Capital One 2014 Annual Report Download - page 103

Download and view the complete annual report

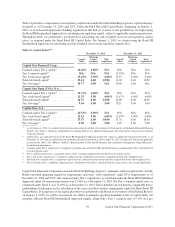

Please find page 103 of the 2014 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under the Final Basel III Capital Rules, when we complete our parallel run for the Advanced Approaches, our

minimum risk-based capital requirement will be the greater requirement of the Basel III Standardized Approach

and the Basel III Advanced Approaches. See “Part 1—Item 1—Supervision and Regulation—Basel III and U.S.

Capital Rules” for additional information. Based on our business mix, we anticipate that we will need to hold more

regulatory capital under the Basel III Advanced Approaches than under the Basel III Standardized Approach to meet

our minimum required regulatory capital ratios.

Capital Planning and Regulatory Stress Testing

In November 2011, the Federal Reserve finalized capital planning rules applicable to large bank holding companies

like us. Under these rules, bank holding companies with consolidated assets of $50 billion or more must submit a

capital plan to the Federal Reserve on an annual basis that contains a description of all planned capital actions,

including dividends or stock repurchases, over a nine-quarter planning horizon beginning with the fourth quarter of

the calendar year prior to the submission of the capital plan (“CCAR cycle”). The bank holding company may take

the capital actions in its capital plan if the Federal Reserve provides a non-objection to the plan. For the 2014 CCAR

cycle, the Federal Reserve’s objection or non-objection applies specifically to capital actions during the four quarters

beginning with the second quarter of 2014 in the planning horizon (“approval window”). On October 17, 2014, the

Federal Reserve issued a final rule to modify the regulations for capital planning and stress testing. The final rule

changes the annual capital plan and stress test cycle start date from October 1 to January 1, effective for the cycle

beginning January 1, 2016. To allow for a transition to the change in timing, the Federal Reserve’s objection or non-

objection applies to the capital actions spanning the five quarters starting with the second quarter of 2015 for the

2015 CCAR cycle. Subsequent submissions each would cover a four-quarter period. For additional information on

the Final Rule, see “Part 1—Item 1. Business—Supervision and Regulation.”

After the Federal Reserve’s non-objection to our 2014 capital plan, we maintained our quarterly dividend of $0.30

per share for all four quarters in 2014. In addition, our Board of Directors authorized the repurchase of up to $2.5

billion of shares of common stock through the end of the first quarter of 2015. During 2014, we repurchased

approximately $2.0 billion of common stock and expect to complete the 2014 Stock Repurchase Program by the

end of the first quarter of 2015. We expect to complete this repurchase program by the end of the first quarter of

2015. On January 5, 2015 we submitted our capital plan to the Board of Directors of the Federal Reserve as part of

the 2015 CCAR cycle.

Equity Offerings and Transactions

On June 12, 2014, the Company issued and sold 20 million depositary shares (“Depositary Shares”), each

representing a 1/40th interest in a share of 6.25% fixed-rate non-cumulative perpetual preferred stock, Series C,

$0.01 par value, with a liquidation preference of $25 per Depositary Share (equivalent to $1,000 per share of Series

C Preferred Stock) (the “Series C Preferred Stock”). The net proceeds of the offering of Series C Preferred Stock

were approximately $484 million, after deducting underwriting commissions and offering expenses.

On October 31, 2014, the Company issued and sold 20 million Depositary Shares, each representing a 1/40th interest

in a share of 6.70% fixed-rate non-cumulative perpetual preferred stock, Series D, $0.01 par value, with a liquidation

preference of $25 per Depositary Share (equivalent to $1,000 per share of Series D Preferred Stock) (the “Series D

Preferred Stock”). The net proceeds of the offering of Series D Preferred Stock were approximately $485 million,

after deducting underwriting commissions and offering expenses.

Under the terms of the Series C Preferred Stock and Series D Preferred Stock, the ability of the Company to pay

dividends on, make distributions with respect to, or to repurchase, redeem or acquire its common stock or any

preferred stock ranking on parity with or junior to the preferred stock, is subject to restrictions in the event that the

Company does not declare and either pay or set aside a sum sufficient for payment of dividends on the related series

of preferred stock for the immediately preceding dividend period.

81 Capital One Financial Corporation (COF)