Capital One 2014 Annual Report Download - page 267

Download and view the complete annual report

Please find page 267 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

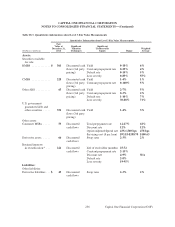

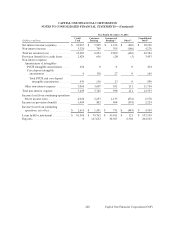

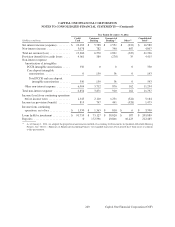

NOTE 19—BUSINESS SEGMENTS

Our principal operations are currently organized into three major business segments, which are defined based on

the products and services provided or the type of customer served: Credit Card, Consumer Banking and

Commercial Banking. The operations of acquired businesses have been integrated into our existing business

segments. Certain activities that are not part of a segment, such as management of our corporate investment

portfolio and asset/liability management by our centralized Corporate Treasury group, are included in the Other

category.

•Credit Card: Consists of our domestic consumer and small business card lending, and the international card

lending businesses in Canada and the United Kingdom.

•Consumer Banking: Consists of our branch-based lending and deposit gathering activities for consumers and

small businesses, national deposit gathering, national auto lending and consumer home loan lending and

servicing activities.

•Commercial Banking: Consists of our lending, deposit gathering and treasury management services to

commercial real estate and commercial and industrial customers. Our commercial and industrial customers

typically include companies with annual revenues between $10 million to $1 billion.

•Other category: Includes the residual impact of the allocation of our centralized Corporate Treasury group

activities, such as management of our corporate investment portfolio and asset/liability management, to our

business segments. Accordingly, net gains and losses on our investment securities portfolio and certain trading

activities are included in the Other category. Other category also includes foreign exchange-rate fluctuations

on foreign currency-denominated transactions; unallocated corporate expenses that do not directly support the

operations of the business segments or for which the business segments are not considered financially

accountable in evaluating their performance, such as acquisition and restructuring charges; certain provisions

for representation and warranty reserves related to continuing operations; certain material items that are non-

recurring in nature; and offsets related to certain line-item reclassifications.

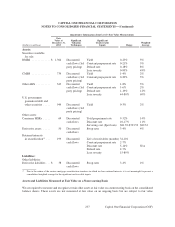

Basis of Presentation

We report the results of each of our business segments on a continuing operations basis. See “Note 2—Discontinued

Operations” for a discussion of discontinued operations. The results of our individual businesses reflect the manner

in which management evaluates performance and makes decisions about funding our operations and allocating

resources.

Business Segment Reporting Methodology

The results of our business segments are intended to reflect each segment as if it were a stand-alone business. Our

internal management and reporting process used to derive our segment results employs various allocation

methodologies, including funds transfer pricing, to assign certain balance sheet assets, deposits and other liabilities

and their related revenue and expenses directly or indirectly attributable to each business segment. Our funds transfer

pricing process provides a funds credit for sources of funds, such as deposits generated by our Consumer Banking

and Commercial Banking businesses, and a funds charge for the use of funds by each segment. Due to the integrated

nature of our business segments, estimates and judgments have been made in allocating certain revenue and expense

items. Transactions between segments are based on specific criteria or approximate third-party rates. We regularly

assess the assumptions, methodologies and reporting classifications used for segment reporting, which may result

in the implementation of refinements or changes in future periods.

245

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)