Sallie Mae 2009 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

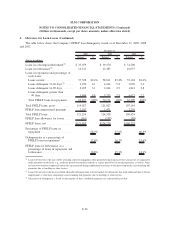

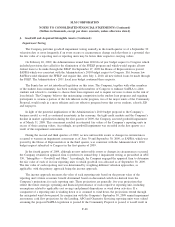

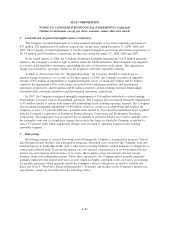

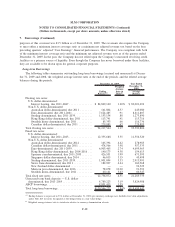

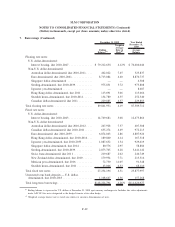

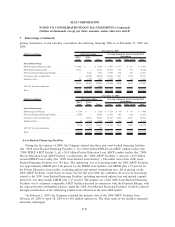

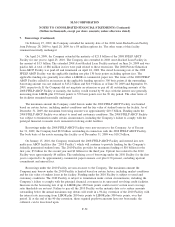

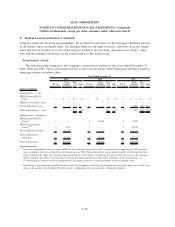

7. Borrowings (Continued)

The following table summarizes activity related to the senior unsecured debt repurchases for the years

ended December 31, 2009 and 2008. The Company began actively repurchasing its outstanding debt in the

second quarter of 2008. “Gains on debt repurchases” is shown net of hedging-related gains and losses.

2009 2008

Years Ended December 31,

Unsecured debt principal repurchased........................... $3,447,245 $1,910,326

Cash outlay for principal repurchases ........................... 3,129,415 1,866,269

Gains on debt repurchases ................................... 536,190 64,477

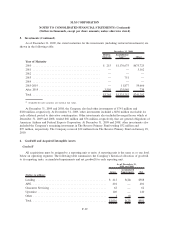

In January 2010, the Company repurchased $812 million of unsecured debt through a tender offer for a

gain of $45 million.

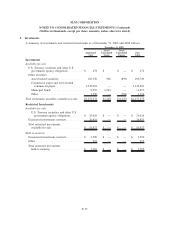

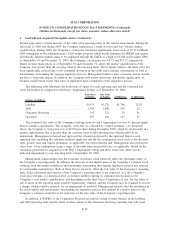

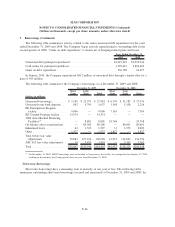

The following table summarizes the Company’s borrowings as of December 31, 2009 and 2008.

Short

Term

Long

Term Total

Short

Term

Long

Term Total

December 31, 2009 December 31, 2008

(Dollars in millions)

Unsecured borrowings . ........ $ 5,185 $ 22,797 $ 27,982 $ 6,794 $ 31,182 $ 37,976

Unsecured term bank deposits . . . 842 4,795 5,637 1,148 1,108 2,256

ED Participation Program

facility .................. 9,006 — 9,006 7,365 — 7,365

ED Conduit Program facility .... 14,314 — 14,314 — — —

2008 Asset-Backed Financing

Facilities

(1)

............... — 8,801 8,801 24,768 — 24,768

On-balance sheet securitizations. . — 89,200 89,200 — 80,601 80,601

Indentured trusts ............. 64 1,533 1,597 31 1,972 2,003

Other ..................... 1,472 — 1,472 1,827 — 1,827

Total before fair value

adjustments ............... 30,883 127,126 158,009 41,933 114,863 156,796

ASC 815 fair value adjustments . . 14 3,420 3,434 — 3,362 3,362

Total ...................... $30,897 $130,546 $161,443 $41,933 $118,225 $160,158

(1)

On December 31, 2009, ABCP borrowings were reclassified to long-term as the facility was renegotiated on January 15, 2010

resulting in the maturity date being greater than one year from December 31, 2009.

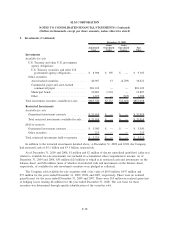

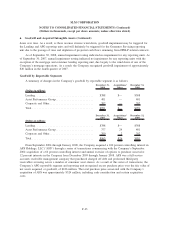

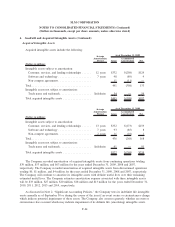

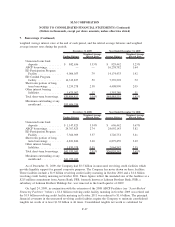

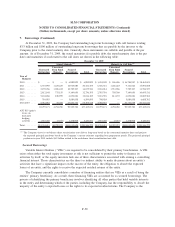

Short-term Borrowings

Short-term borrowings have a remaining term to maturity of one year or less. The following tables

summarize outstanding short-term borrowings (secured and unsecured) at December 31, 2009 and 2008, the

F-46

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)