Capital One 2014 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

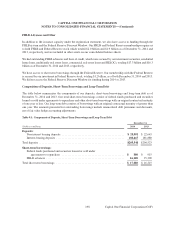

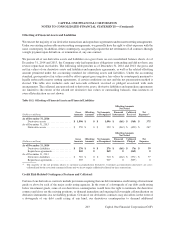

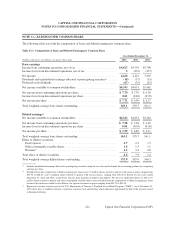

Offsetting of Financial Assets and Liabilities

We execute the majority of our derivative transactions and repurchase agreements under master netting arrangements.

Under our existing enforceable master netting arrangements, we generally have the right to offset exposure with the

same counterparty. In addition, either counterparty can generally request the net settlement of all contracts through

a single payment upon default on, or termination of, any one contract.

We present all of our derivative assets and liabilities on a gross basis on our consolidated balance sheets. As of

December 31, 2014 and 2013, the Company only had repurchase obligations outstanding and did not have any

reverse repurchase receivables. The following table presents as of December 31, 2014 and 2013, the gross and

net fair values of our derivative assets and liabilities and repurchase agreements, as well as the related offsetting

amount permitted under the accounting standard for offsetting assets and liabilities. Under the accounting

standard, gross positive fair values could be offset against gross negative fair values by counterparty pursuant to

legally enforceable master netting agreements, if certain conditions are met and the net presentation method is

elected. The table also includes cash and non-cash collateral received or pledged associated with such

arrangements. The collateral amounts related to derivative assets, derivative liabilities and repurchase agreements

are limited to the extent of the related net derivative fair values or outstanding balances, thus instances of

overcollateralization are not shown.

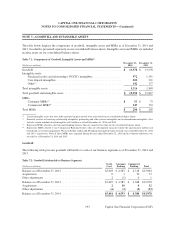

Table 10.2: Offsetting of Financial Assets and Financial Liabilities

Offsetting Amounts

Not Netted

Gross Offsetting Net Amounts Financial Collateral Net

(Dollars in millions) Amounts Amounts as Recognized Instruments Received Exposure(1)

As of December 31, 2014

Derivatives assets . . . . . . . . . . . . . . . . . . . $ 1,096 $ 0 $ 1,096 $ (161) $ (560) $ 375

As of December 31, 2013

Derivatives assets . . . . . . . . . . . . . . . . . . . $ 959 $ 0 $ 959 $ (262) $ (450) $ 247

Offsetting Amounts

Not Netted

Gross Offsetting Net Amounts Financial Collateral Net

(Dollars in millions) Amounts Amounts as Recognized Instruments Pledged Exposure

As of December 31, 2014

Derivatives liabilities . . . . . . . . . . . . . . . . $ 276 $ 0 $ 276 $ (161) $ (76) $ 39

Repurchase agreements . . . . . . . . . . . . . . 869 0 869 0 (869) 0

As of December 31, 2013

Derivatives liabilities . . . . . . . . . . . . . . . . $ 710 $ 0 $ 710 $ (262) $ (371) $ 77

Repurchase agreements . . . . . . . . . . . . . . 907 0 907 0 (907) 0

(1) The majority of the net position relates to customer-accommodation derivatives. Customer-accommodation derivatives are cross-

collateralized by the associated commercial loans and we do not require additional collateral on these transactions.

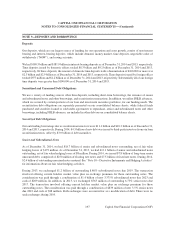

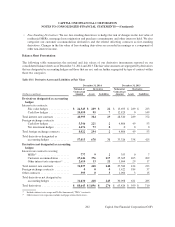

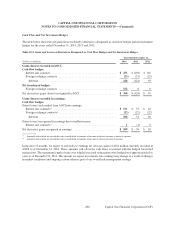

Credit Risk-Related Contingency Features and Collateral

Certain of our derivatives contracts include provisions requiring that our debt maintain a credit rating of investment

grade or above by each of the major credit rating agencies. In the event of a downgrade of our debt credit rating

below investment grade, some of our derivatives counterparties would have the right to terminate the derivative

contract and close out the existing positions, or demand immediate and ongoing full overnight collateralization on

derivative instruments in a net liability position. Certain of our derivatives contracts may also allow, in the event of

a downgrade of our debt credit rating of any kind, our derivatives counterparties to demand additional

203

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)