Capital One 2014 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One Financial Corporation (COF)

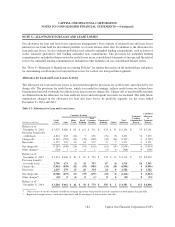

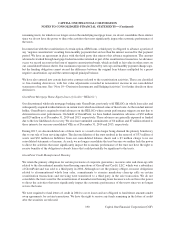

NOTE 7—GOODWILL AND INTANGIBLE ASSETS

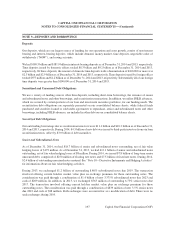

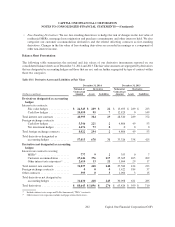

The table below displays the components of goodwill, intangible assets and MSRs as of December 31, 2014 and

2013. Goodwill is presented separately on our consolidated balance sheets. Intangible assets and MSRs are included

in other assets on our consolidated balance sheets.

Table 7.1: Components of Goodwill, Intangible Assets and MSRs(1)

December 31, December 31,

(Dollars in millions) 2014 2013

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13,978 $ 13,978

Intangible assets:

Purchased credit card relationship (“PCCR”) intangibles . . . . . . . . . . . . . . . . . . . . 972 1,341

Core deposit intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 202 331

Other(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 142 177

Total intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,316 1,849

Total goodwill and intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 15,294 $ 15,827

MSRs:

Consumer MSRs(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 53 $ 73

Commercial MSRs(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147 132

Total MSRs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 200 $ 205

(1) Certain intangible assets that were fully amortized in prior periods were removed from our consolidated balance sheets.

(2) Primarily consists of brokerage relationship intangibles, partnership and other contract intangibles and trademark/name intangibles. Also

includes certain indefinite-lived intangibles of $4 million as of both December 31, 2014 and 2013.

(3) Represents MSRs related to our Consumer Banking business that are carried at fair value on our consolidated balance sheets.

(4) Represents MSRs related to our Commercial Banking business that are subsequently measured under the amortization method and

periodically assessed for impairment. We recorded $21 million and $3 million amortization expense for the years ended December 31, 2014

and 2013, respectively. None of these MSRs were impaired during the year ended December 31, 2014 and no valuation allowance was

recorded as of December 31, 2014 and 2013.

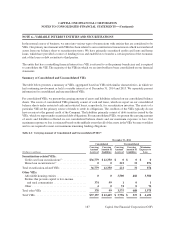

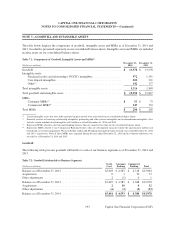

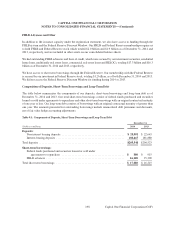

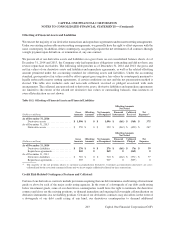

Goodwill

The following table presents goodwill attributable to each of our business segments as of December 31, 2014 and

2013.

Table 7.2: Goodwill Attributable to Business Segments

Credit Consumer Commercial

(Dollars in millions) Card Banking Banking Total

Balance as of December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,003 $ 4,583 $ 4,318 $13,904

Acquisitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 3 70 73

Other adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 (1) 0 1

Balance as of December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,005 $ 4,585 $ 4,388 $13,978

Acquisitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 10 0 12

Other adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6) (2) (4) (12)

Balance as of December 31, 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,001 $ 4,593 $ 4,384 $13,978

193

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)