Capital One 2014 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.153

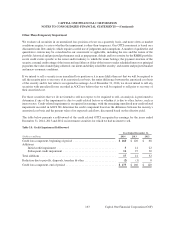

Obligations Resulting from Joint and Several Liability Arrangements

In February 2013, the FASB issued guidance for the recognition, measurement, and disclosure of obligations

resulting from joint and several liability arrangements for which the total amount of the obligation, within the scope

of this guidance, is fixed at the reporting date, except for obligations addressed within existing guidance in U.S.

GAAP. The guidance clarified that an entity shall measure the obligations as the sum of the amount the reporting

entity agreed to pay on the basis of its arrangement among its co-obligors and any additional amount the reporting

entity expects to pay on behalf of its co-obligors. The guidance also requires an entity to disclose the nature and

amounts of the obligations as well as other information about those obligations. The guidance is effective for annual

and interim periods beginning after December 15, 2013. The adoption of this guidance in the first quarter of 2014

did not have a significant impact on our financial condition, results of operations or liquidity as the guidance is

consistent with our current practice.

Recently Issued but Not Yet Adopted Accounting Standards

Consolidation: Amendments to the Consolidation Analysis

In February 2015, the FASB issued revised guidance intended to improve upon and simplify the consolidation

assessment required to evaluate whether organizations should consolidate certain legal entities such as limited

partnerships, limited liability corporations, and securitization structures. The guidance also removed the indefinite

deferral of specialized guidance for certain investment funds. This guidance is effective for annual and interim

periods beginning after December 15, 2015, with early adoption permitted. Entities can elect to adopt the guidance

either on a full or modified retrospective basis. We are currently evaluating the guidance to determine whether our

consolidation conclusions will change for certain legal entities. Accordingly, we cannot yet determine the impact

our adoption of this guidance will have in the first quarter of 2016.

Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could

Be Achieved after the Requisite Service Period

In June 2014, the FASB issued guidance clarifying that a performance target contained within a share-based payment

award that affects vesting and can be achieved after the requisite service period has been completed is to be

accounted for as a performance condition. Accordingly, the grantor of such awards should recognize compensation

cost in the period in which it becomes probable that the performance target will be achieved. The amount of the

compensation cost recognized should represent the cost attributable to the requisite service period fulfilled. The

guidance is effective for annual and interim periods beginning after December 15, 2015, with early adoption

permitted. Entities may elect to adopt the guidance on either a prospective or modified retrospective basis. We do

not expect our adoption of this guidance in the first quarter of 2015 to have a significant impact on our financial

condition, results of operations or liquidity as the guidance is consistent with our current practice.

Accounting for Repurchase Transactions

In June 2014, the FASB issued guidance that requires repurchase-to-maturity transactions to be accounted for as

secured borrowings rather than sales. New disclosures will also be required for certain transactions accounted for

as secured borrowings and transfers accounted for as sales when the transferor retains substantially all of the exposure

to the economic return on the transferred financial assets. We do not expect our adoption of the accounting guidance

in the first quarter of 2015 to have a significant impact on our financial condition, results of operations or liquidity

as the guidance is consistent with our current practice. The new disclosures will be provided beginning in the second

quarter of 2015.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital One Financial Corporation (COF)