Capital One 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Commercial Banking: Consists of our lending, deposit gathering and treasury management services to

commercial real estate and commercial and industrial customers. Our commercial and industrial customers

typically include companies with annual revenues between $10 million to $1 billion.

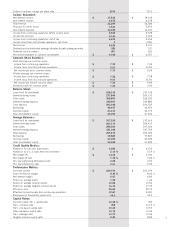

Customer usage and payment patterns, credit quality, levels of marketing expense and operating efficiency all affect

our profitability. In our Credit Card business, we experience fluctuations in purchase volumes and the level of

outstanding loan receivables due to higher seasonal consumer spending and payment patterns around the winter

holiday season, summer vacations and back-to-school periods. No individual quarter in 2014, 2013 or 2012

accounted for more than 30% of our total revenues in any of these fiscal years. Delinquency rates in our Credit Card

and Consumer Banking businesses also have historically exhibited seasonal patterns, with delinquency rates generally

tending to decrease in the first two quarters of the year as customers use income tax refunds to pay down outstanding

loan balances.

For additional information on our business segments, including the financial performance of each business, see “Part

II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”)—

Executive Summary and Business Outlook,” “MD&A—Business Segment Financial Performance” and “Note

19—Business Segments” of this Report.

SUPERVISION AND REGULATION

General

Capital One Financial Corporation is a bank holding company (“BHC”) under Section 3 of the Bank Holding

Company Act of 1956, as amended (12 U.S.C. § 1842) (the “BHC Act”) and is subject to the requirements of the

BHC Act, including its required approvals for investments in or acquisitions of banking organizations, capital

adequacy standards and limitations on our nonbanking activities. We are also subject to supervision, examination

and regulation by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). Permissible

activities for a BHC include those activities that are so closely related to banking as to be a proper incident

thereto, such as consumer lending and other activities that have been approved by the Federal Reserve by

regulation or order. Certain servicing activities are also permissible for a BHC if conducted for or on behalf of the

BHC or any of its affiliates. Impermissible activities for BHCs include activities that are related to commerce such

as retail sales of nonfinancial products. Under the Dodd-Frank Wall Street Reform and Consumer Protection Act

(the “Dodd-Frank Act”), Federal Reserve regulation, and Federal Reserve policy, we are expected to act as a source

of financial and managerial strength to any banks that we control, including the Banks, and to commit resources to

support them.

On May 27, 2005, we became a “financial holding company” under the Gramm-Leach-Bliley Act amendments

to the BHC Act (the “GLBA”). The GLBA removed many of the restrictions on the activities of BHCs that become

financial holding companies. A financial holding company, and the nonbank companies under its control, are

permitted to engage in activities considered financial in nature (including, for example, insurance underwriting,

agency sales and brokerage, securities underwriting and dealing and merchant banking activities), incidental to

financial activities and, if the Federal Reserve determines that they pose no risk to the safety or soundness of

depository institutions or the financial system in general, activities complementary to financial activities.

Our election to become a financial holding company under the GLBA certifies that the depository institutions we

control meet certain criteria, including capital, management and Community Reinvestment Act (“CRA”)

requirements. Effective July 21, 2011, under amendments to the BHC Act enacted under the Dodd-Frank Act, Capital

One Financial Corporation also must be “well capitalized” and “well managed.” The failure to meet the criteria for

financial holding company status could, depending on which requirements were not met, result in the Company

facing restrictions on new financial activities or acquisitions or being required to discontinue existing activities that

are not generally permissible for bank holding companies.

3Capital One Financial Corporation (COF)