Capital One 2014 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.151

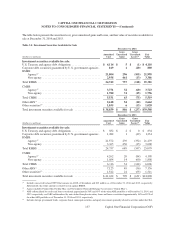

and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when

the differences are expected to reverse. We record valuation allowances to reduce deferred tax assets to the amount

that is more likely than not to be realized. See “Note 17—Income Taxes” for additional detail.

Earnings Per Share

We have unvested share-based payment awards which have a right to receive nonforfeitable dividends. These share-

based payment awards are deemed to be participating securities. As a result, earnings per share is reported under

the “two-class” method. The “two-class” method is an earnings allocation method under which earnings per share

is calculated for each class of common stock and participating security considering both dividends declared (or

accumulated) and participation rights in undistributed earnings as if all such earnings had been distributed during

the period.

Earnings per common share is calculated by dividing net income, after deducting dividends on preferred stock and

undistributed earnings allocated to participating securities, by the average number of common shares outstanding

during the period, net of any treasury shares. We calculate diluted earnings per share by dividing net income, after

deducting dividends on preferred stock and undistributed earnings allocated to participating securities, by the average

number of common shares outstanding during the period, net of any treasury shares, after consideration of the

potential dilutive effect of common stock equivalents (for example, warrants, stock options, restricted stock awards

and units and performance share awards and units). Common stock equivalents are calculated based upon the treasury

stock method using an average market price of common shares sold during the period. Dilution is not considered

when the company is in a net loss position. Common stock equivalents that have an antidilutive effect are excluded

from the computation of diluted earnings per share.

Derivative Instruments and Hedging Activities

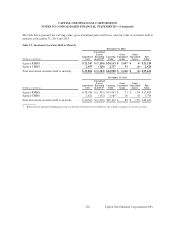

All derivative financial instruments, whether designated for hedge accounting or not, are reported at their fair value

on our consolidated balance sheets as either assets or liabilities. We report derivatives in a gain position, or derivative

assets, on our consolidated balance sheets as a component of other assets. We report derivatives in a loss position,

or derivative liabilities, on our consolidated balance sheets as a component of other liabilities. We report derivative

asset and liability amounts on a gross basis based on individual contracts, which does not take into consideration the

effects of master counterparty netting agreements or collateral netting. See “Note 10—Derivative Instruments and

Hedging Activities” for additional detail on the accounting for derivative instruments, including those designated as

qualifying for hedge accounting.

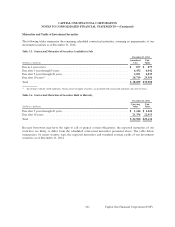

Fair Value

Fair value is defined as the price that would be received for an asset or paid to transfer a liability in an orderly transaction

between market participants on the measurement date (also referred to as an exit price). The fair value accounting

guidance provides a three-level fair value hierarchy for classifying financial instruments. This hierarchy is based on

whether the inputs to the valuation techniques used to measure fair value are observable or unobservable. Fair value

measurement of a financial asset or liability is assigned to a level based on the lowest level of any input that is significant

to the fair value measurement in its entirety. The three levels of the fair value hierarchy are described below:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: Observable market-based inputs, other than quoted prices in active markets for identical assets or

liabilities

Level 3: Unobservable inputs

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)