Capital One 2014 Annual Report Download - page 253

Download and view the complete annual report

Please find page 253 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to those from other sources and reviewing other control documentation. Additionally, when necessary, the CVG and

TAV challenge prices from third-party vendors to ensure reasonableness of prices through a pricing challenge process.

This may include a request for transparency of the assumptions used by the third party.

The FVC, which includes representation from our Risk Management and Finance divisions, is a forum for discussing

fair market valuations, inputs, assumptions, methodologies, variance thresholds, valuation control environments and

material risks or concerns related to fair market valuations. Additionally, the FVC is empowered to resolve valuation

disputes between the primary valuation providers and the CVG, and provides guidance and oversight to ensure an

appropriate valuation control environment. The FVC regularly reviews and approves our valuation methodologies to

ensure that our methodologies and practices are consistent with industry standards and adhere to regulatory and

accounting guidance. The Chief Financial Officer determines when material issues or concerns regarding valuations

shall be raised to the Audit Committee or another delegated committee of the Board of Directors.

We have a model policy, established by an independent Model Risk Office, which governs the validation of models

and related supporting documentation to ensure the appropriate use of models for pricing. The MVG is part of the

Model Risk Office and validates all models and provides ongoing monitoring of their performance, including the

validation and monitoring of the performance of all valuation models.

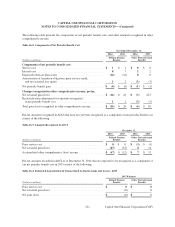

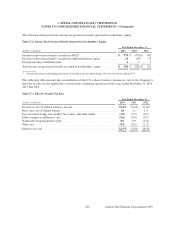

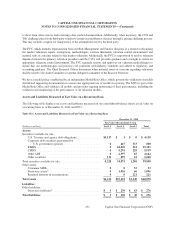

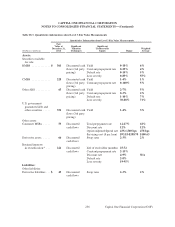

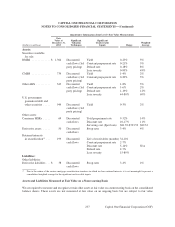

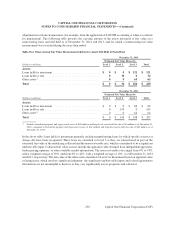

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following table displays our assets and liabilities measured on our consolidated balance sheets at fair value on

a recurring basis as of December 31, 2014 and 2013:

Table 18.1: Assets and Liabilities Measured at Fair Value on a Recurring Basis

December 31, 2014

Fair Value Measurements Using

(Dollars in millions) Level 1 Level 2 Level 3 Total

Assets:

Securities available for sale:

U.S. Treasury and agency debt obligations . . . . . . . . . . . . . . . . . $4,117 $ 1 $ 0 $ 4,118

Corporate debt securities guaranteed by

U.S. government agencies . . . . . . . . . . . . . . . . . . . . . . . . . . 0 467 333 800

RMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 24,820 561 25,381

CMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 5,291 228 5,519

Other ABS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 2,597 65 2,662

Other securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111 899 18 1,028

Total securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,228 34,075 1,205 39,508

Other assets:

Consumer MSRs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 0 53 53

Derivative assets(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 1,026 66 1,096

Retained interests in securitizations . . . . . . . . . . . . . . . . . . . . . . 0 0 221 221

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,232 $35,101 $1,545 $40,878

Liabilities:

Other liabilities:

Derivative liabilities(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3 $ 230 $ 43 $ 276

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3 $ 230 $ 43 $ 276

231

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)