Capital One 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

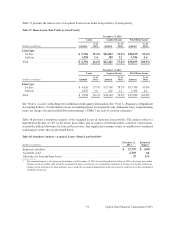

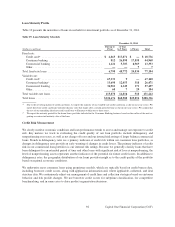

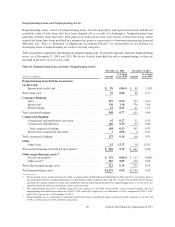

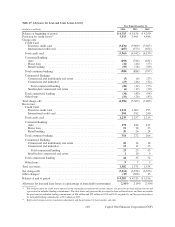

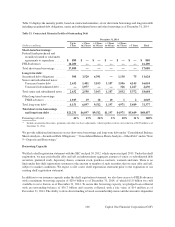

Nonperforming Loans and Nonperforming Assets

Nonperforming assets consist of nonperforming loans, foreclosed property and repossessed assets and the net

realizable value of auto loans that have been charged-off as a result of a bankruptcy. Nonperforming loans

generally include loans that have been placed on nonaccrual status and certain restructured loans whose

contractual terms have been modified in a manner that grants a concession to a borrower experiencing financial

difficulty. See “Note 1—Summary of Significant Accounting Policies” for information on our policies for

classifying loans as nonperforming for each of our loan categories.

Table 24 presents comparative information on nonperforming loans, by portfolio segment, and other nonperforming

assets, as of December 31, 2014 and 2013. We do not classify loans held for sale as nonperforming, as they are

recorded at the lower of cost or fair value.

Table 24: Nonperforming Loans and Other Nonperforming Assets(1)

December 31, 2014 December 31, 2013

% of Total % of Total

(Dollars in millions) Amount Loans HFI Amount Loans HFI

Nonperforming loans held for investment:

Credit Card:

International credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 70 0.86% $ 88 1.10%

Total credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70 0.08 88 0.11

Consumer Banking:

Auto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 197 0.52 194 0.61

Home loan(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 330 1.10 376 1.06

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 0.61 41 1.13

Total consumer banking(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 549 0.77 611 0.86

Commercial Banking:

Commercial and multifamily real estate . . . . . . . . . . . . . . . . . . 62 0.27 52 0.25

Commercial and industrial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106 0.39 93 0.40

Total commercial lending . . . . . . . . . . . . . . . . . . . . . . . . . . . . 168 0.33 145 0.33

Small-ticket commercial real estate . . . . . . . . . . . . . . . . . . . . . . 7 0.96 4 0.41

Total commercial banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 175 0.34 149 0.33

Other:

Other loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 13.37 19 15.83

Total nonperforming loans held for investment(2)(3) . . . . . . . . . . . . . . $ 809 0.39 $ 867 0.44

Other nonperforming assets:(4)

Foreclosed property(5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 139 0.06% $ 113 0.06%

Other assets(6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 183 0.09 160 0.08

Total other nonperforming assets . . . . . . . . . . . . . . . . . . . . . . . . . . . 322 0.15 273 0.14

Total nonperforming assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,131 0.54 $1,140 0.58

(1) We recognized interest income for loans classified as nonperforming of $38 million and $40 million in 2014 and 2013, respectively. Interest

income forgone related to nonperforming loans was $49 million and $55 million in 2014 and 2013, respectively. Forgone interest income

represents the amount of interest income that would have been recorded during the period for nonperforming loans as of the end of the

period had the loans performed according to their contractual terms.

(2) The nonperforming loan ratio, excluding Acquired Loans’ impact for our home loan portfolio, total consumer banking, and total

nonperforming loans held for investment was 4.86%, 1.14%, and 0.44%, respectively, as of December 31, 2014, compared to 5.29%, 1.44%,

and 0.51%, respectively, as of December 31, 2013.

(3) Nonperforming loans as a percentage of total loans held for investment, excluding the impact of domestic credit card loans, was 0.62% and

0.70% as of December 31, 2014 and 2013, respectively.

96 Capital One Financial Corporation (COF)