Capital One 2014 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

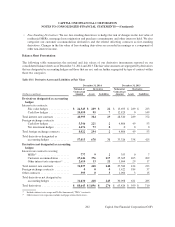

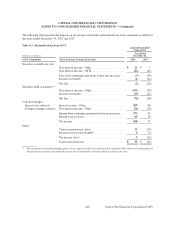

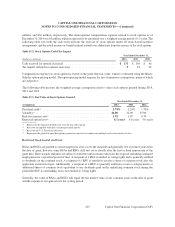

NOTE 13—EARNINGS PER COMMON SHARE

The following table sets forth the computation of basic and diluted earnings per common share:

Table 13.1: Computation of Basic and Diluted Earnings per Common Share

Year Ended December 31,

(Dollars and shares in millions, except per share data) 2014 2013 2012

Basic earnings

Income from continuing operations, net of tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,423 $4,354 $3,709

Income (loss) from discontinued operations, net of tax . . . . . . . . . . . . . . . . . . . . . 5(233) (217)

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,428 4,121 3,492

Dividends and undistributed earnings allocated to participating securities(1) . . . . . (18) (17) (15)

Preferred stock dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (67) (53) (15)

Net income available to common stockholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,343 $4,051 $3,462

Net income from continuing operations per share . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7.70 $ 7.39 $ 6.56

Income (loss) from discontinued operations per share . . . . . . . . . . . . . . . . . . . . . . 0.01 (0.40) (0.39)

Net income per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7.71 $ 6.99 $ 6.17

Total weighted-average basic shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . 563.1 579.7 561.1

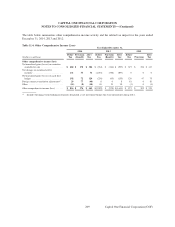

Diluted earnings(2)

Net income available to common stockholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,343 $4,051 $3,462

Net income from continuing operations per share . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7.58 $ 7.28 $ 6.49

Income (loss) from discontinued operations per share . . . . . . . . . . . . . . . . . . . . . . 0.01 (0.39) (0.38)

Net income per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7.59 $ 6.89 $ 6.11

Total weighted-average basic shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . 563.1 579.7 561.1

Effect of dilutive securities:

Stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.7 2.2 1.5

Other contingently issuable shares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.6 1.5 1.1

Warrants(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.5 4.2 2.8

Total effect of dilutive securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.8 7.9 5.4

Total weighted-average diluted shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . 571.9 587.6 566.5

(1) Includes undistributed earnings allocated to participating securities using the two-class method under the accounting guidance for computing

earnings per share.

(2) Excluded from the computation of diluted earnings per share were 2.9 million shares related to options with exercise prices ranging from

$70.96 to $88.81, and 5.2 million shares related to options with exercise prices ranging from $56.28 to $88.81 for the years ended

December 31, 2014 and 2013, respectively, because their inclusion would be anti-dilutive. For the year ended December 31, 2012, 6.9

million shares related to options and other contingently issuable shares were excluded from the computation of diluted earnings per share

because their inclusion would be anti-dilutive; the options had exercise prices ranging from $45.75 to $89.10.

(3) Represents warrants issued as part of the U.S. Department of Treasury’s Troubled Assets Relief Program (“TARP”). As of December 31,

2014, there were 6.4 million warrants to purchase common stock outstanding, which represents approximately half of the warrants issued

in the initial offering.

212

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)