Capital One 2014 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

172

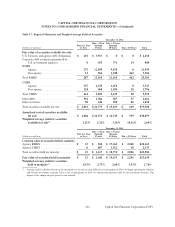

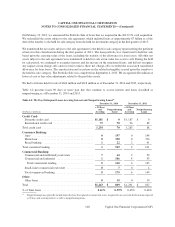

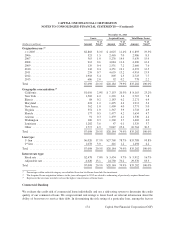

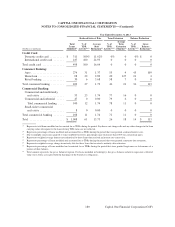

December 31, 2014

Total Consumer

Auto Home Loan Retail Banking Banking

(Dollars in millions) Amount Rate Amount Rate(2) Amount Rate Amount Rate(2)

Credit performance:

30+ day delinquencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,682 7.09% $ 302 1.01% $ 40 1.11% $ 3,024 4.23%

90+ day delinquencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 197 0.52 218 0.73 16 0.44 431 0.60

Nonperforming loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 197 0.52 330 1.10 22 0.61 549 0.77

December 31, 2013

Total Consumer

Auto Home Loan Retail Banking Banking

(Dollars in millions) Amount Rate Amount Rate(2) Amount Rate Amount Rate(2)

Credit performance:

30+ day delinquencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,375 7.46% $ 323 0.91% $ 52 1.44% $ 2,750 3.89%

90+ day delinquencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 194 0.61 239 0.68 23 0.65 456 0.65

Nonperforming loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 194 0.61 376 1.06 41 1.13 611 0.86

(1) Percentages by geographic region are calculated based on the total held-for-investment consumer banking loans as of the end of the reported

period.

(2) Excluding the impact of Acquired Loans, the 30+ day delinquency rates, 90+ day delinquency rates, and the nonperforming loans rates for

home loan portfolio were 4.45%, 3.21% and 4.86% as of December 31, 2014; and 4.55%, 3.37%, and 5.29% as of December 31, 2013.

Excluding the impact of Acquired Loans, the 30+ day delinquency rates, 90+ day delinquency rates, and the nonperforming loans rates for

total Consumer Banking were 6.28%, 0.89% and 1.14%, as of December 31, 2014; and 6.47%, 1.07% and 1.44% as of December 31, 2013.

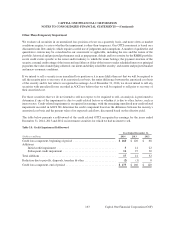

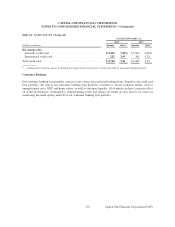

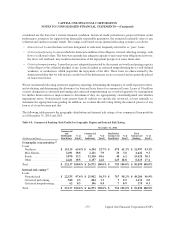

Table 4.6: Consumer Banking: Net Charge-offs

Year Ended December 31,

2014 2013

(Dollars in millions) Amount Rate(1) Amount Rate(1)

Net charge-offs:

Auto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 619 1.78% $ 546 1.85%

Home loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 0.05 16 0.04

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39 1.07 54 1.46

Total consumer banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 675 0.95 $ 616 0.85

(1) Calculated for each loan category by dividing net charge-offs for the period by average loans held for investment during the period.

Excluding the impact of Acquired Loans, the net charge-off rates for home loan portfolio were 0.24%, and 0.21%, for the years ended

December 31, 2014, and 2013, respectively; and the net charge-off rates for total consumer banking were 1.49%, and 1.51%, for the years

ended December 31, 2014, and 2013, respectively.

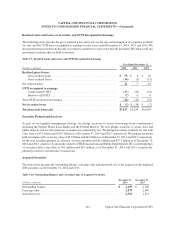

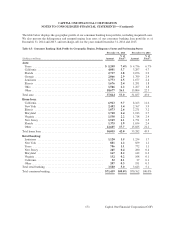

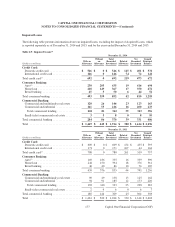

Home Loan

Our home loan portfolio consists of both first-lien and second-lien residential mortgage loans. In evaluating the

credit quality and risk of our home loan portfolio, we continually monitor a variety of mortgage loan characteristics

that may affect the default experience on our overall home loan portfolio, such as vintage, geographic concentrations,

lien priority and product type. Certain loan concentrations have experienced higher delinquency rates as a result of

the significant decline in home prices since the peak in 2006 and the rise in unemployment. These loan concentrations

include loans originated between 2006 and 2008 in an environment of decreasing home sales, broadly declining

home prices and more relaxed underwriting standards.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)