Capital One 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

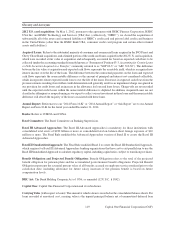

|

Subprime: For purposes of lending in our Credit Card business we generally consider FICO scores of 660 or below,

or other equivalent risk scores, to be subprime. For purposes of auto lending in our Consumer Banking business we

generally consider borrowers FICO scores of 620 or below to be subprime.

Tangible common equity (“TCE”): Common equity less goodwill and intangible assets adjusted for deferred tax

liabilities associated with non-tax deductible intangible assets and tax deductible goodwill.

Tier 1 Common Capital: Tier 1 capital less preferred stock, qualifying trust preferred securities, hybrid securities

and qualifying noncontrolling interest in subsidiaries under Basel I.

Troubled debt restructuring (“TDR”): A TDR is deemed to occur when the Company modifies the contractual

terms of a loan agreement by granting a concession to a borrower that is experiencing financial difficulty.

U.S. federal banking agencies: The Federal Reserve, the OCC and the FDIC.

U.S. GAAP: Accounting principles generally accepted in the United States of America. Accounting rules and

conventions defining acceptable practices in preparing financial statements in the U.S.

Unfunded commitments: Legally binding agreements to provide a defined level of financing until a specified future

date.

Variable Interest Entity (“VIE”): An entity that: (1) lacks enough equity investment at risk to permit the entity to

finance its activities without additional financial support from other parties; (2) has equity owners that lack the right

to make significant decisions affecting the entity’s operations; and/or (3) has equity owners that do not have an

obligation to absorb or the right to receive the entity’s losses or return.

Volker Rule: A final rule implementing Section 619 of the Dodd-Frank Act that contains prohibitions on proprietary

trading and certain investments in, and relationships with, covered funds (hedge funds, private equity funds, and

similar funds).

Acronyms

ABS: Asset-backed security

AOCI: Accumulated other comprehensive income

ARM: Adjustable rate mortgage

ASC: Accounting Standard Codification

BHC: Bank holding company

bps: Basis points

CAD: Canadian Dollar

CCAR: Comprehensive Capital Analysis and Review

CDE: Community development entities

CFPB: Consumer Financial Protection Bureau

CFTC: Commodity Futures Trading Commission

CMBS: Commercial mortgage-backed securities

COEP: Capital One (Europe) plc

COF: Capital One Financial Corporation

COSO: Committee of Sponsoring Organizations of the Treadway Commission

CRA: Community Reinvestment Act

DUS: Delegated Underwriting and Servicing

Fannie Mae: Federal National Mortgage Association

FASB: Financial Accounting Standards Board

FCA: U.K. Financial Conduct Authority

124 Capital One Financial Corporation (COF)