Capital One 2014 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.149

date of the SAC promotional period, interest charges are applied retroactively to the purchase date. We accrue SAC

interest income on a monthly basis throughout the term of the SAC period based on the amount we expect to

collect. Accordingly, we do not accrue interest income for borrowers who we expect will pay their principal balance

in full prior to the expiration of the SAC period or for borrowers who we expect will be unable to pay the full

amount.

Card Partnership Agreements

Our partnership agreements relate to alliances with retailers and other partners to provide lending and other services

to mutual customers. We primarily issue private-label and co-branded credit card loans to these customers over the

term of these arrangements, which typically range from two to ten years.

Certain partners assist in or perform marketing activities on our behalf and promote our products and services to

their customers. As compensation for providing these services, we often pay royalties, bounties, or other special

bonuses to these partners. Depending upon the nature of the payments, they are recorded as a reduction of revenue,

marketing expenses or other operating expenses. We have certain credit card partnership arrangements in which our

partner agrees to share in a portion of the credit losses associated with the partnership.

If a partnership agreement provides for profit, revenue or loss sharing payments, we must determine whether to

report those payments on a gross or net basis in our consolidated financial statements. We evaluate the contractual

provisions of each transaction and applicable accounting guidance to determine the manner in which to report the

impact of sharing arrangements in our consolidated financial statements. Our consolidated net income is the same

regardless of whether revenue and loss sharing arrangements are reported on a gross or net basis.

When presented on a net basis, the loss sharing amounts due from partners are recorded as a reduction in our

provision for credit losses on our consolidated statements of income and reduce the charge-off amounts that we

report. The allowance for loan and lease losses attributable to these portfolios are also reduced by the loss sharing

amount due from the partners.

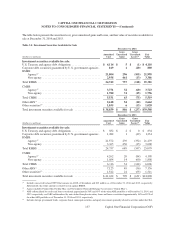

Net presentation of loss sharing arrangements resulted in reductions in reported charge-offs of $164 million, $151

million and $156 million for the years ended December 31, 2014, 2013 and 2012, respectively. The reduction in the

provision for loan and lease losses attributable to these arrangements were $167 million, $111 million and $187

million for the years ended December 31, 2014, 2013 and 2012, respectively. The expected reimbursement from

these partners, which is netted against our allowance for loan and lease losses, was approximately $143 million and

$141 million as of December 31, 2014 and 2013, respectively.

Collaborative Arrangements

A collaborative arrangement is a contractual arrangement that involves a joint operating activity between two or

more parties that are active participants in the activity. These parties are exposed to significant risks and rewards

based upon the economic success of the joint operating activity. We assess each of our partnership agreements with

profit, revenue or loss sharing payments to determine if a collaborative arrangement exists and, if so, how revenue

generated from third parties, costs incurred and transactions between participants in the collaborative arrangement

should be accounted for and reported on our consolidated financial statements. We currently have one partnership

agreement that meets the definition of a collaborative agreement.

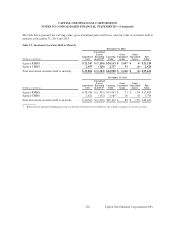

We share a fixed percentage of revenues, consisting of finance charges and late fees, with the partner, and the partner

is required to reimburse us for a fixed percentage of credit losses incurred. Revenues and losses related to the partner’s

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)