Capital One 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Approaches on January 1, 2015, during which it will calculate capital ratios under both the Basel III Standardized

Approach and the Basel III Advanced Approaches, though it will continue to use the Basel III Standardized Approach

for purposes of meeting regulatory capital requirements. By rule, the parallel run must last at least four consecutive

quarters. Therefore, the first quarter of 2016 is the earliest possible date on which the Company would use the Basel

III Advanced Approaches framework in calculating its regulatory capital and risk-weighted assets for purposes of

risk-based capital requirements. Consistent with the experience of other U.S. banks, it is possible that our parallel

run will last longer than the four quarter minimum. Under the Dodd-Frank Act and the Final Basel III Capital Rules,

organizations subject to Basel III Advanced Approaches may not hold less capital than would be required under the

Basel III Standardized Approach. Therefore, even after we exit parallel run, we will continue to calculate regulatory

capital and risk-weighted assets under the Basel III Standardized Approach.

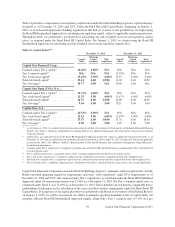

As of January 1, 2014, the new minimum risk-based and leverage capital requirements for Advanced Approaches

banking organizations include a common equity Tier 1 capital ratio of at least 4.0%, a Tier 1 risk-based capital ratio

of at least 5.5%, a total risk-based capital ratio of at least 8.0%, and a Tier 1 leverage capital ratio of at least 4.0%.

On January 1, 2015, the minimum risk-based capital ratio requirements increased to 4.5% for the common equity

Tier 1 capital ratio and to 6.0% for the Tier 1 risk-based capital ratio. The minimum requirements for the total risk-

based capital ratio and the Tier 1 leverage capital ratio did not change from 2014 to 2015.

The Final Basel III Capital Rules also introduced a new supplementary leverage ratio of 3.0% for all Advanced

Approaches banking organizations. On September 3, 2014 the Federal Banking Agencies issued a final rule that

revised the calculation of total leverage exposures and implemented the supplementary leverage ratio. The

supplementary leverage ratio compares Tier 1 capital to total leverage exposures, and includes all on-balance sheet

assets and many off-balance sheet assets, including derivatives and unused commitments. The new supplementary

leverage ratio becomes effective on January 1, 2018, however as an Advanced Approaches banking organization,

we are required to calculate and publicly disclose our supplementary leverage ratio beginning in the first quarter of

2015.

Insured depository institutions are also subject to PCA capital regulations. Under current PCA regulations, an

insured depository institution is considered to be well-capitalized if it maintains a Tier 1 risk-based capital ratio

of at least 6.0%, a total risk-based capital ratio of at least 10.0%, a Tier 1 leverage capital ratio of at least 5.0%,

and is not subject to any written agreement, order, capital directive, or PCA directive issued by its regulator.

While the Final Basel III Capital Rules increased some of the thresholds for the PCA capital categories and add

the new common equity Tier 1 capital ratio to the PCA regulations, those changes are not effective until

January 1, 2015. Beginning on January 1, 2015, the well-capitalized level for the Tier 1 risk-based capital ratio

will increase to 8.0%, and the well-capitalized level for the common equity Tier 1 capital ratio will be established

at 6.5%. The well-capitalized levels for the total risk-based capital ratio and the Tier 1 leverage capital ratio

will not change.

Prior to 2014, we also disclosed a Tier 1 common capital ratio for our bank holding company, which is a regulatory

capital measure widely used by investors, analysts, rating agencies and bank regulatory agencies to assess the capital

position of financial services companies. There was no mandated minimum or well-capitalized standard for the Tier

1 common capital ratio.

We disclose a non-GAAP TCE ratio in “Part II—Item 6. Summary of Selected Financial Data.” While the TCE ratio

is a capital measure widely used by investors, analysts, rating agencies, and bank regulatory agencies to assess the

capital position of financial services companies, it may not be comparable to similarly titled measures reported by

other companies. We provide information on the calculation of this ratio in “MD&A—Table F—Reconciliation of

Non-GAAP Measures and Calculation of Regulatory Capital Measures.”

78 Capital One Financial Corporation (COF)