Sallie Mae 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

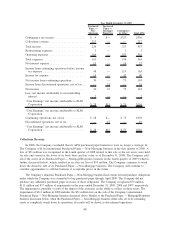

Net loss attributable to SLM Corporation from discontinued operations was $157 million and $140 million

for the years ended December 31, 2009 and 2008, respectively, compared to net income of $15 million for the

year ended December 31, 2007. The Company sold all of the assets in its Purchased Paper — Mortgage/

Properties business in the fourth quarter of 2009 for $280 million. Because of the sale, the Purchased Paper —

Mortgage/Properties business is required to be presented separately as discontinued operations for all periods

presented. This sale of assets in the fourth quarter of 2009 resulted in an after-tax loss of $95 million. Total

after-tax impairments, including the loss on sale, for the years ended December 31, 2009, 2008 and 2007 were

$154 million, $161 million and $2 million, respectively.

Contingency Fee Income

Contingency fee income decreased $44 million from $340 million for the year ended December 31, 2008

to $296 million for the year ended December 31, 2009. This decrease was primarily a result of significantly

less guarantor collections revenue associated with rehabilitating delinquent FFELP loans. Loans are considered

rehabilitated after a certain number of on-time payments have been collected. The Company earns a

rehabilitation fee only when the Guarantor sells the rehabilitated loan. The disruption in the credit markets has

limited the sale of rehabilitated loans.

The contingency fee income for the year ended December 31, 2008 was relatively unchanged compared

to 2007.

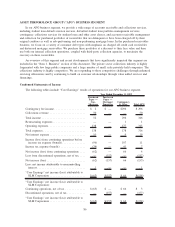

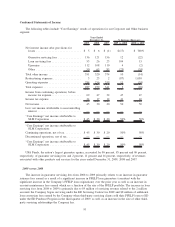

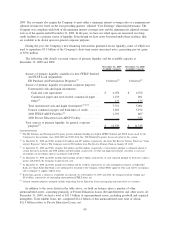

Purchased Paper — Non-Mortgage

2009 2008 2007

Years Ended

December 31,

Face value of purchases for the period .......................... $390 $5,353 $6,111

Purchase price for the period ................................. 30 483 556

Purchase price as a percentage of face value purchased .............. 7.6% 9.0% 9.1%

Gross Cash Collections (“GCC”) .............................. $376 $ 655 $ 463

Collections revenue ........................................ 50 129 217

Collections revenue as a percentage of GCC ...................... 13% 20% 47%

Carrying value of purchased paper ............................. $285 $ 544 $ 587

The decrease in collections revenue as a percentage of gross cash collections (“GCC”) in 2009 compared

to 2008 and 2007 was primarily due to the significant impairment recognized in 2008.

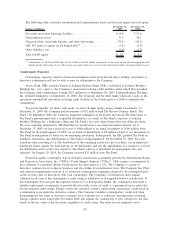

Contingency Inventory

The following table presents the outstanding inventory of receivables serviced through our APG business

segment. These assets are not on our balance sheet.

2009 2008 2007

As of

December 31,

Contingency:

Student loans ........................................ $ 8,762 $ 9,852 $8,195

Other.............................................. 1,262 1,726 1,509

Total ................................................ $10,024 $11,578 $9,704

Operating Expenses — APG Business Segment

For the years ended December 31, 2009, 2008 and 2007, operating expenses for the APG contingency

and other businesses totaled $177 million, $187 million and $197 million, respectively. The decrease in

operating expenses in 2009 versus prior years is primarily due to the Company’s cost reduction initiatives.

89