Capital One 2014 Annual Report Download - page 288

Download and view the complete annual report

Please find page 288 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

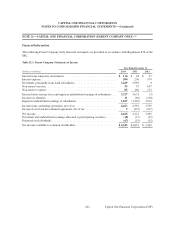

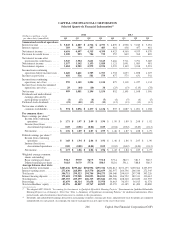

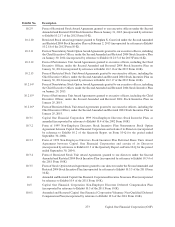

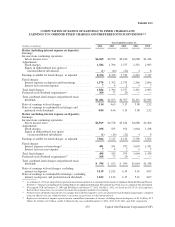

2014 2013

(Dollars in millions, except

per share data) (unaudited) Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

Summarized results of operations:

Interest income . . . . . . . . . . . . . . . $ 5,045 $ 4,887 $ 4,712 $ 4,753 $ 4,839 $ 4,998 $ 5,010 $ 5,051

Interest expense . . . . . . . . . . . . . . . 389 390 397 403 416 438 457 481

Net interest income . . . . . . . . . . . . 4,656 4,497 4,315 4,350 4,423 4,560 4,553 4,570

Provision for credit losses . . . . . . . 1,109 993 704 735 957 849 762 885

Net interest income after

provision for credit losses . . . . . 3,547 3,504 3,611 3,615 3,466 3,711 3,791 3,685

Non-interest income . . . . . . . . . . . 1,157 1,142 1,153 1,020 1,121 1,091 1,085 981

Non-interest expense . . . . . . . . . . . 3,284 2,985 2,979 2,932 3,235 3,109 3,018 2,991

Income from continuing

operations before income taxes . 1,420 1,661 1,785 1,703 1,352 1,693 1,858 1,675

Income tax provision . . . . . . . . . . . 450 536 581 579 477 575 631 541

Income from continuing

operations, net of tax . . . . . . . . . 970 1,125 1,204 1,124 875 1,118 1,227 1,134

Income (loss) from discontinued

operations, net of tax . . . . . . . . . 29 (44) (10) 30 (23) (13) (119) (78)

Net income . . . . . . . . . . . . . . . . . . . 999 1,081 1,194 1,154 852 1,105 1,108 1,056

Dividends and undistributed

earnings allocated to

participating securities(2) . . . . . . (4) (5) (4) (5) (4) (5) (4) (5)

Preferred stock dividends . . . . . . . (21) (20) (13) (13) (13) (13) (13) (13)

Net income available to

common stockholders . . . . . . . . $ 974 $ 1,056 $ 1,177 $ 1,136 $ 835 $ 1,087 $ 1,091 $ 1,038

Per common share:

Basic earnings per share:(2)

Income from continuing

operations . . . . . . . . . . . . . . . . $ 1.71 $ 1.97 $ 2.09 $ 1.94 $ 1.50 $ 1.89 $ 2.08 $ 1.92

Income (loss) from

discontinued operations . . . . . 0.05 (0.08) (0.02) 0.05 (0.04) (0.02) (0.20) (0.13)

Net income . . . . . . . . . . . . . . . . . $ 1.76 $ 1.89 $ 2.07 $ 1.99 $ 1.46 $ 1.87 $ 1.88 $ 1.79

Diluted earnings per share:(2)

Income from continuing

operations . . . . . . . . . . . . . . . . . $ 1.68 $ 1.94 $ 2.06 $ 1.91 $ 1.46 $ 1.86 $ 2.05 $ 1.90

Income (loss) from

discontinued operations . . . . . 0.05 (0.08) (0.02) 0.05 (0.03) (0.02) (0.20) (0.13)

Net income . . . . . . . . . . . . . . . . . $ 1.73 $ 1.86 $ 2.04 $ 1.96 $ 1.43 $ 1.84 $ 1.85 $ 1.77

Weighted average common

shares outstanding:

Basic earnings per share . . . . . . 554.3 559.9 567.5 571.0 573.4 582.3 581.5 580.5

Diluted earnings per share . . . . . 561.8 567.9 577.6 580.3 582.6 591.1 588.8 586.3

Average balance sheet data:

Loans held for investment . . . . . . . $203,436 $199,422 $194,996 $193,722 $192,813 $191,135 $190,562 $195,997

Interest-earning assets . . . . . . . . . . 273,436 268,890 263,570 262,659 262,957 264,796 266,544 272,345

Total assets . . . . . . . . . . . . . . . . . . . 304,711 299,523 294,744 294,275 294,040 294,919 297,748 303,226

Interest-bearing deposits . . . . . . . . 179,401 179,928 182,053 184,183 184,206 186,752 189,311 190,612

Total deposits . . . . . . . . . . . . . . . . . 205,355 205,199 206,315 205,842 205,706 208,340 210,650 211,555

Borrowings . . . . . . . . . . . . . . . . . . 43,479 40,314 35,658 35,978 36,463 36,355 36,915 41,574

Total stockholders’ equity . . . . . . . 45,576 44,827 43,767 42,859 42,355 41,185 41,490 40,880

(1) We adopted ASU 2014-01 “Accounting for Investments in Qualified Affordable Housing Projects” (Investments in Qualified Affordable

Housing Projects) as of January 1, 2014. See “Note 1—Summary of Significant Accounting Policies” for additional information. Prior

period results and related metrics have been recast to conform to this presentation.

(2) Dividends and undistributed earnings allocated to participating securities, earnings per share, and preferred stock dividends are computed

independently for each period. Accordingly, the sum of each quarter may not agree to the year-to-date total.

266

CAPITAL ONE FINANCIAL CORPORATION

Selected Quarterly Financial Information(1)

Capital One Financial Corporation (COF)