Capital One 2014 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.we include in other liabilities on our consolidated balance sheets, was $3 million and $4 million as of

December 31, 2014 and 2013, respectively. These financial guarantees had expiration dates ranging from 2014 to

2025 as of December 31, 2014. The amount of liability recognized on our balance sheets for Fannie Mae and other

loss sharing agreements was $36 million and $14 million as of December 31, 2014 and 2013, respectively. No

additional collateral or recourse provisions exist to reduce this exposure.

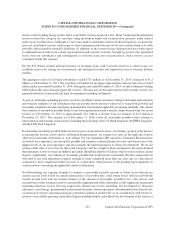

U.K. Cross Sell

In the U.K., we previously sold payment protection insurance (“PPI”) and other ancillary cross sell products. In

response to an elevated level of customer complaints across the industry, heightened media coverage and pressure

from consumer advocacy groups, the U.K. Financial Conduct Authority (“FCA”) investigated and raised concerns

about the way some companies have handled complaints related to the sale of these insurance policies. In connection

with this matter, we have established a reserve related to U.K. cross sell products, including PPI, which totaled $116

million and $169 million as of December 31, 2014 and 2013, respectively. An increased expectation of claims as a

result of the rate of decline in the volume of claims being lower than previously expected and an update to our

calculation used to determine PPI refunds resulted in a $61 million addition to the reserve in the year ended

December 31, 2014. The addition to the reserve during 2014 was more than offset by a combination of utilization

of the reserve through customer refund payments and foreign exchange movements.

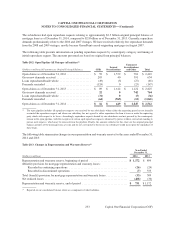

Mortgage Representation and Warranty Liabilities

We acquired three subsidiaries that originated residential mortgage loans and sold these loans to various purchasers,

including purchasers who created securitization trusts. These subsidiaries are Capital One Home Loans, LLC,

which was acquired in February 2005; GreenPoint, which was acquired in December 2006 as part of the North

Fork acquisition; and CCB, which was acquired in February 2009 and subsequently merged into CONA

(collectively, the “subsidiaries”).

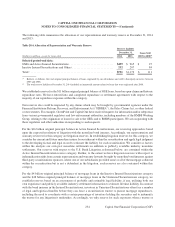

In connection with their sales of mortgage loans, the subsidiaries entered into agreements containing varying

representations and warranties about, among other things, the ownership of the loan, the validity of the lien

securing the loan, the loan’s compliance with any applicable loan criteria established by the purchaser, including

underwriting guidelines and the existence of mortgage insurance, and the loan’s compliance with applicable

federal, state and local laws. The representations and warranties do not address the credit performance of the

mortgage loans, but mortgage loan performance often influences whether a claim for breach of representation

and warranty will be asserted and has an effect on the amount of any loss in the event of a breach of a

representation or warranty.

Each of these subsidiaries may be required to repurchase mortgage loans in the event of certain breaches of these

representations and warranties. In the event of a repurchase, the subsidiary is typically required to pay the unpaid

principal balance of the loan together with interest and certain expenses (including, in certain cases, legal costs

incurred by the purchaser and/or others). The subsidiary then recovers the loan or, if the loan has been foreclosed,

the underlying collateral. The subsidiary is exposed to any losses on the repurchased loans after giving effect to any

recoveries on the collateral. In some instances, rather than repurchase the loans, a subsidiary may agree to make

cash payments to make an investor whole on losses or to settle repurchase claims, possibly including claims for

attorneys’ fees and interest. In addition, our subsidiaries may be required to indemnify certain purchasers and others

against losses they incur as a result of certain breaches of representations and warranties.

These subsidiaries, in total, originated and sold to non-affiliates approximately $111 billion original principal balance

of mortgage loans between 2005 and 2008, which are the years (or “vintages”) with respect to which our subsidiaries

have received the vast majority of the repurchase requests and other related claims.

251

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)