 — —

Other ABS(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —— —— 9 9

Total investment securities held to maturity . . . . . . $ 22,500 $23,634 $ 19,132 $19,185 $ 9 $ 9

(1) U.S. agency debt obligations, includes amortized cost and fair value of $1 million as of both December 31, 2014 and 2013, and amortized

cost of $301 million and fair value of $302 million as of December 31, 2012.

(2) Agency includes Fannie Mae, Freddie Mac, and Government National Mortgage Association (“Ginnie Mae”).

(3) ABS collateralized by credit card loans constituted approximately 56% and 65% of the other ABS portfolio as of December 31, 2014, and

2013, respectively, and ABS collateralized by auto dealer floor plan inventory loans and leases constituted approximately 16% and 15% of

the other ABS portfolio as of December 31, 2014, and 2013, respectively.

(4) Includes foreign government bonds, corporate securities, municipal securities and equity investments primarily related to activities under

the Community Reinvestment Act (“CRA”).

Credit Ratings

Our portfolio of investment securities continues to be concentrated in securities that generally have high credit

ratings and low credit risk, such as securities issued and guaranteed by the U.S. Treasury and Agencies.

Approximately 93% and 92% of our total investment securities portfolio was rated AA+ or its equivalent, or better,

as of December 31, 2014, and 2013, respectively, while approximately 6% and 5% was below investment grade as

of December 31, 2014 and 2013, respectively. We categorize the credit ratings of our investment securities based on

the lowest credit rating as issued by the following rating agencies: Standard & Poor’s Ratings Services (“S&P”),

Moody’s Investors Service (“Moody’s”) and Fitch Ratings (“Fitch”).

73 Capital One Financial Corporation (COF)