Capital One 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

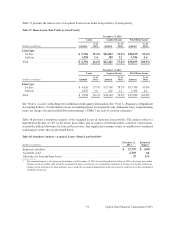

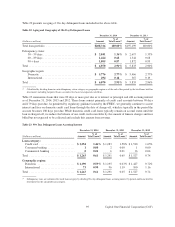

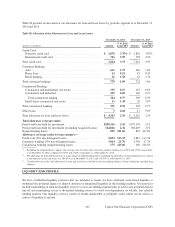

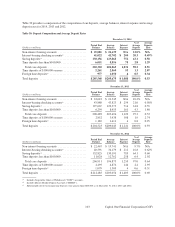

Table 28 presents an allocation of our allowance for loan and lease losses by portfolio segment as of December 31,

2014 and 2013.

Table 28: Allocation of the Allowance for Loan and Lease Losses

December 31, 2014 December 31, 2013

% of Total % of Total

(Dollars in millions) Amount Loans HFI Amount Loans HFI

Credit Card:

Domestic credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,878 3.70% $ 2,836 3.87%

International credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 326 3.99 378 4.70

Total credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,204 3.73 3,214 3.95

Consumer Banking:

Auto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 661 1.75 606 1.90

Home loan(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62 0.21 83 0.24

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56 1.58 63 1.74

Total consumer banking(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 779 1.09 752 1.06

Commercial Banking:

Commercial and multifamily real estate . . . . . . . . . . . . . . . . . . . . . 155 0.67 143 0.69

Commercial and industrial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 229 0.85 166 0.71

Total commercial lending . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 384 0.77 309 0.70

Small-ticket commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . 11 1.43 29 3.05

Total commercial banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 395 0.78 338 0.75

Other loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 4.68 11 9.09

Total allowance for loan and lease losses . . . . . . . . . . . . . . . . . . . . . . $ 4,383 2.10 $ 4,315 2.19

Total allowance coverage ratios:

Period-end loans held for investment . . . . . . . . . . . . . . . . . . . . . . . . . $208,316 2.10 $197,199 2.19

Period-end loans held for investment (excluding Acquired Loans) . . 184,816 2.36 168,649 2.54

Nonperforming loans(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 809 541.86 867 497.69

Allowance coverage ratios by loan category:(3)

Credit card (30+ day delinquent loans) . . . . . . . . . . . . . . . . . . . . . . . . 2,832 113.13 2,881 111.56

Consumer banking (30+ day delinquent loans) . . . . . . . . . . . . . . . . . 3,024 25.76 2,750 27.35

Commercial banking (nonperforming loans) . . . . . . . . . . . . . . . . . . . 175 225.86 149 226.85

(1) Excluding the Acquired Loans’ impact, the coverage ratio for home loans and total consumer banking was 0.52% and 1.56%, respectively,

as of December 31, 2014, compared to 0.64% and 1.68%, respectively, as of December 31, 2013.

(2) The allowance for loan and lease losses as a percentage of nonperforming loans, excluding the allowance for loan and lease losses related

to our domestic credit card loans, was 186.07% as of December 31, 2014, and 170.59% as of December 31, 2013.

(3) Calculated based on the total allowance for loan and lease losses divided by the outstanding balance of loans within the specified loan

category.

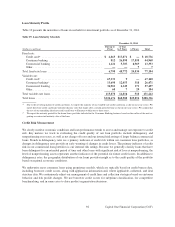

LIQUIDITY RISK PROFILE

We have established liquidity practices that are intended to ensure we have sufficient asset-based liquidity to

withstand the potential impact of deposit attrition or diminished liquidity in the funding markets. Our practices

include maintaining an adequate liquidity reserve to cover our funding requirements as well as any potential deposit

run-off and maintaining access to diversified funding sources to avoid over-dependence on volatile, less reliable

funding markets. Our liquidity reserves consist of readily-marketable or pledgable assets which can be used as a

source of liquidity, if needed.

101 Capital One Financial Corporation (COF)