Capital One 2014 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

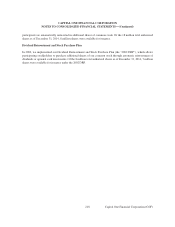

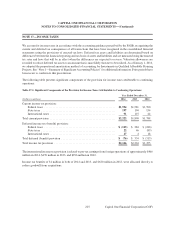

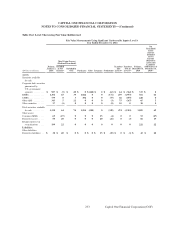

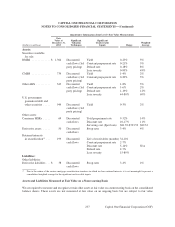

The following table presents the accrued balance of tax, interest and penalties related to unrecognized tax

benefits:

Table 17.5: Reconciliation of the Change in Unrecognized Tax Benefits

Gross Accrued Gross Tax,

Unrecognized Interest and Interest and

(Dollars in millions) Tax Benefits Penalties Penalties

Balance as of January 1, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 208 $ 54 $ 262

Additions for tax positions related to prior years . . . . . . . . . . . . . . . . . . . . . . 15 7 22

Reductions for tax positions related to prior years due to

IRS and other settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (109) (22) (131)

Balance as of December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 114 $ 39 $ 153

Additions for tax positions related to prior years . . . . . . . . . . . . . . . . . . . . . . 9 2 11

Reductions for tax positions related to prior years due to

IRS and other settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16) (5) (21)

Balance as of December 31, 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 107 $ 36 $ 143

Portion of balance at December 31, 2014 that, if recognized,

would impact the effective income tax rate . . . . . . . . . . . . . . . . . . . . . . $ 70 $ 23 $ 93

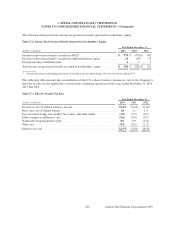

We are subject to examination by the IRS and other tax authorities in certain countries and states in which we have

significant business operations. The tax years subject to examination vary by jurisdiction. During 2014, the IRS paid

to the Company tax refunds in the aggregate amount of $155 million with respect to the taxable years 2000 to 2008,

for which examinations were completed in 2013. The IRS also completed the examination of the Company’s federal

income tax returns for the taxable years 2009, 2010, and 2011 during 2014 and paid tax refunds to the Company in

the aggregate amount of $123 million. Because receivables had been recorded in prior years for these refunds, they

did not have a significant effect on the income tax provisions in 2012, 2013 and 2014.

The IRS initiated the examinations of the Company’s federal income tax returns for the tax years 2012 and 2013

during 2014, which are expected to be completed in 2015. During 2014, the Company entered into the IRS

Compliance Assurance Process (“CAP”) for the Company’s 2014 federal income tax return. Under the CAP

examination process, the IRS exam team contemporaneously reviewed the Company’s intended tax return

reporting of certain 2014 transactions disclosed to the IRS on a quarterly basis during 2014. The CAP

examination process is expected to be completed in 2015 prior to the filing of the Company’s 2014 federal

income tax return.

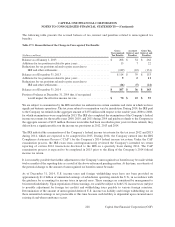

It is reasonably possible that further adjustments to the Company’s unrecognized tax benefits may be made within

twelve months of the reporting date as a result of the above-referenced pending matters. At this time, an estimate of

the potential change to the amount of unrecognized tax benefits cannot be made.

As of December 31, 2014, U.S. income taxes and foreign withholding taxes have not been provided on

approximately $1.4 billion of unremitted earnings of subsidiaries operating outside the U.S., in accordance with

the guidance for accounting for income taxes in special areas. These earnings are considered by management to

be invested indefinitely. Upon repatriation of these earnings, we could be subject to both U.S. income taxes (subject

to possible adjustment for foreign tax credits) and withholding taxes payable to various foreign countries.

Determination of the amount of unrecognized deferred U.S. income tax liability and foreign withholding tax on

these unremitted earnings is not practicable at this time because such liability is dependent upon circumstances

existing if and when remittance occurs.

228

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)